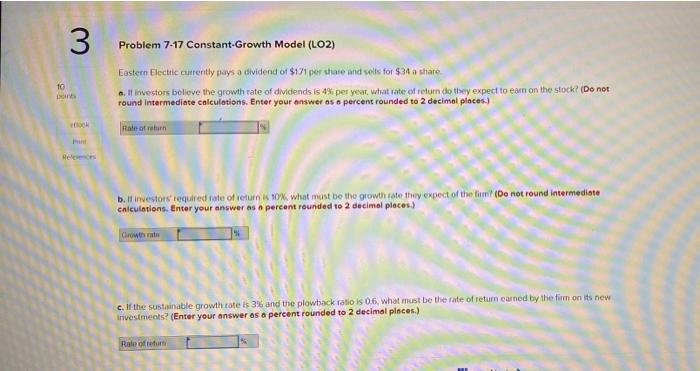

Question: 3 Problem 7-17 Constant-Growth Model (LO2) 10 Eastern Electric cuently pays a dividend of $171 per share and sells for $34 a share a. Il

3 Problem 7-17 Constant-Growth Model (LO2) 10 Eastern Electric cuently pays a dividend of $171 per share and sells for $34 a share a. Il investors believe the growth rate of dividends is 4% per year what rate of return do they expect to earn on the stock? (Do not round Intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Rate of return Rele b. It investors' required rate of return is 10%, what must be the growth rate they expect of the firm (Do not round Intermediate calculations. Enter your answer as a percent rounded 10 2 decimal places.) Chrow that c. If the sustainable growth rate is 3% and the plowback ratio is 06, what must be the rate of retum earned by the firm on its new Investments? (Enter your answer as a percent rounded to 2 decimal places.) Rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts