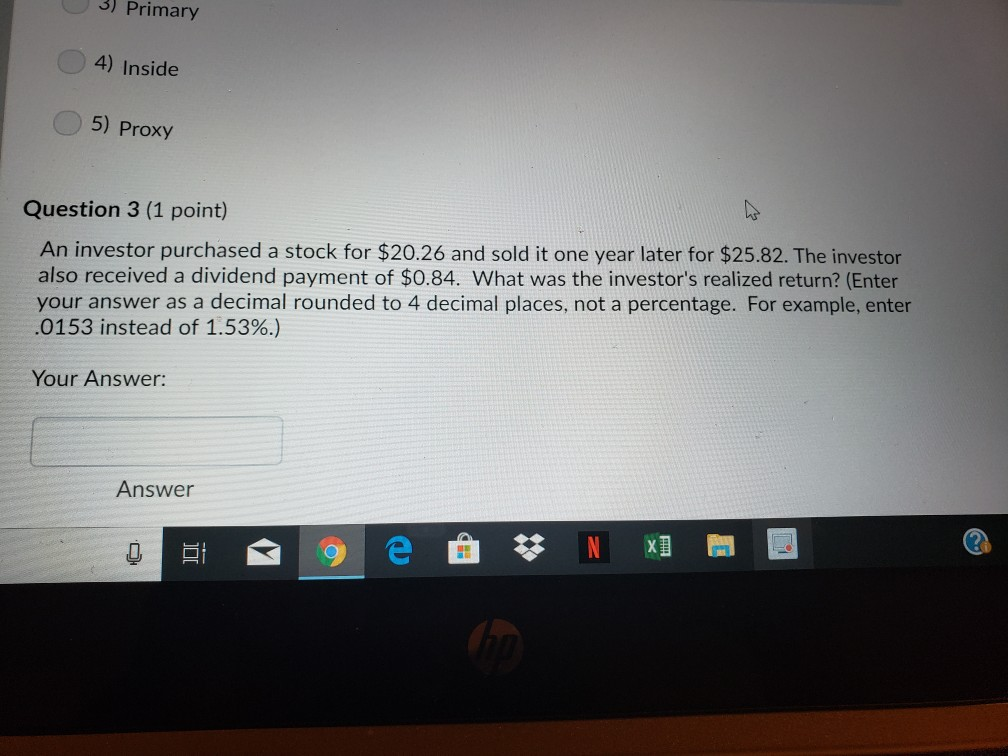

Question: 3) Primary 4) Inside 5) Proxy Question 3 (1 point) An investor purchased a stock for $20.26 and sold it one year later for $25.82.

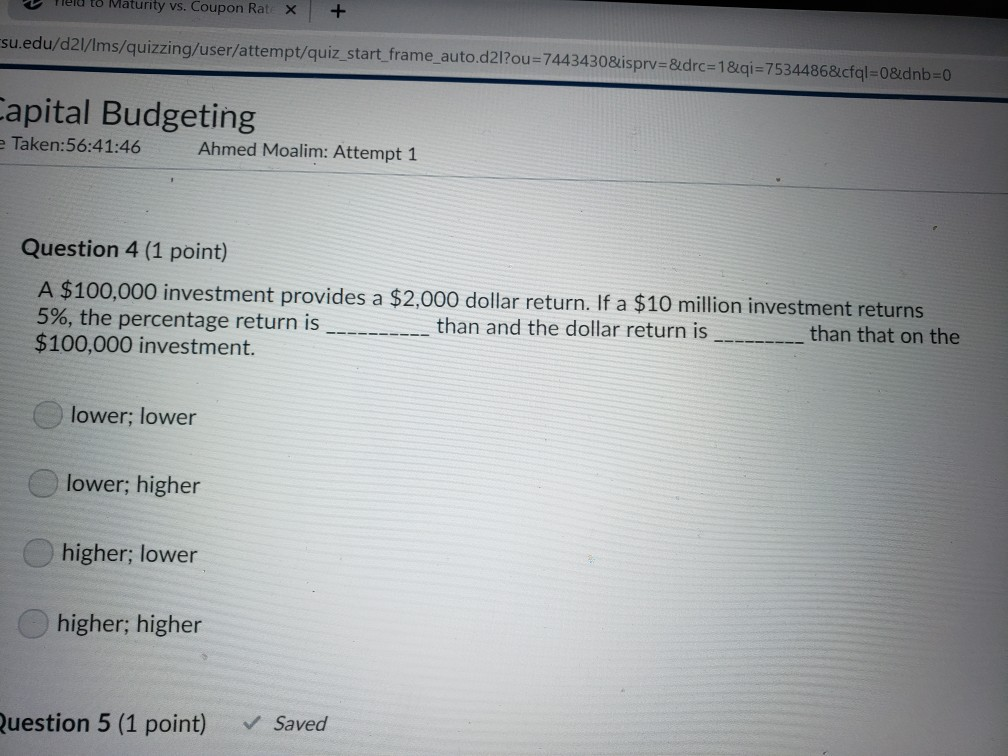

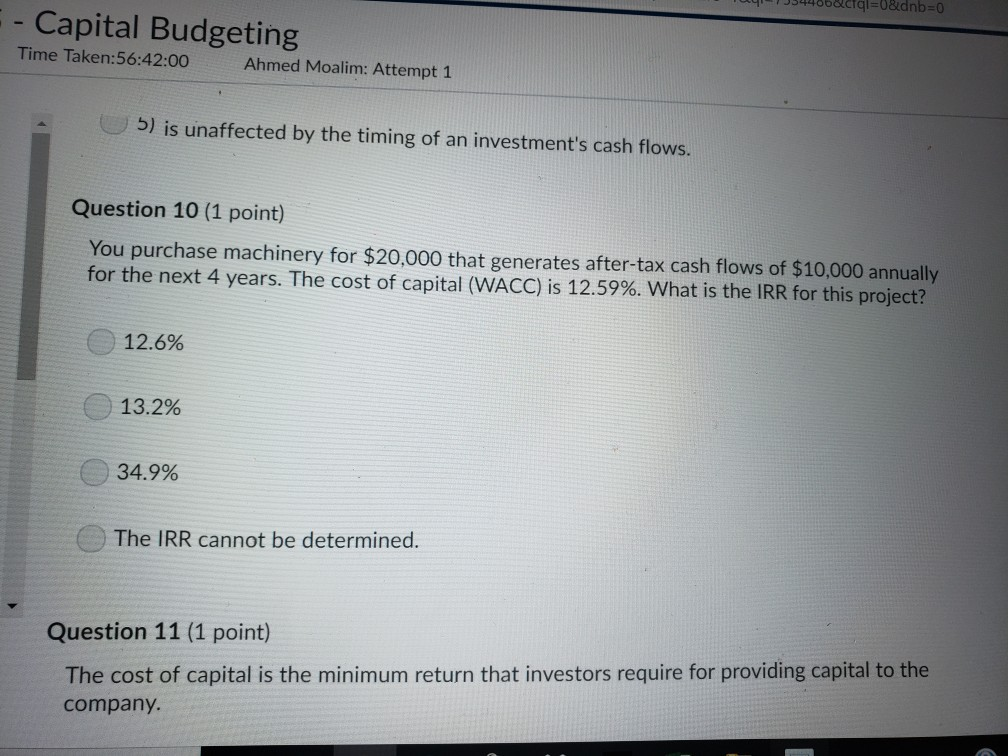

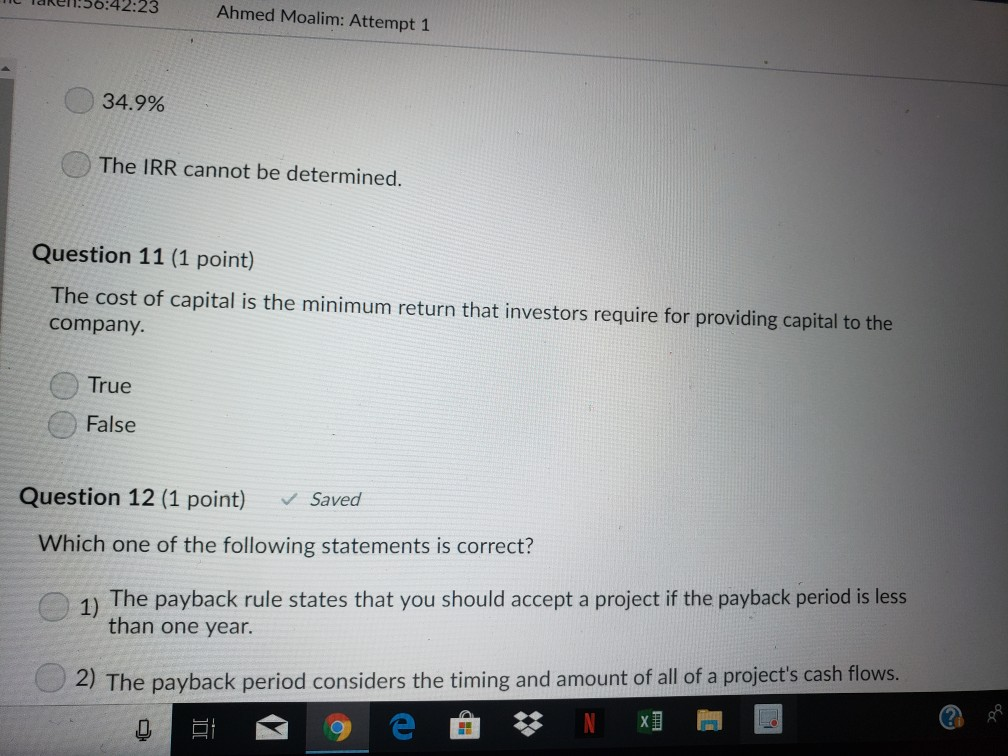

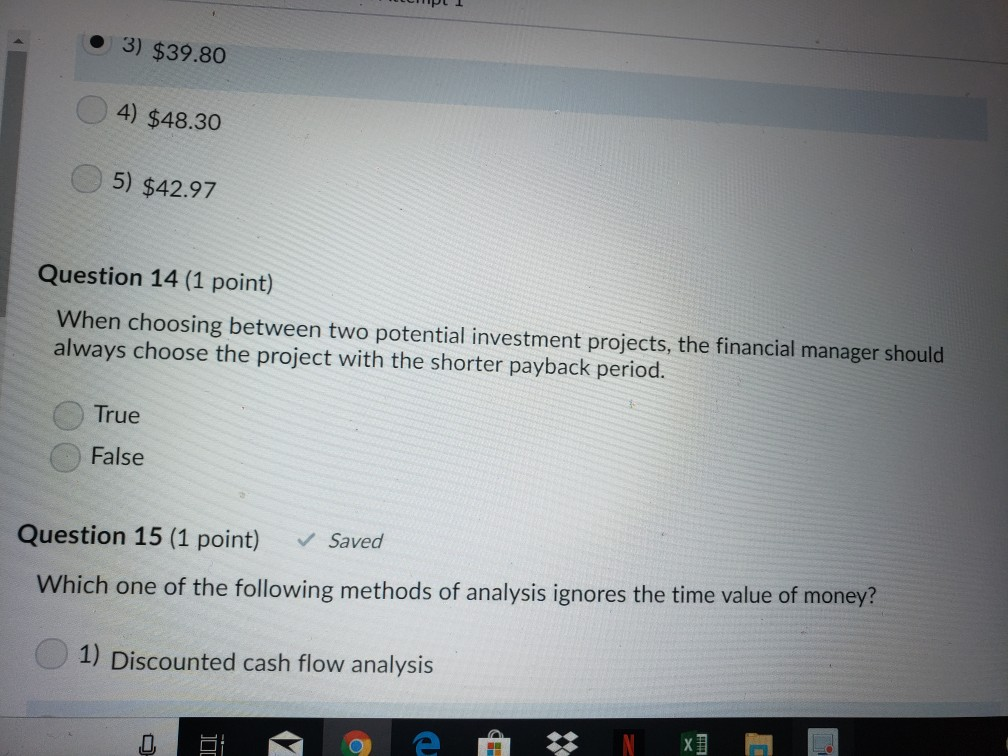

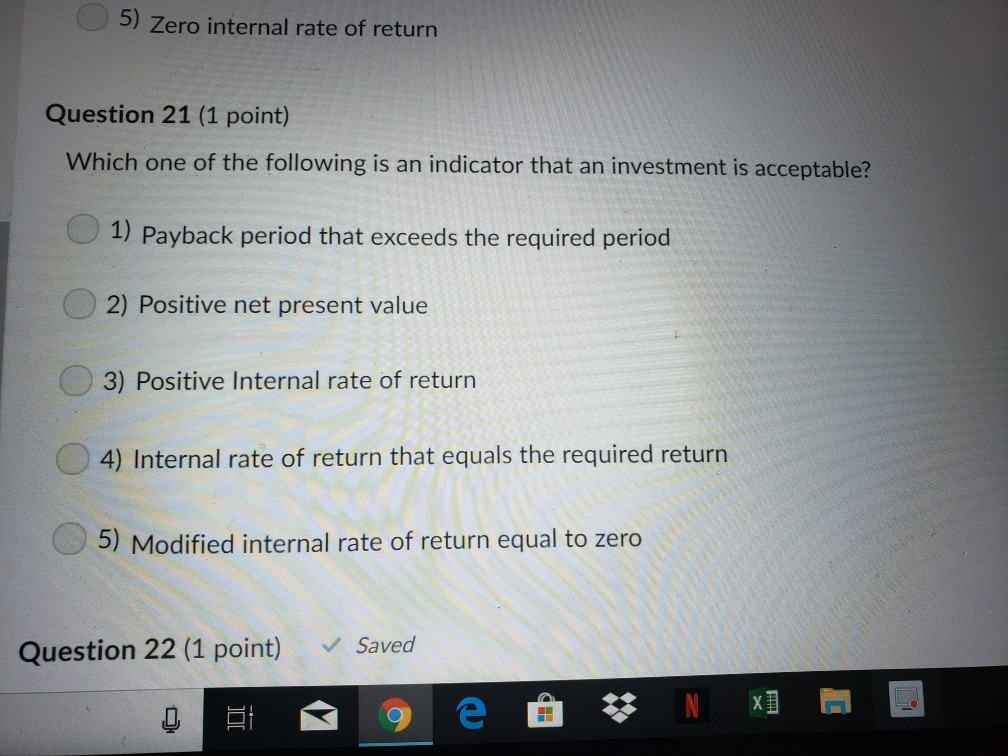

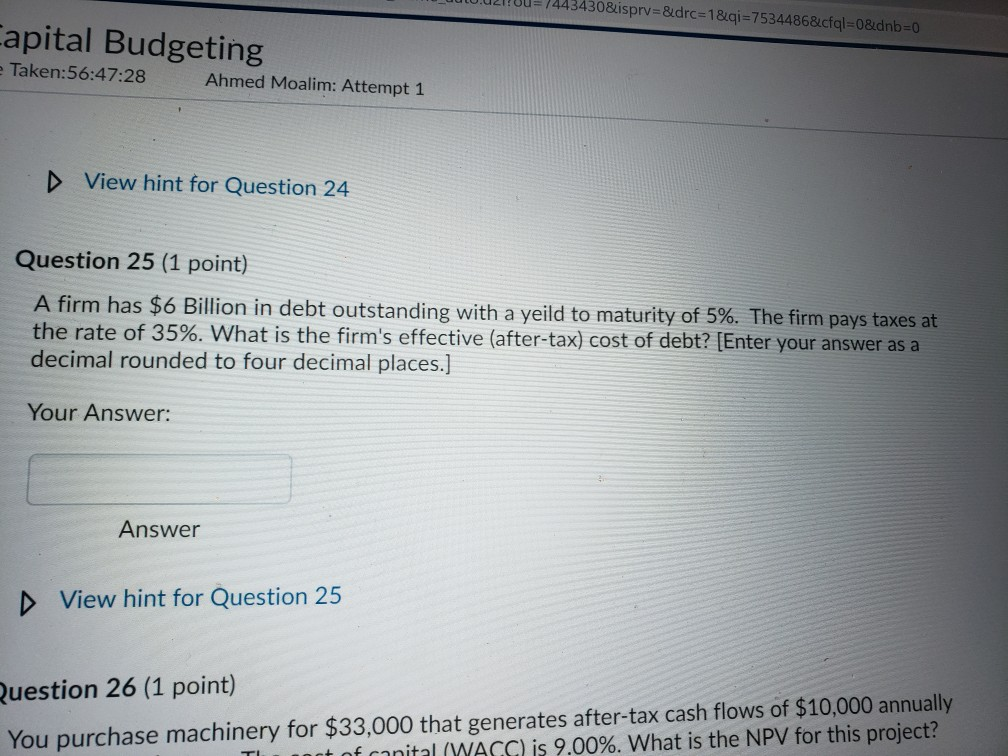

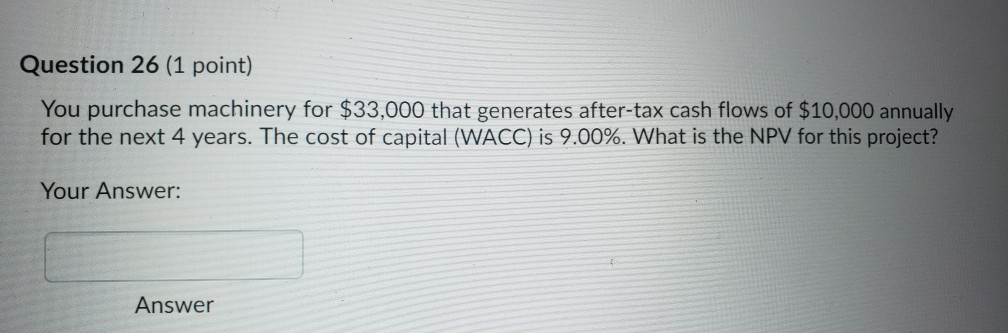

3) Primary 4) Inside 5) Proxy Question 3 (1 point) An investor purchased a stock for $20.26 and sold it one year later for $25.82. The investor also received a dividend payment of $0.84. What was the investor's realized return? (Enter your answer as a decimal rounded to 4 decimal places, not a percentage. For example, enter .0153 instead of 1.53%.) Your Answer: Answer Capital Budgeting Time Taken:56:42:00 Ahmed Moalim: Attempt 1 5) is unaffected by the timing of an investment's cash flows. Question 10 (1 point) You purchase machinery for $20,000 that generates after-tax cash flows of $10,000 annually for the next 4 years. The cost of capital (WACC) is 12.59%. what is the IRR for this project? 12.6% 13.2% - () 34.9% The IRR cannot be determined. Question 11 (1 point) The cost of capital is the minimum return that investors require for providing capital to the company elakel:56:42:23 Ahmed Moalim: Attempt 1 34.9% The IRR cannot be determined. Question 11 (1 point) The cost of capital is the minimum return that investors require for providing capital to the company True False Question 12 (1 point) Saved Which one of the following statements is correct? 1) The payback rule states that you should accept a project if the payback period is less than one year. 2) The payback period considers the timing and amount of all of a project's cash flows 3) $39.80 4) $48.30 5) $42.97 Question 14 (1 point) When choosing between two potential investment projects, the financial manager should always choose the project with the shorter payback period. True False Question 15 (1 point) Saved Which one of the following methods of analysis ignores the time value of money? 1) Discounted cash flow analysis 5) Zero internal rate of return Question 21 (1 point) Which one of the following is an indicator that an investment is acceptable? 1) Payback period that exceeds the required period 2) Positive net present value 3) Positive Internal rate of returin 4) Internal rate of return that equals the required return 5) Modified internal rate of return equal to zero Question 22 (1 point) Saved apital Budgeting Taken:56:47:28 Ahmed Moalim: Attempt 1 View hint for Question 24 Question 25 (1 point) A firm has $6 Billion in debt outstanding with a yeild to maturity of 5%. The firm pays taxes at the rate of 35%. What is the firm's effective after-tax) cost of debt? [Enter your answer as a decimal rounded to four decimal places.] Your Answer: Answer D View hint for Question 25 uestion 26 (1 point) You purchase machinery for $33,000 that generates after-tax cash flows of $10,000 annually t of capital (WACC) is 9.00%. What is the NPV for this project? Question 26 (1 point) You purchase machinery for $33,000 that generates after-tax cash flows of $10,000 annually for the next 4 years. The cost of capital (WACC) is 9.00%. What is the NPV for this project? Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts