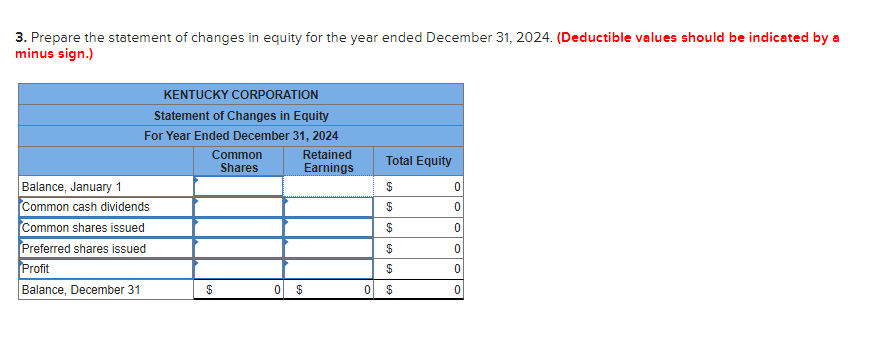

Question: 3. Prepare the statement of changes in equity for the year ended December 31, 2024. (Deductible values should be indicated by a minus sign.) Required:

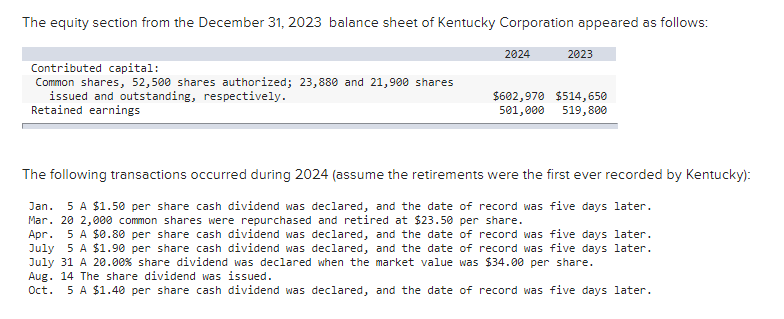

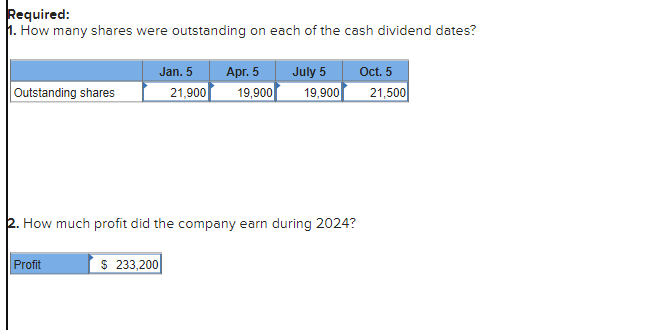

3. Prepare the statement of changes in equity for the year ended December 31, 2024. (Deductible values should be indicated by a minus sign.) Required: 1. How many shares were outstanding on each of the cash dividend dates? 2. How much profit did the company earn during 2024 ? The equity section from the December 31, 2023 balance sheet of Kentucky Corporation appeared as follows: The following transactions occurred during 2024 (assume the retirements were the first ever recorded by Kentucky): Jan. 5 A $1.50 per share cash dividend was declared, and the date of record was five days later. Mar. 20 2,000 common shares were repurchased and retired at $23.50 per share. Apr. 5 A $0.80 per share cash dividend was declared, and the date of record was five days later. July 5 A $1.90 per share cash dividend was declared, and the date of record was five days later. July 31 A 20.00% share dividend was declared when the market value was $34.00 per share. Aug. 14 The share dividend was issued. Oct. 5 A $1.40 per share cash dividend was declared, and the date of record was five days later

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts