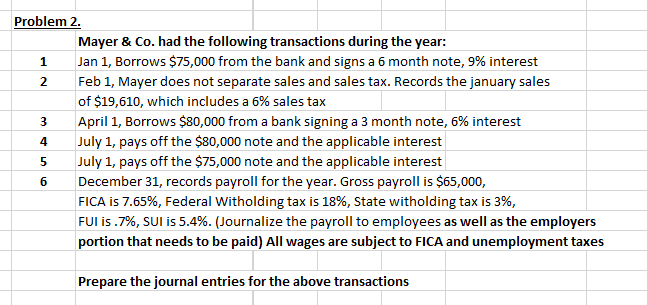

Question: 3 Problem 2. Mayer & Co. had the following transactions during the year: 1 Jan 1, Borrows $75,000 from the bank and signs a 6

3 Problem 2. Mayer & Co. had the following transactions during the year: 1 Jan 1, Borrows $75,000 from the bank and signs a 6 month note, 9% interest 2 Feb 1, Mayer does not separate sales and sales tax. Records the january sales of $19,610, which includes a 6% sales tax April 1, Borrows $80,000 from a bank signing a 3 month note, 6% interest July 1, pays off the $80,000 note and the applicable interest July 1, pays off the $75,000 note and the applicable interest December 31, records payroll for the year. Gross payroll is $65,000, FICA is 7.65%, Federal Witholding tax is 18%, State witholding tax is 3%, FUI is.7%, SUI is 5.4%. (Journalize the payroll to employees as well as the employers portion that needs to be paid) All wages are subject to FICA and unemployment taxes 4 5 6 Prepare the journal entries for the above transactions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts