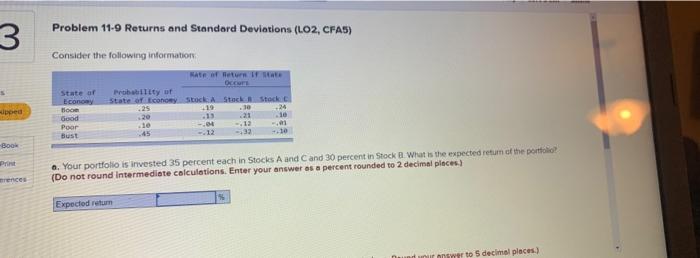

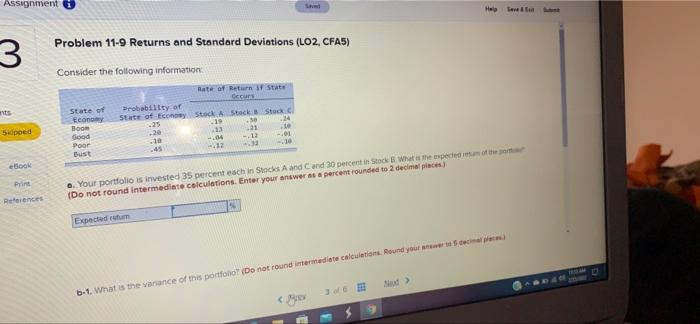

Question: 3 Problem 11-9 Returns and Standard Deviations (LO2, CFA5) Consider the following information wipped HARIF State of Occm Probability of Economy State of Economy Stock

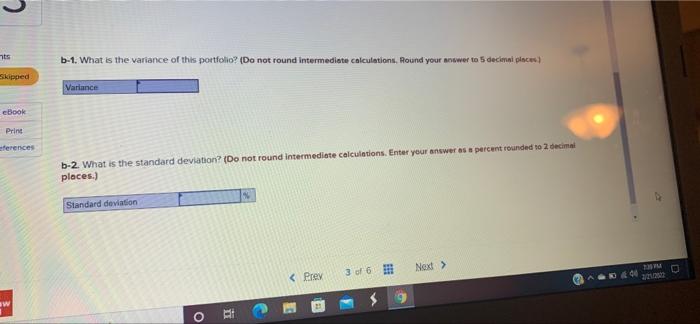

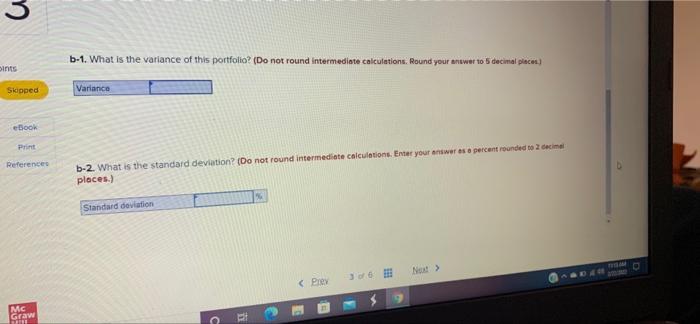

3 Problem 11-9 Returns and Standard Deviations (LO2, CFA5) Consider the following information wipped HARIF State of Occm Probability of Economy State of Economy Stock Stock Stock toc 325 410 .30 Good 24 20 -13 .21 Poor .to 13 . --23 -10 -. -Book o. Your portfolio is invested 35 percent each in Stocks A and Cand 30 percent in Stock What is the expected return of the portfolio (Do not round Intermediate calculations. Enter your answer as a percent rounded to 2 decimal places) 5 Expected retum Tower to decimal places.) ts b-1. What is the variance of this portfolio? (Do not round Intermediate calculations, Round your answer to 5 decenniplaces) Skipped Variance cBook Print ferences b-2 What is the standard deviation? (Do not round Intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Standard deviation Next > b-1. What is the variance of this portfolio Do not round intermediate calculation. Round your social 3 3 b-1. What is the variance of this portfolio? (Do not round intermediate calculations. Round your answer to decimal places ints Skipped Variance eBook Print References b-2 What is the standard deviation? (Do not round intermediate calculations. Enter your answer as a percent rounded to decine places.) Standard deviation Not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts