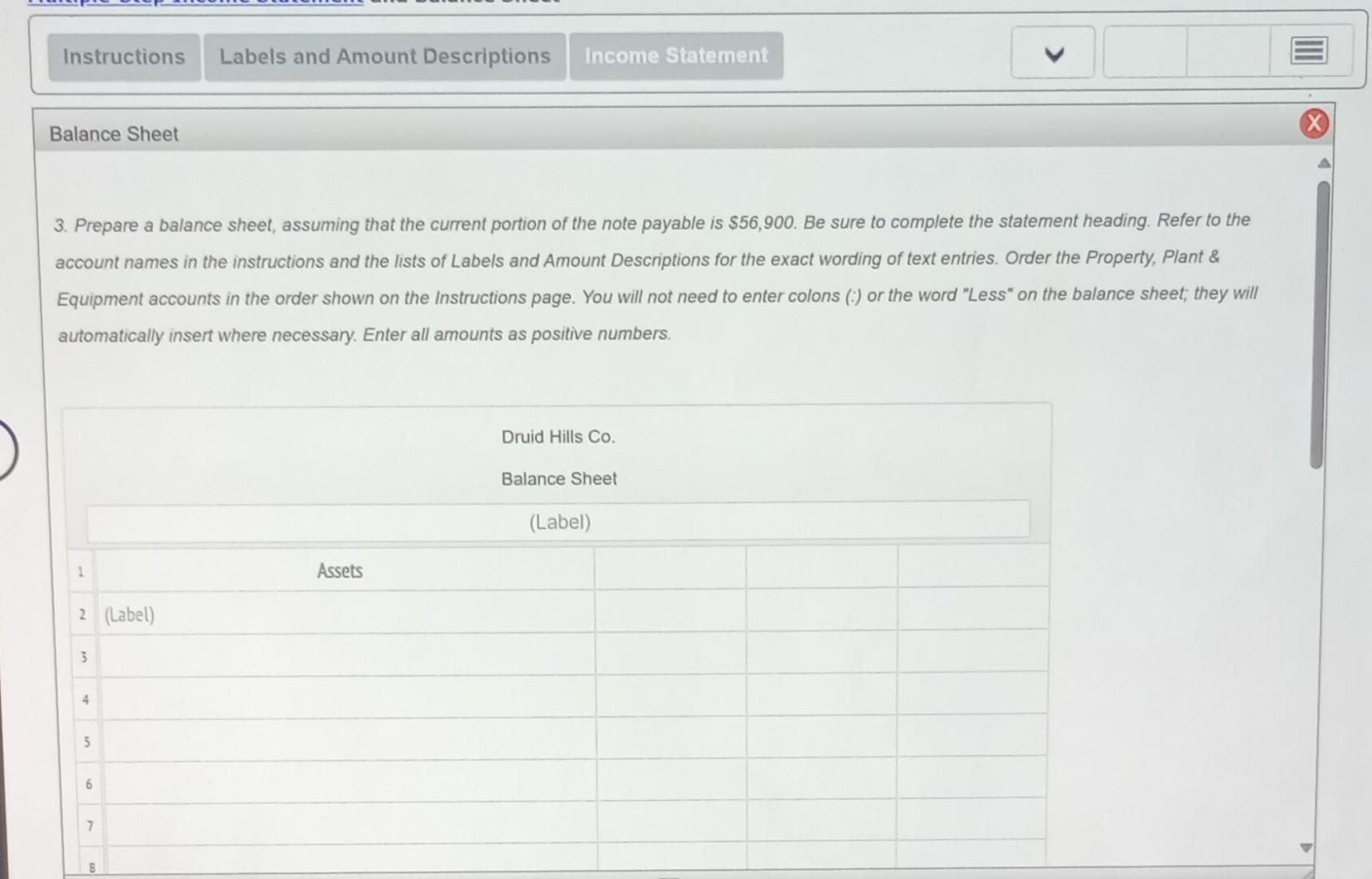

Question: 3. Prepare a balance sheet, assuming that the current portion of the note payable is $56,900. Be sure to complete the statement heading. Refer to

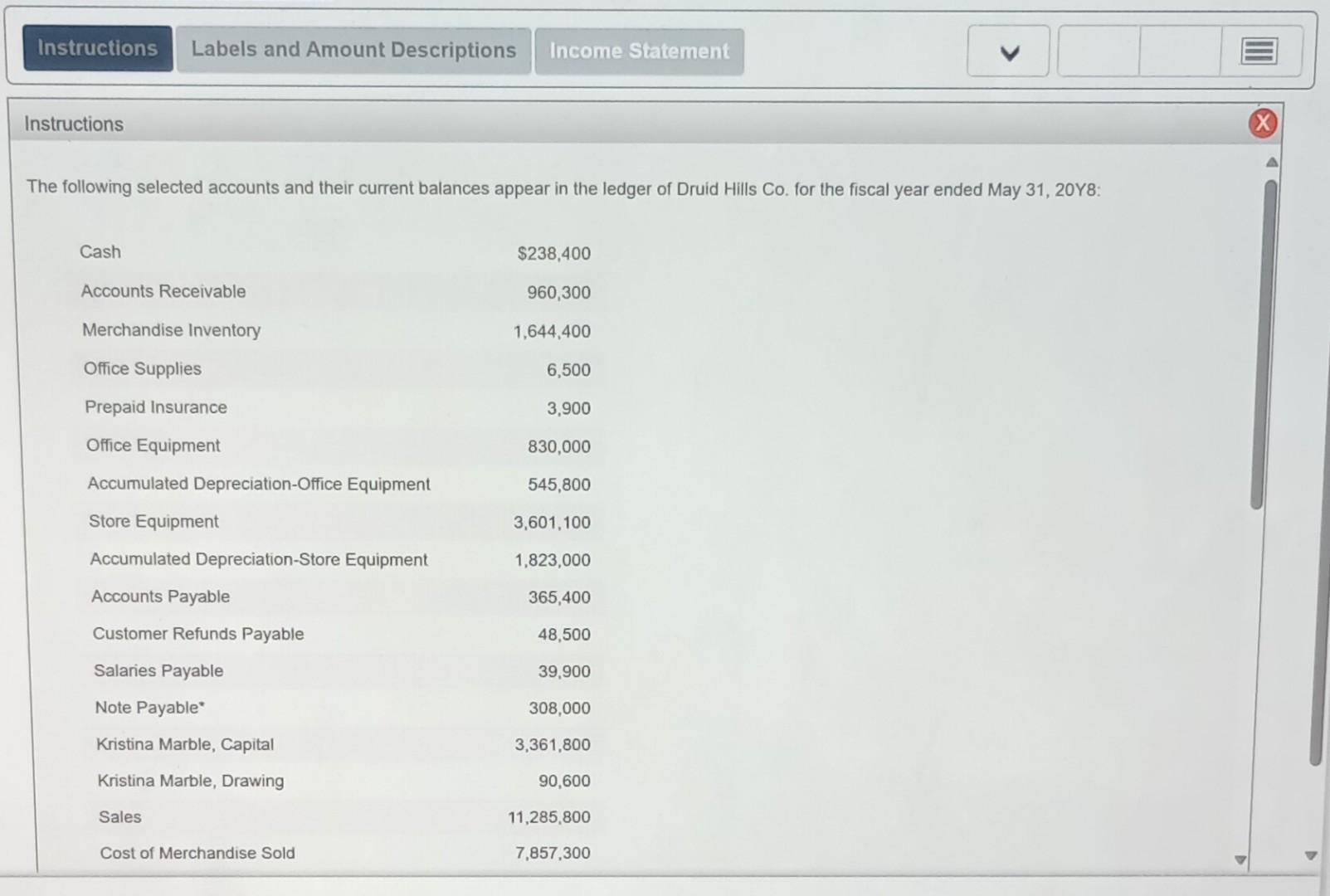

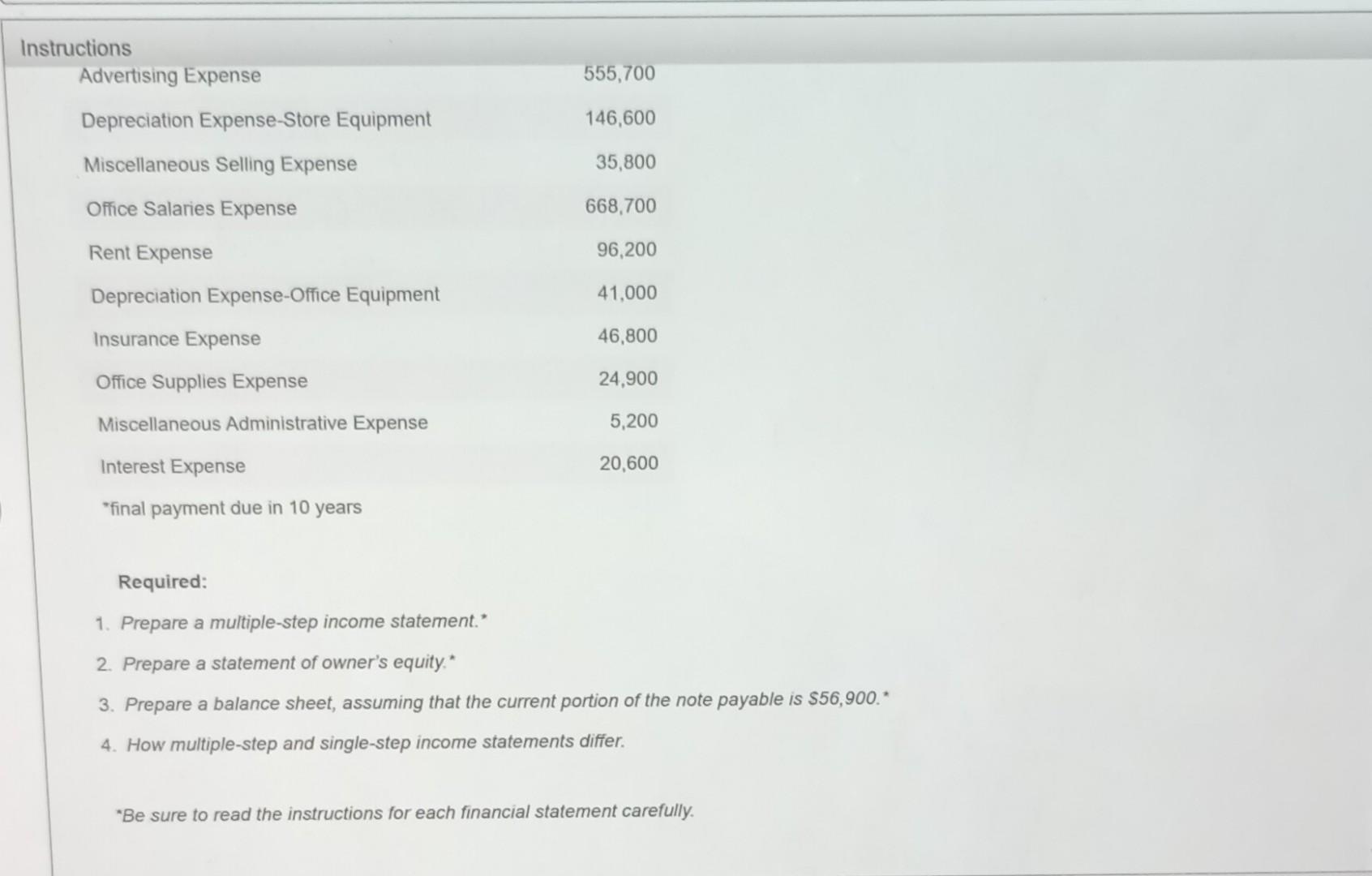

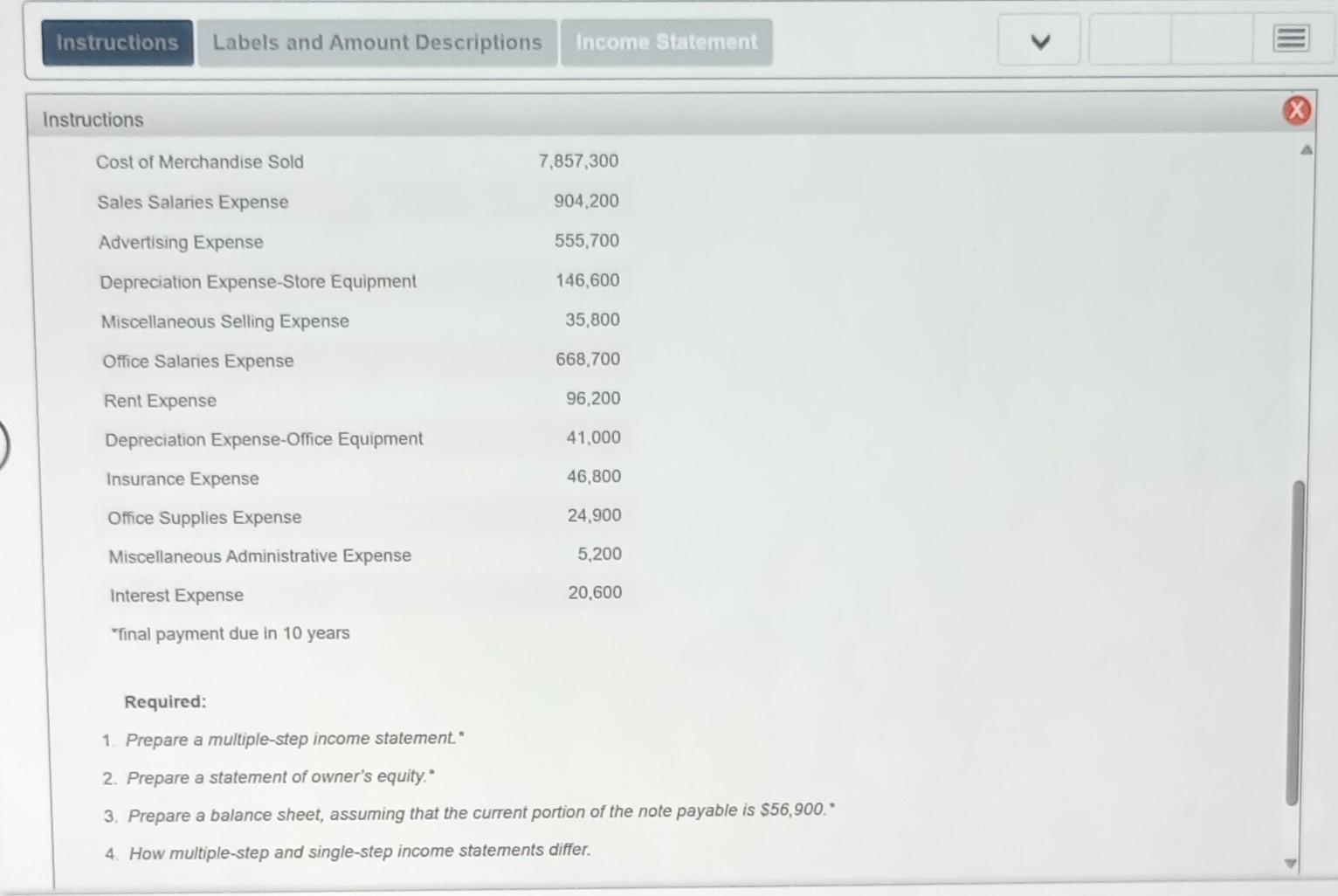

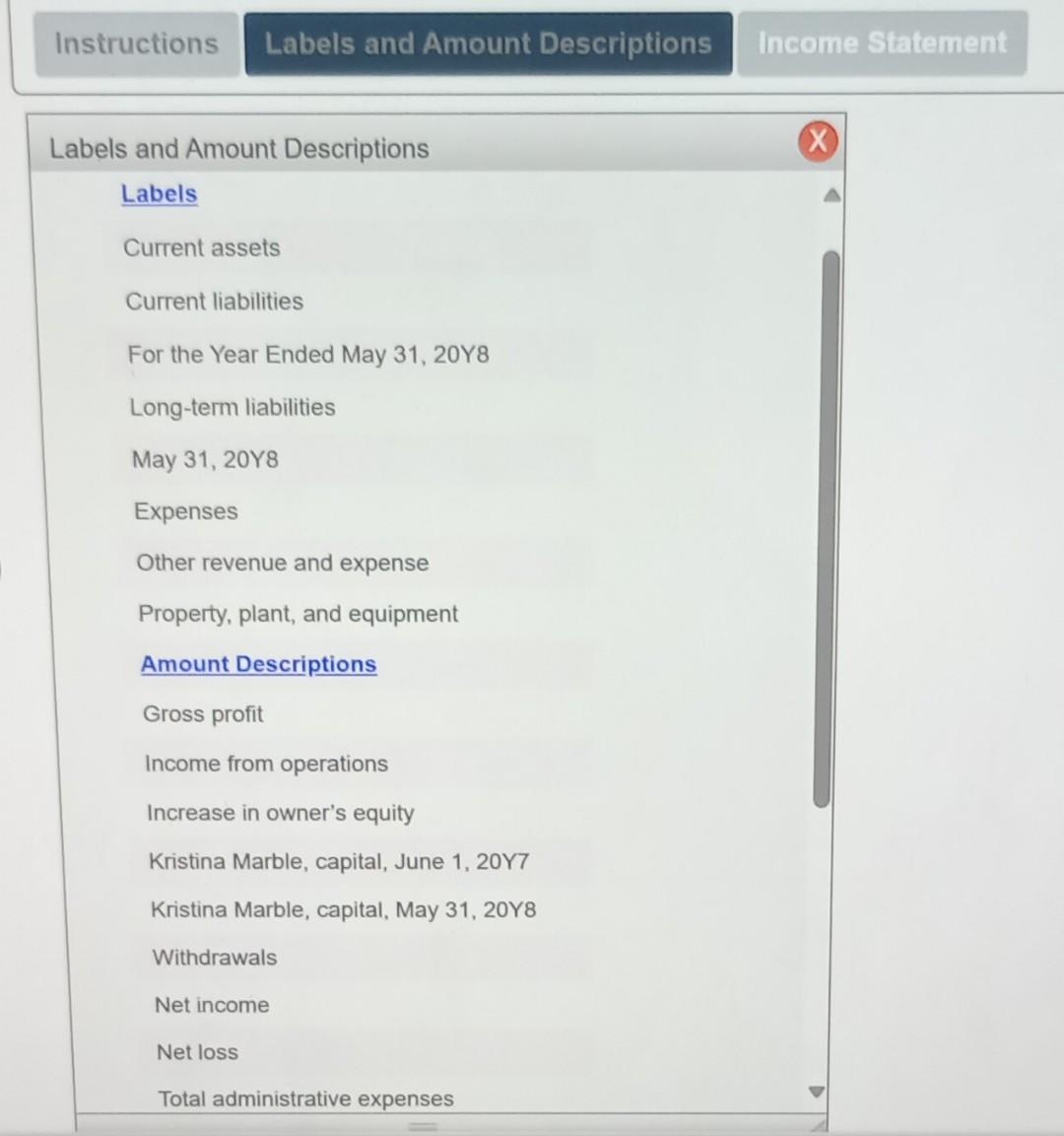

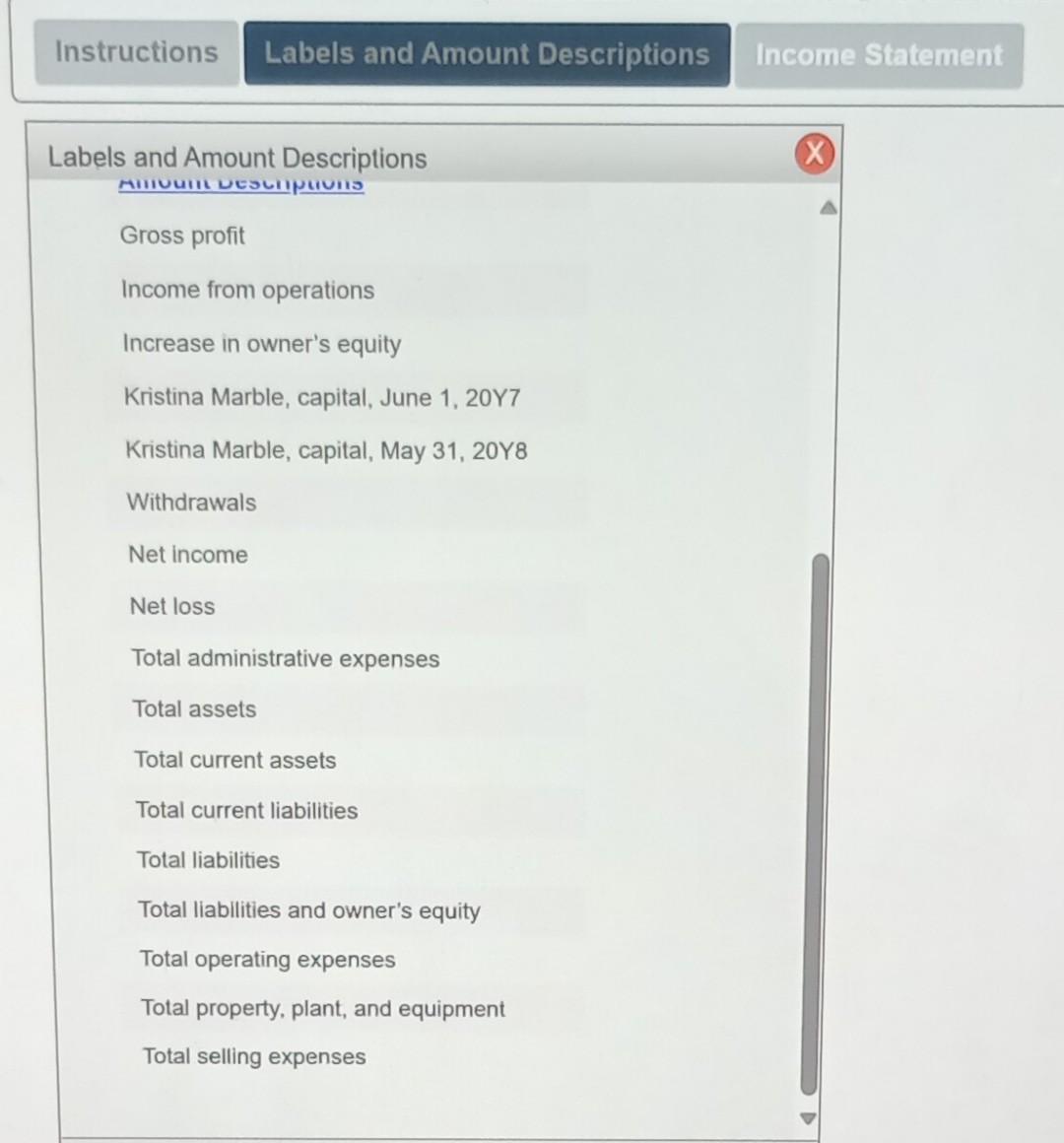

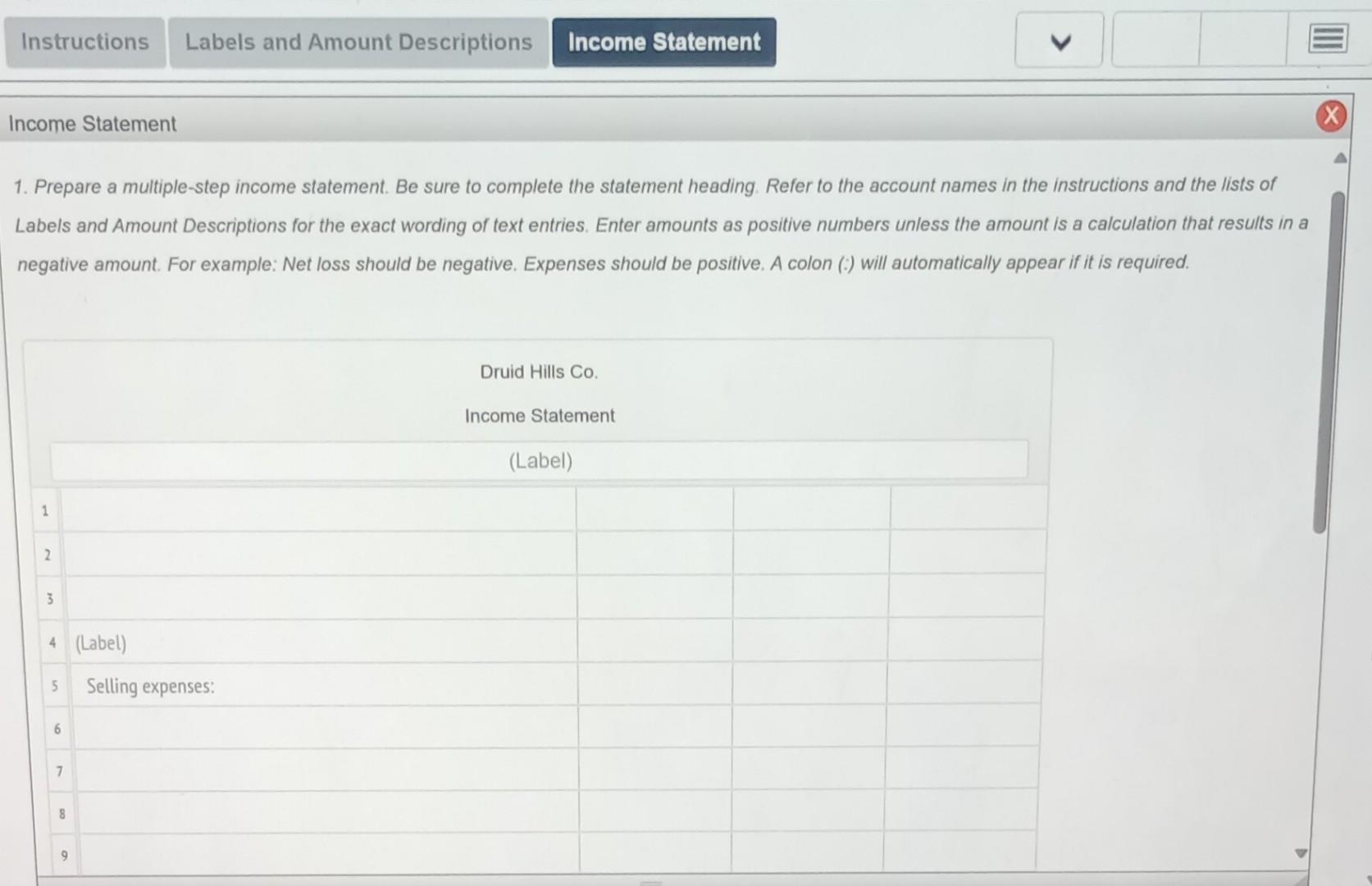

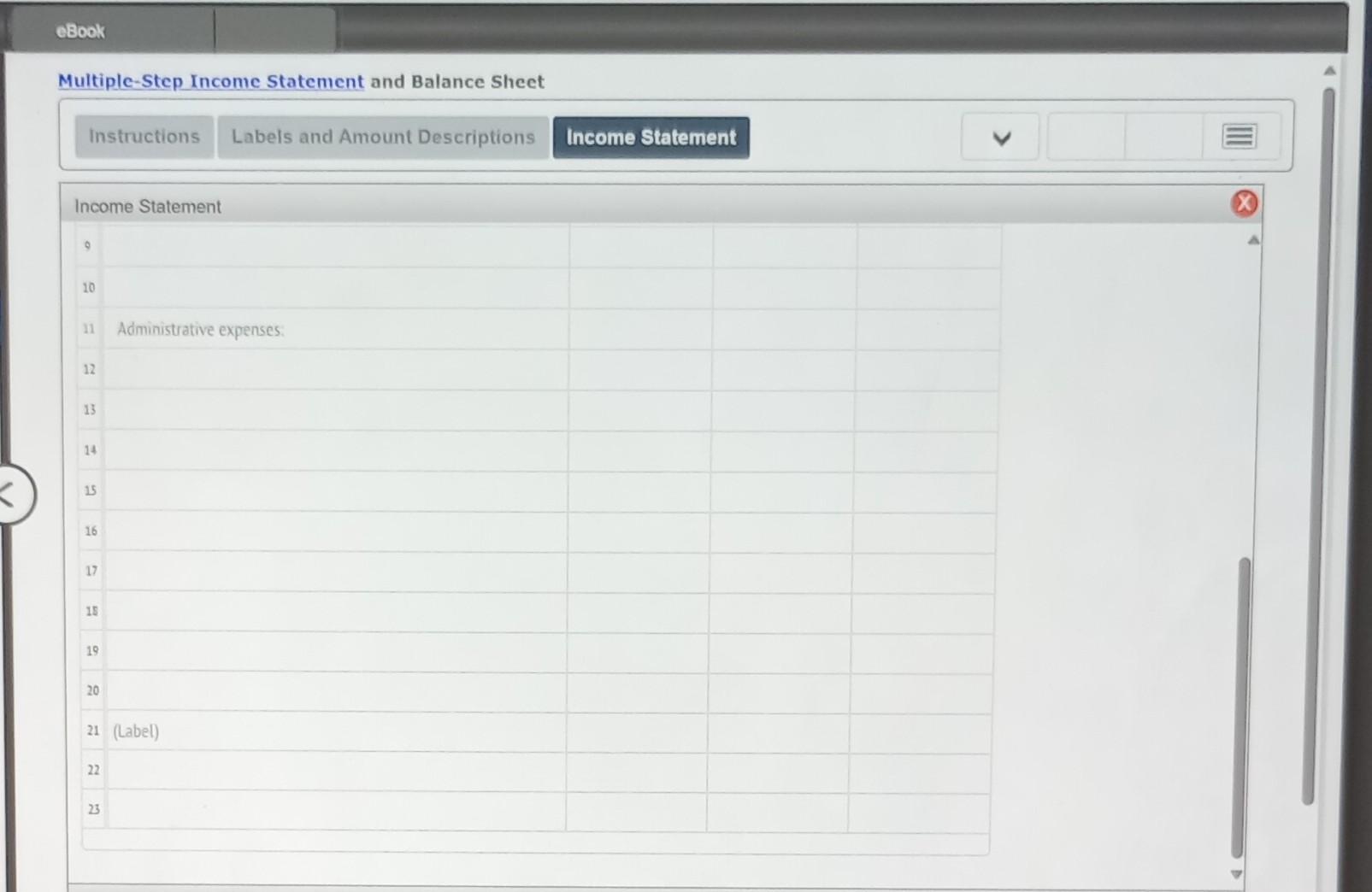

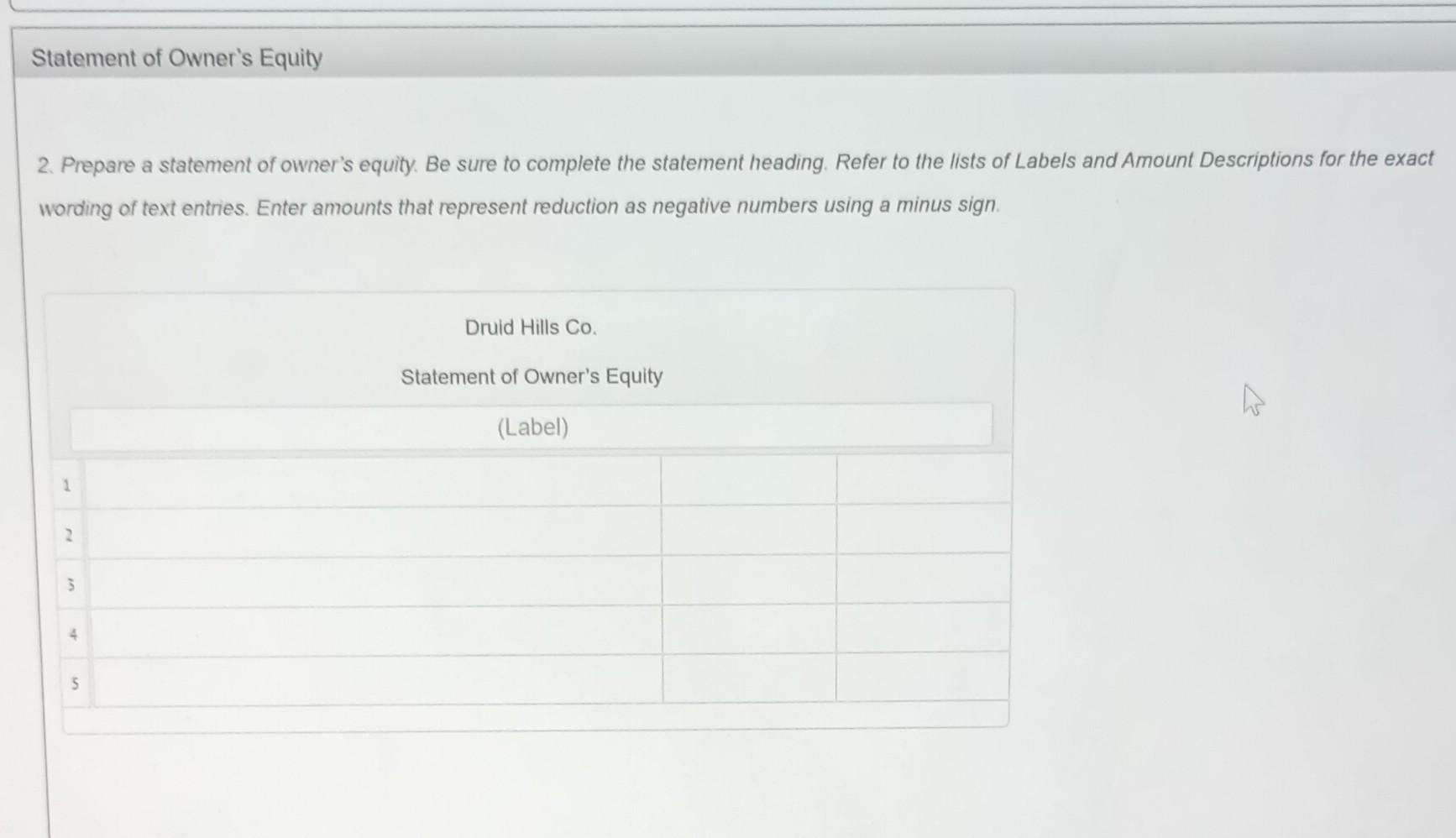

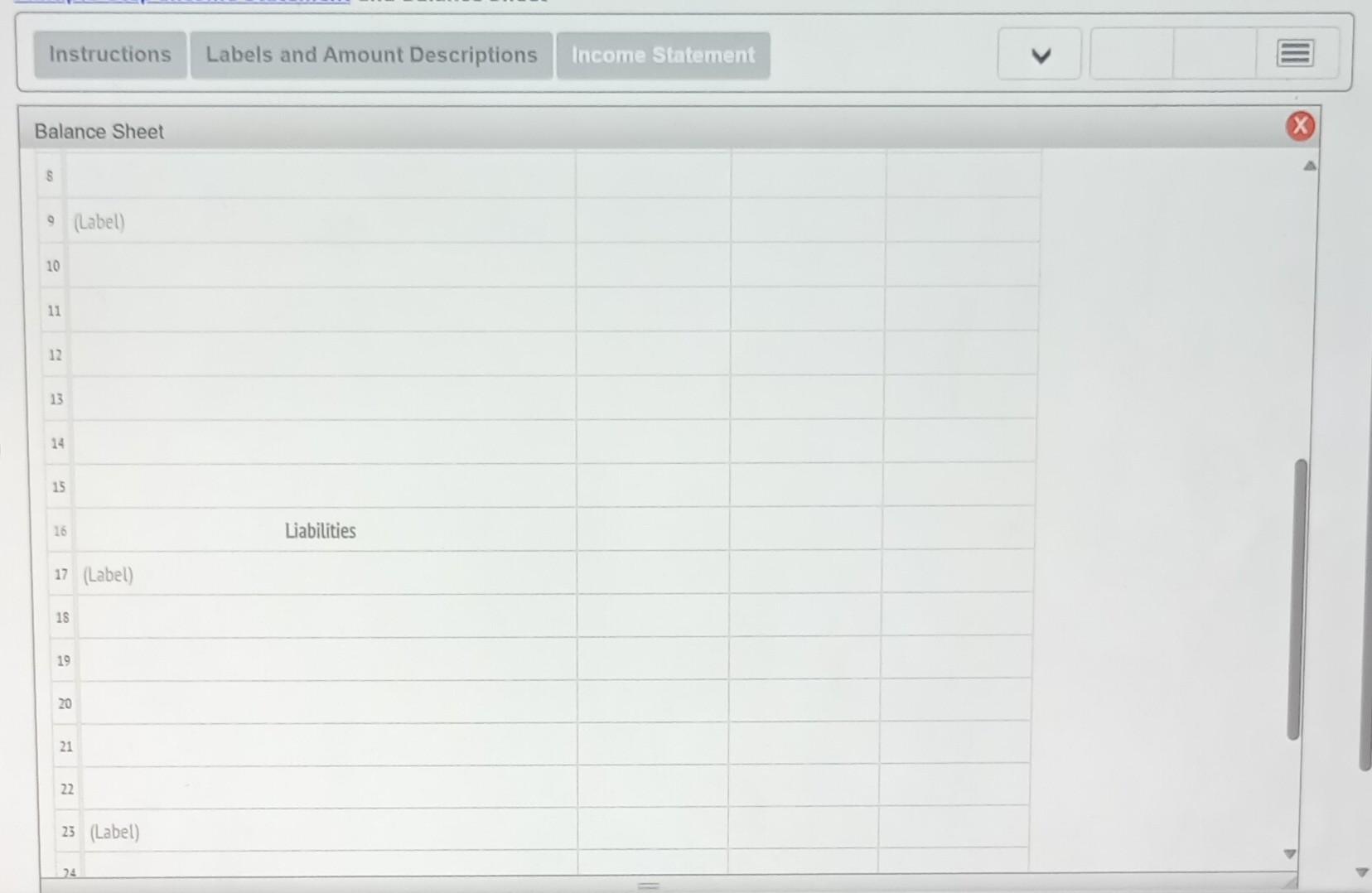

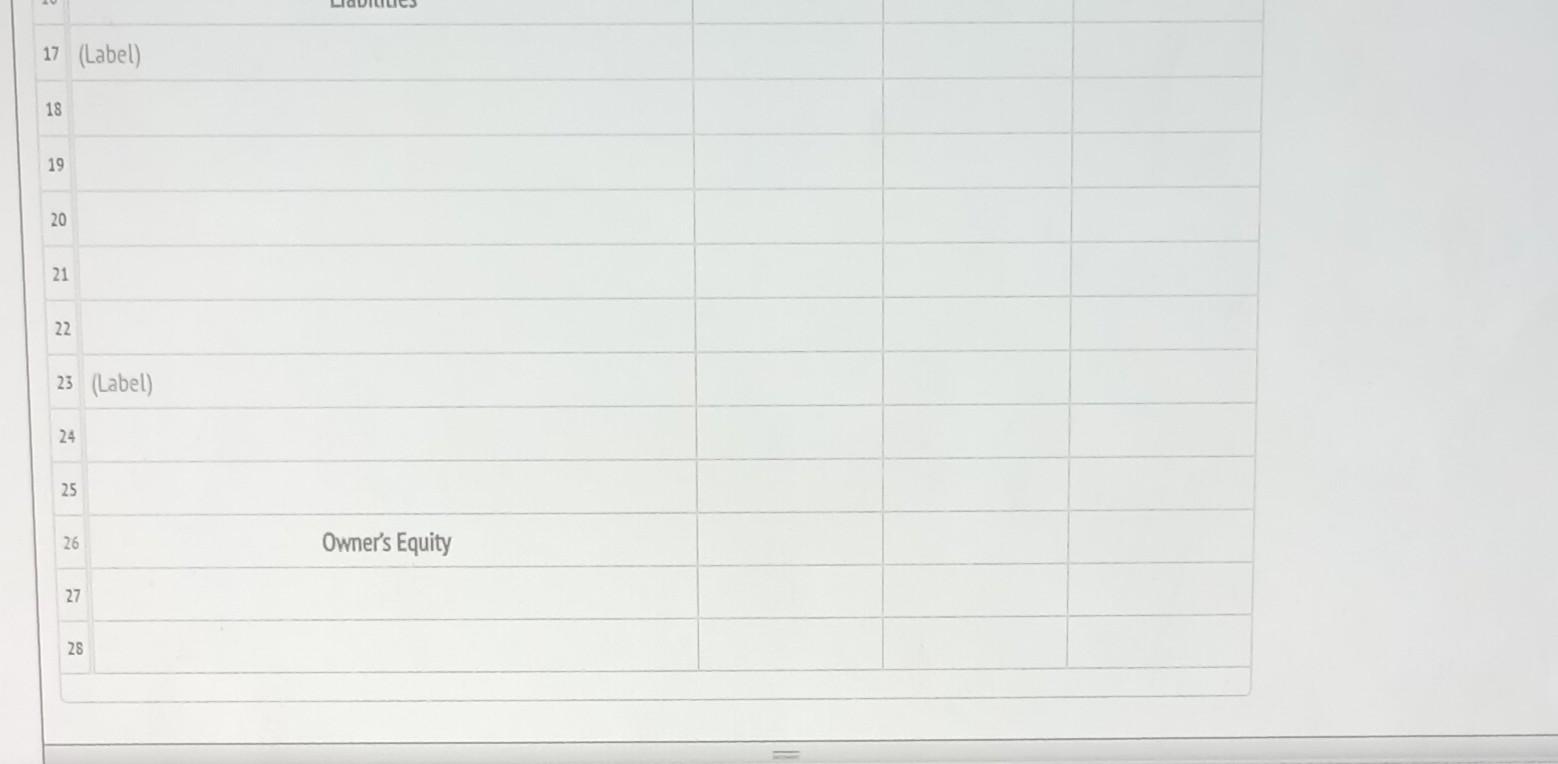

3. Prepare a balance sheet, assuming that the current portion of the note payable is $56,900. Be sure to complete the statement heading. Refer to the account names in the instructions and the lists of Labels and Amount Descriptions for the exact wording of text entries. Order the Property, Plant \& Equipment accounts in the order shown on the Instructions page. You will not need to enter colons (:) or the word "Less" on the balance sheet; they will automatically insert where necessary. Enter all amounts as positive numbers. The following selected accounts and their current balances appear in the ledger of Druid Hills Co. for the fiscal year ended May 31, 20Y8: 4. How multiple-step and single-step income statements differ. Which type of income statement shows intermediate balances? Multiple-step Single-step Instructions Labels and Amount Descriptions Income Statement Labels and Amount Descriptions milivuili vescinplivirs Gross profit Income from operations Increase in owner's equity Kristina Marble, capital, June 1, 20Y7 Kristina Marble, capital, May 31, 20 Y8 Withdrawals Net income Net loss Total administrative expenses Total assets Total current assets Total current liabilities Total liabilities Total liabilities and owner's equity Total operating expenses Total property, plant, and equipment Total selling expenses Required: 1. Prepare a multiple-step income statement." 2. Prepare a statement of owner's equity * 3. Prepare a balance sheet, assuming that the current portion of the note payable is $56,900. * 4. How multiple-step and single-step income statements differ. "Be sure to read the instructions for each financial statement carefully. Required: 1 Prepare a multiple-step income statement. 2. Prepare a statement of owner's equity. 3. Prepare a balance sheet, assuming that the current portion of the note payable is $56,900. 4. How multiple-step and single-step income statements differ. \begin{tabular}{|l|l} Instructions Labels and Amount Descriptions \\ \hline \end{tabular} Income Statement Balance Sheet 8 9 (Label) 10 11 12 13 14 15 16 Liabilities 17 (Label) 18 19 20 21 22 23 (Label) 34 2. Prepare a statement of owner's equity. Be sure to complete the statement heading. Refer to the lists of Labels and Amount Descriptions for the exact wording of text entries. Enter amounts that represent reduction as negative numbers using a minus sign. 1. Prepare a multiple-step income statement. Be sure to complete the statement heading. Refer to the account names in the instructions and the lists of Labels and Amount Descriptions for the exact wording of text entries. Enter amounts as positive numbers untess the amount is a calculation that results in a negative amount. For example: Net loss should be negative. Expenses should be positive. A colon (:) will automatically appear if it is required. Multiple-Step Income Statement and Balance Sheet Instructions Labels and Amount Descriptions Income Statement Income Statement Instructions Labels and Amount Descriptions Income Statement Labels and Amount Descriptions Labels Current assets Current liabilities For the Year Ended May 31, 20 Y8 Long-term liabilities May 31,20Y8 Expenses Other revenue and expense Property, plant, and equipment Amount Descriptions Gross profit Income from operations Increase in owner's equity Kristina Marble, capital, June 1, 20 Y7 Kristina Marble, capital, May 31, 20 Y8 Withdrawals Net income Net loss Total administrative expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts