Question: 3 Practice Problem 2 Consider a country with two types of people, risky and non-risky. - Suppose both types have utility U=ln[C], where C is

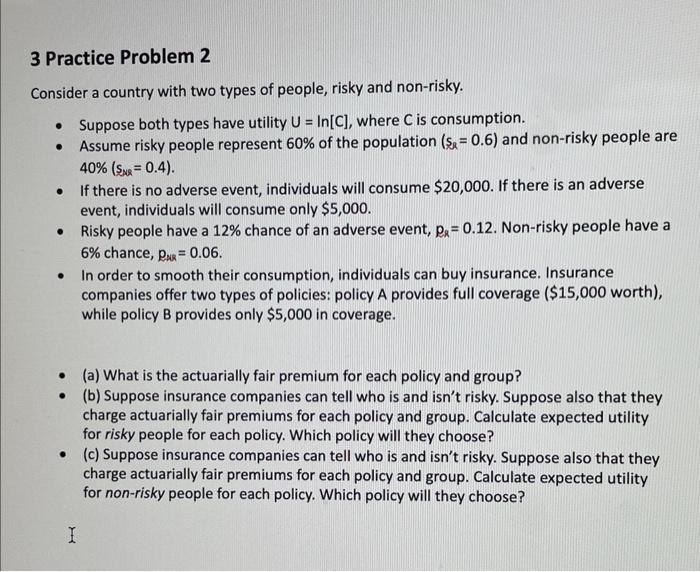

3 Practice Problem 2 Consider a country with two types of people, risky and non-risky. - Suppose both types have utility U=ln[C], where C is consumption. - Assume risky people represent 60% of the population (s=0.6) and non-risky people are 40%(s20=0.4). - If there is no adverse event, individuals will consume $20,000. If there is an adverse event, individuals will consume only $5,000. - Risky people have a 12% chance of an adverse event, pr=0.12. Non-risky people have a 6% chance, pus=0.06. - In order to smooth their consumption, individuals can buy insurance. Insurance companies offer two types of policies: policy A provides full coverage ( $15,000 worth), while policy B provides only $5,000 in coverage. - (a) What is the actuarially fair premium for each policy and group? - (b) Suppose insurance companies can tell who is and isn't risky. Suppose also that they charge actuarially fair premiums for each policy and group. Calculate expected utility for risky people for each policy. Which policy will they choose? - (c) Suppose insurance companies can tell who is and isn't risky. Suppose also that they charge actuarially fair premiums for each policy and group. Calculate expected utility for non-risky people for each policy. Which policy will they choose? 3 Practice Problem 2 Consider a country with two types of people, risky and non-risky. - Suppose both types have utility U=ln[C], where C is consumption. - Assume risky people represent 60% of the population (s=0.6) and non-risky people are 40%(s20=0.4). - If there is no adverse event, individuals will consume $20,000. If there is an adverse event, individuals will consume only $5,000. - Risky people have a 12% chance of an adverse event, pr=0.12. Non-risky people have a 6% chance, pus=0.06. - In order to smooth their consumption, individuals can buy insurance. Insurance companies offer two types of policies: policy A provides full coverage ( $15,000 worth), while policy B provides only $5,000 in coverage. - (a) What is the actuarially fair premium for each policy and group? - (b) Suppose insurance companies can tell who is and isn't risky. Suppose also that they charge actuarially fair premiums for each policy and group. Calculate expected utility for risky people for each policy. Which policy will they choose? - (c) Suppose insurance companies can tell who is and isn't risky. Suppose also that they charge actuarially fair premiums for each policy and group. Calculate expected utility for non-risky people for each policy. Which policy will they choose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts