Question: 3. Preparing a single-step and a multiple-step income statement Aa Aa Income statements can be presented using two formats: a single-step statement and a multiple-step

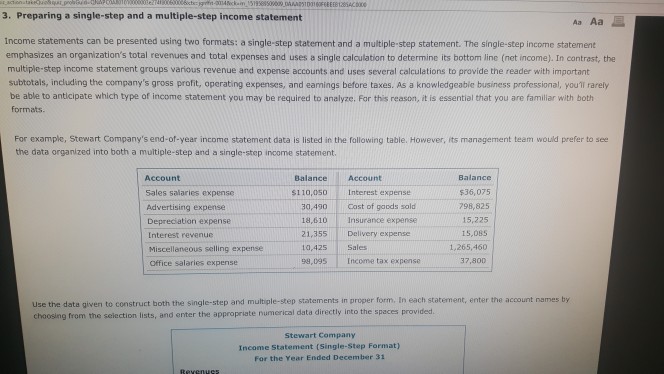

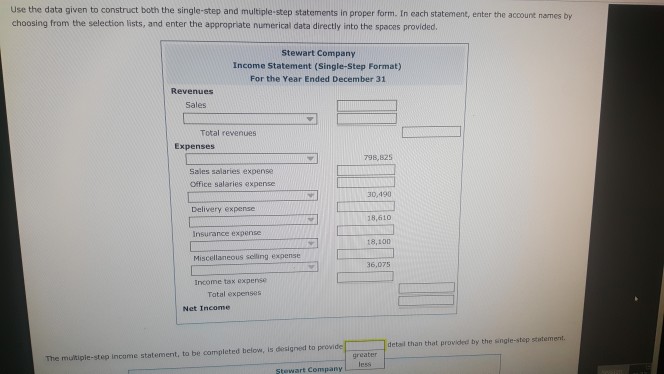

3. Preparing a single-step and a multiple-step income statement Aa Aa Income statements can be presented using two formats: a single-step statement and a multiple-step statement. The single-step income statement emphasizes an organization's total revenues and total expenses and uses a single calculation to determine its bottom line (net income). In contrest, the multiple-step income statement groups various revenue and expense accounts and uses several calculations to provide the reader with important subtotals, including the company's gross profit, operating expenses, and eamings before taxes. As a knowledgeable business professional, you'll rarely be able to antlcipate which type of income statement you may be required to analyze. For this reason, it is essential that you are familiar with both formats For example, Stewart Company's end-of-year income statement data is listed in the following table. However, its management team would prefer to see the data organized into both a multiple-step and a single-step income statement. Account Sales salaries expense Advertising expense Depreciation expense Interest revenue Miscellaneous selling expense Office salaries expense Balance $36,075 798,825 15,225 15,085 Balance Account $110,050 Interest expense 30,490Cost of gaods sold 18,610 Insurance expense 21,355 Delivery expense 10,425 Sales 99,095 Income tax expense 1,265,460 37,800 use the data given to construct both the single-step and multiple-step statements in proper form. In each statement, enter the account names by choosing from the selection lists, and enter the appropr iate numerical data directly into the spaces provided. Stewart Company Income Statement (Single-Step Format) For the Year Ended December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts