Question: 3 points Save Answer Question 11 Galaxy Mobile expects an EBIT of $20,000 every year in perpetuity. The firm currently has no debt, and its

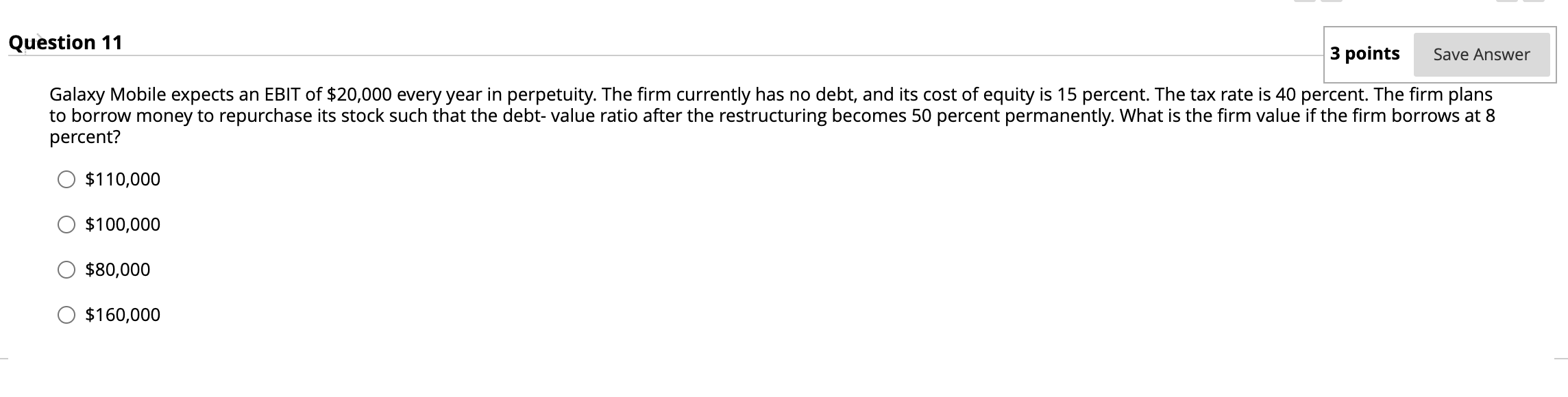

3 points Save Answer Question 11 Galaxy Mobile expects an EBIT of $20,000 every year in perpetuity. The firm currently has no debt, and its cost of equity is 15 percent. The tax rate is 40 percent. The firm plans to borrow money to repurchase its stock such that the debt-value ratio after the restructuring becomes 50 percent permanently. What is the firm value if the firm borrows at 8 percent? $110,000 $100,000 $80,000 $160,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts