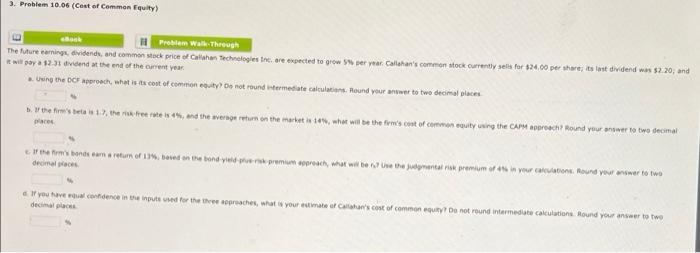

Question: 3. Problem 10.06 (Cost of Common Equity) Problem Walk Through The future caring, dividends, and common stock price of Callahan Technologies Inc. are expected to

3. Problem 10.06 (Cost of Common Equity) Problem Walk Through The future caring, dividends, and common stock price of Callahan Technologies Inc. are expected to grow per year. Callahan's common stock currently sells for $24.00 per share its last dividend was $2.20, and laya 12 dividend at the end of the current year . Uwing the Croach, what is to cost of common courty? Do not round veermediate catalans. Round your rower to two decimal places ve firm's beta 1), free teists, and the were return on the market to what will be the few cost of common souty wwing the CPM approach? Round your answer to two decimal Das com bons can retum of Ibony pre roch, what will be one the star risk premium 45 you calon Round your wiwer towe decimales au travers commence in the mood for the three ches, what is your estimate of Contas cost of common equity Do not round intermediate calculations. Hound your answer to two decine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts