Question: 3 Problem 3: Designing Target Beta Portfolios (50 points) An investor wishes to design a hedge basket to offset of a position she holds in

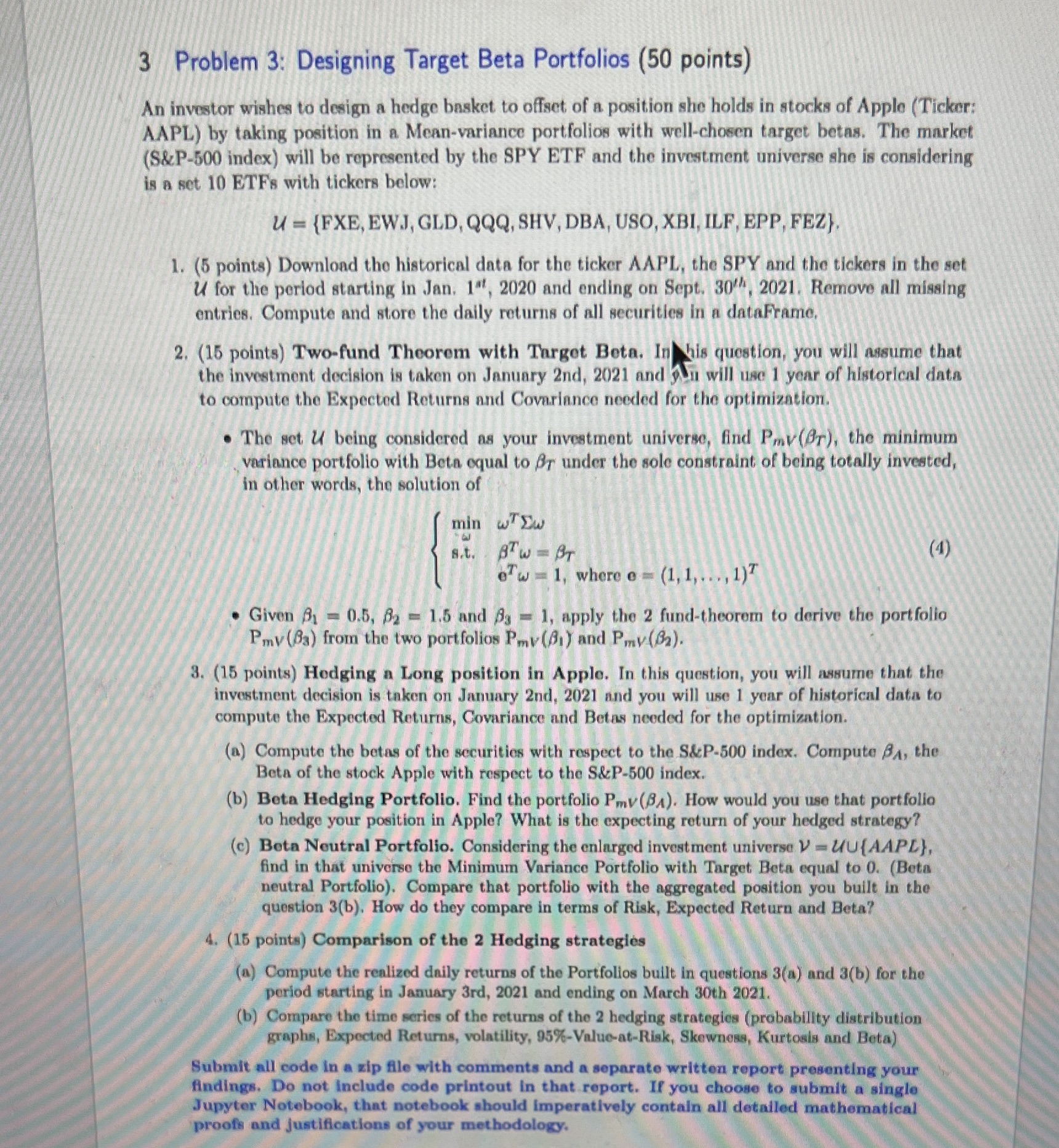

3 Problem 3: Designing Target Beta Portfolios (50 points) An investor wishes to design a hedge basket to offset of a position she holds in stocks of Apple (Ticker: AAPL) by taking position in a Mean-variance portfolios with well-chosen target betas. The market (S&P-500 index) will be represented by the SPY ETF and the investment universe she is considering is a set 10 ETFs with tickers below: U = {FXE, EWJ, GLD, QQQ, SHV, DBA, USO, XBI, ILF, EPP, FEZ} 1. (5 points) Download the historical data for the ticker AAPL, the SPY and the tickers in the set U for the period starting in Jan. 1", 2020 and ending on Sept. 30', 2021. Remove all missing entries. Compute and store the daily returns of all securities in a dataFrame, 2. (15 points) Two-fund Theorem with Target Beta. In his question, you will assume that the investment decision is taken on January 2nd, 2021 and you will use 1 year of historical data to compute the Expected Returns and Covariance needed for the optimization. . The set U being considered as your investment universe, find Pov (Or), the minimum variance portfolio with Beta equal to Br under the sole constraint of being totally invested, in other words, the solution of min wT Ew s.t. BTW = BT (4) ew = 1, where e = (1, 1,.. ., 1)? . Given 81 = 0.5, 82 - 1.5 and 83 = 1, apply the 2 fund-theorem to derive the portfolio Pmv (83) from the two portfolios Pmv(#1) and Pmy (82). 3. (15 points) Hedging a Long position in Apple. In this question, you will assume that the investment decision is taken on January 2nd, 2021 and you will use 1 year of historical data to compute the Expected Returns, Covariance and Betas needed for the optimization. (a) Compute the betas of the securities with respect to the S&P-500 index. Compute BA, the Beta of the stock Apple with respect to the S&P-500 index. (b) Beta Hedging Portfolio. Find the portfolio Pmy(BA). How would you use that portfolio to hedge your position in Apple? What is the expecting return of your hedged strategy? (c) Beta Neutral Portfolio. Considering the enlarged investment universe V = UU{ AAPL}, find in that universe the Minimum Variance Portfolio with Target Beta equal to 0. (Beta neutral Portfolio). Compare that portfolio with the aggregated position you built in the question 3(b). How do they compare in terms of Risk, Expected Return and Beta? 4. (15 points) Comparison of the 2 Hedging strategies (a) Compute the realized daily returns of the Portfolios built in questions 3(a) and 3(b) for the period starting in January 3rd, 2021 and ending on March 30th 2021." (b) Compare the time series of the returns of the 2 hedging strategies (probability distribution graphs, Expected Returns, volatility, 95%-Value-at-Risk, Skewness, Kurtosis and Beta) Submit all code in a zip file with comments and a separate written report presenting your findings. Do not include code printout in that report. If you choose to submit a single Jupyter Notebook, that notebook should imperatively contain all detailed mathematical proofs and justifications of your methodology