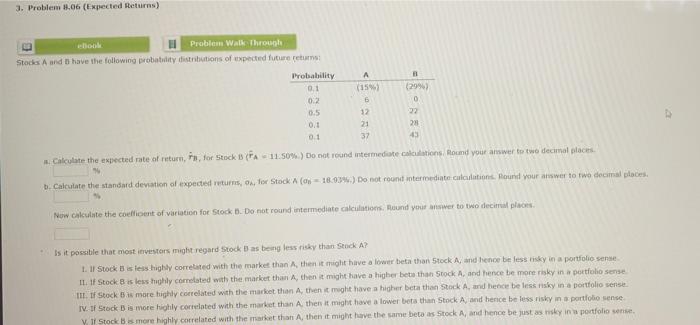

Question: 3. Problem 8.06 (Expected Returns) A 1 6 . 12 ebook Problem Walkthrough Stocks A and I have the following probability distributions of expected future

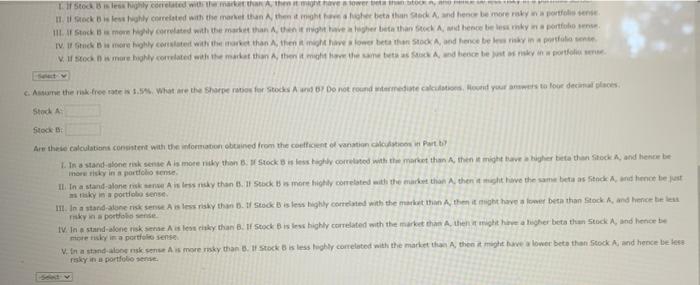

3. Problem 8.06 (Expected Returns) A 1 6 . 12 ebook Problem Walkthrough Stocks A and I have the following probability distributions of expected future returns Probability 0.1 (15% (299) 0.2 0.5 22 0.1 21 0.1 37 43 Calculate the expected rate of return, F,for Stock B (PA11.509.) Do not und intermediate calculations Round your answer to two decimal places 10 b. Calculate the standard deviation of expected returns, on for Stock (o 18.03%. Do not round Intermediate calculation. Round your answer to two decimal places 23 Now calculate the coefficient of variation for Stock . Do not round intermediate calculations. Round your awer to two decimal places Is it possible that most investors might regard Stock B as being less risky than Stock A 1. Il Stock is less highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be less risky in a portfolio sense IL 1 Stock 8 is less highly correlated with the market than A, then it might have a higher beathan Stock A, and hence be more risk in portfolio sense III. I Stock is more highly correlated with the market than A, then it might have a higher beathan Stock A, and hence be less masky in a portfolio sense IV 3 Stock B is more highly correlated with the market than A then it might have a lower beta than Stock A, and hence be less risky in a portlobo sense Stock is more highly correlated with the market than A then it might have the same beta as Stock A, and hence be just as risky in a portfolio sense Stock is les correlated with mathew 11. Stock is less ghly correlated with the more than then her bietet Stad And hence be more aty na proses II. of Stock mohly created with them that might have her but than och hence be learnky portfolio IV. I sted more highly conster with the most than then it might have lower beathan Stock A, and hence beyin portfolio Wir stock more highly correlated with the matter then it might have them to as to and hence betyr c. Anne the risk free rate. What we the sharperation for Stocks A und B Do not round Wermediate cautions Howrid you were to four decinta aces Stod Stock Are these calculation consistent with the formation obtained from the content of vanation calcul Party In a standalone rask sense is more niby the stock is less taghly correlated with the market than then it might have bigher beathan Stock A, and hence be inor risky in a portfolio sente Il In a stand-alone risks A is less risky than . I Stocks more highly correlated with the market than A then the the same as Stack And hence te just y porto sense III. In a standalone nisk senet Ais less risky than 1. Stock is less tighly correlated with the market than then it ght have to beta thon Stock and hence portfolio sense 1V. In a standalone risk A les risky than B. If Stock Bites highly correlated with the market than A henteuer beta than Stock A, and hence moterisky in a portfolio sense V. in a standalone A more risky than 8. Stock is less ghly correlated with the market tha A, then it might have lower beathan Stock And hence be less risky in a portfolio sense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts