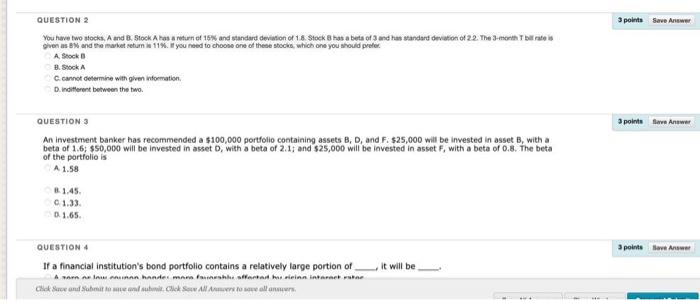

Question: 3 pounds Save Answer QUESTION 2 You have two ocks, A and B. Stock Amos a return of 15% and standard deviation of 1.6 Stock

3 pounds Save Answer QUESTION 2 You have two ocks, A and B. Stock Amos a return of 15% and standard deviation of 1.6 Stock Bhas a beta of 3 and has standard deviation of 22. The month bitrate is Diven as B and the market return a 11% you need to choose one of these stocks which one you should prefer A Stock B. Stock C.cannot determine with given information D. indifferent between the two. 5 points fewer QUESTION 3 An investment banker has recommended a $100,000 portfolio containing assets B, D, and F. $25,000 will be invested in asset B, with a beta of 1.6; $50,000 will be invested in asset D, with a beta of 2.11 and $25,000 will be invested in asset F, with a beta of 0.8. The beta of the portfolio is A 1.58 1.45 01.33 01.65. QUESTION 4 3 point Save Answer It will be If a financial institution's bond portfolio contains a relatively large portion of A AIRLINA hande man fashflara hurina internet he Choke and Sumitoman stok Sallow allows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts