Question: 3. Projections of future performance should be based primarily on continuing operations. What was diluted EPS for continuing operations in each of the most recent

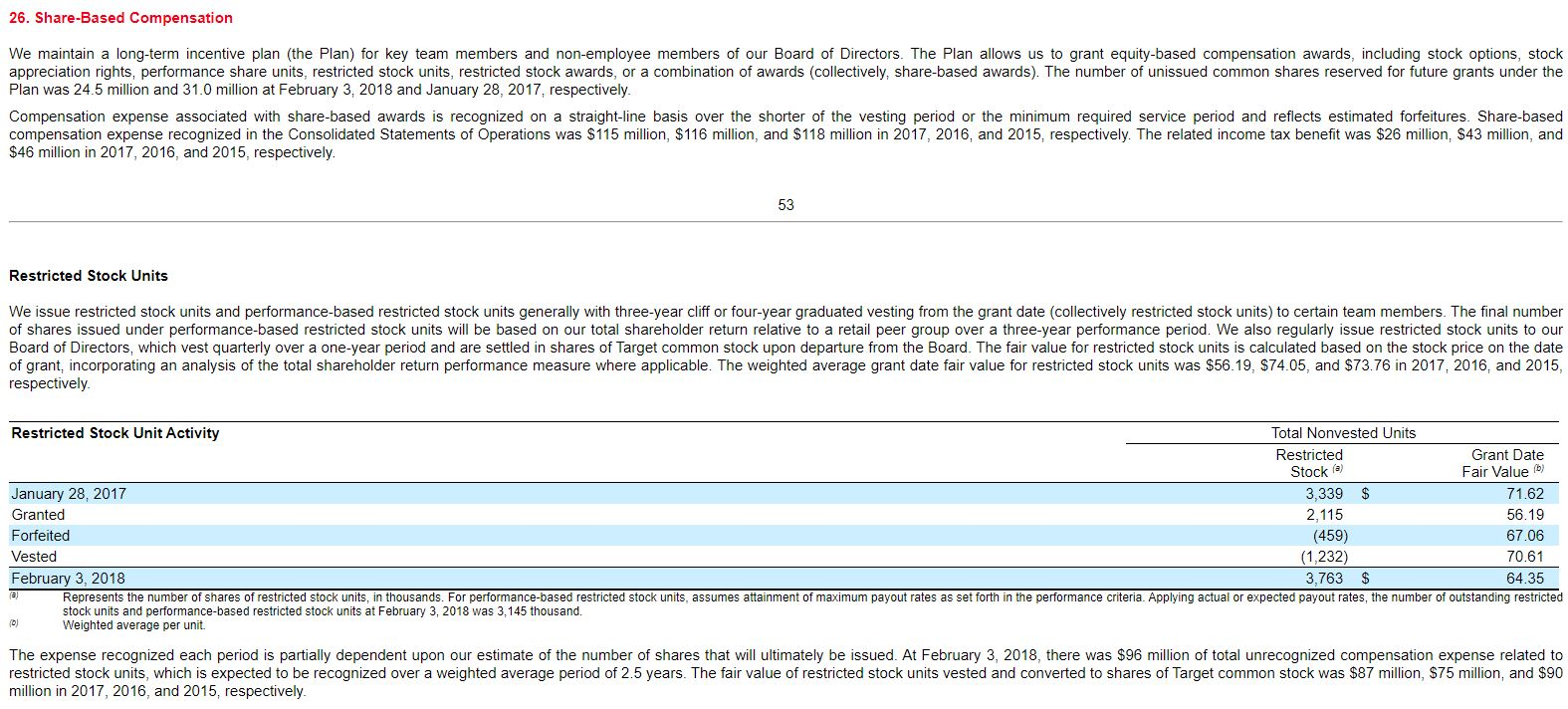

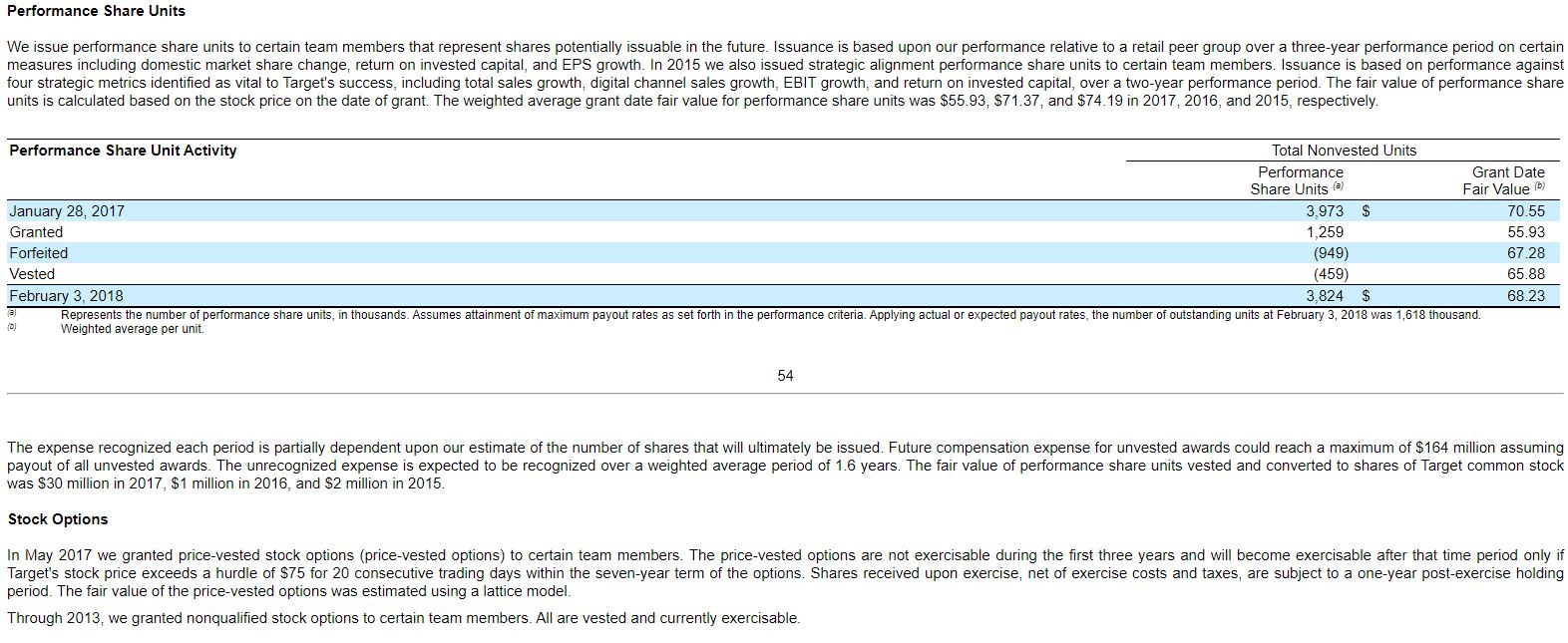

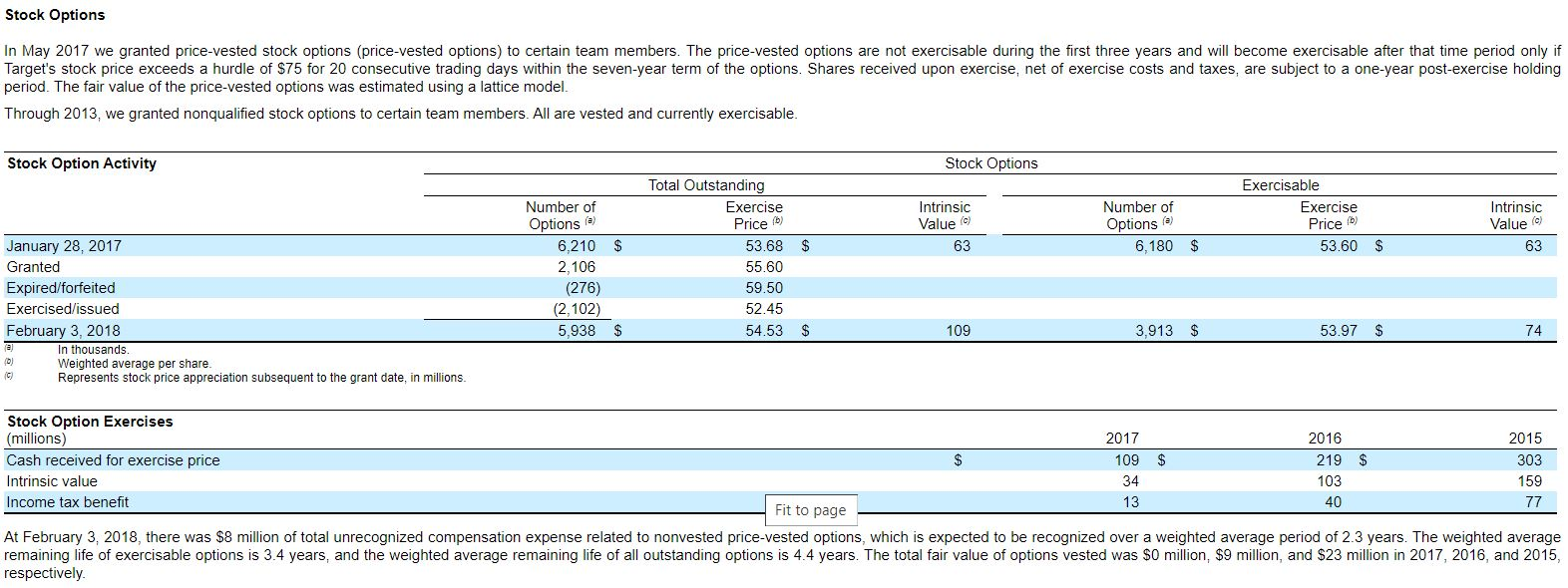

3. Projections of future performance should be based primarily on continuing operations. What was diluted EPS for continuing operations in each of the most recent three years? 4. How many shares were included in diluted earnings per share but not basic earnings per share due to share-based compensation awards? 26. Share-Based Compensation We maintain a long-term incentive plan (the Plan) for key team members and non-employee members of our Board of Directors. The Plan allows us to grant equity-based compensation awards, including stock options, stock appreciation rights, performance share units, restricted stock units, restricted stock awards, or a combination of awards (collectively, share-based awards). The number of unissued common shares reserved for future grants under the Plan was 24.5 million and 31.0 million at February 3, 2018 and January 28, 2017, respectively. Compensation expense associated with share-based awards is recognized on a straight-line basis over the shorter of the vesting period or the minimum required service period and reflects estimated forfeitures. Share-based compensation expense recognized in the Consolidated Statements of Operations was $115 million, $116 million, and $118 million in 2017, 2016, and 2015, respectively. The related income tax benefit was $26 million, $43 million, and $46 million in 2017, 2016, and 2015, respectively. Restricted Stock Units We issue restricted stock units and performance-based restricted stock units generally with three-year cliff or four-year graduated vesting from the grant date (collectively restricted stock units) to certain team members. The final number of shares issued under performance-based restricted stock units will be based on our total shareholder return relative to a retail peer group over a three-year performance period. We also regularly issue restricted stock units to our Board of Directors, which vest quarterly over a one-year period and are settled in shares of Target common stock upon departure from the Board. The fair value for restricted stock units is calculated based on the stock price on the date of grant, incorporating an analysis of the total shareholder return performance measure where applicable. The weighted average grant date fair value for restricted stock units was $56.19, $74.05, and $73.76 in 2017, 2016, and 2015, respectively Restricted Stock Unit Activity Total Nonvested Units Restricted Grant Date Stock ) Fair Value b) January 28, 2017 3,339 $ 71.62 Granted 2,115 56.19 Forfeited (459) 67.06 Vested (1,232) 70.61 February 3, 2018 3,763 $ 64.35 Represents the number of shares of restricted stock units, in thousands. For performance-based restricted stock units, assumes attainment of maximum payout rates as set forth in the performance criteria. Applying actual or expected payout rates, the number of outstanding restricted stock units and performance-based restricted stock units at February 3, 2018 was 3,145 thousand. Weighted average per unit. The expense recognized each period is partially dependent upon our estimate of the number of shares that will ultimately be issued. At February 3, 2018, there was $96 million of total unrecognized compensation expense related to restricted stock units, which is expected to be recognized over a weighted average period of 2.5 years. The fair value of restricted stock units vested and converted to shares of Target common stock was $87 million, $75 million, and $90 million in 2017, 2016, and 2015, respectively. Performance Share Units We issue performance share units to certain team members that represent shares potentially issuable in the future. Issuance is based upon our performance relative to a retail peer group over a three-year performance period on certain measures including domestic market share change, return on invested capital, and EPS growth. In 2015 we also issued strategic alignment performance share units to certain team members. Issuance is based on performance against four strategic metrics identified as vital to Target's success, including total sales growth, digital channel sales growth, EBIT growth, and return on invested capital, over a two-year performance period. The fair value of performance share units is calculated based on the stock price on the date of grant. The weighted average grant date fair value for performance share units was $55.93, $71.37, and $74.19 in 2017, 2016, and 2015, respectively. Performance Share Unit Activity Total Nonvested Units Performance Grant Date Share Units (2) Fair Value (5) January 28, 2017 3,973 $ 70.55 Granted 1,259 55.93 Forfeited (949) 67.28 Vested (459) 65.88 February 3, 2018 3,824 S 68.23 Represents the number of performance share units, in thousands. Assumes attainment of maximum payout rates as set forth in the performance criteria. Applying actual or expected payout rates, the number of outstanding units at February 3, 2018 was 1,618 thousand. Weighted average per unit. 54 The expense recognized each period is partially dependent upon our estimate of the number of shares that will ultimately be issued. Future compensation expense for unvested awards could reach a maximum of $164 million assuming payout of all unvested awards. The unrecognized expense is expected to be recognized over a weighted average period of 1.6 years. The fair value of performance share units vested and converted to shares of Target common stock was $30 million in 2017, $1 million in 2016, and $2 million in 2015. Stock Options In May 2017 we granted price-vested stock options (price-vested options) to certain team members. The price-vested options are not exercisable during the first three years and will become exercisable after that time period only if Target's stock price exceeds a hurdle of $75 for 20 consecutive trading days within the seven-year term of the options. Shares received upon exercise, net of exercise costs and taxes, are subject to a one-year post-exercise holding period. The fair value of the price-vested options was estimated using a lattice model. Through 2013, we granted nonqualified stock options to certain team members. All are vested and currently exercisable. Stock Options In May 2017 we granted price-vested stock options (price-vested options) to certain team members. The price-vested options are not exercisable during the first three years and will become exercisable after that time period only if Target's stock price exceeds a hurdle of $75 for 20 consecutive trading days within the seven-year term of the options. Shares received upon exercise, net of exercise costs and taxes, are subject to a one-year post-exercise holding period. The fair value of the price-vested options was estimated using a lattice model. Through 2013, we granted nonqualified stock options to certain team members. All are vested and currently exercisable. Stock Option Activity Stock Options Intrinsic Value Number of Options() 6,180 Exercisable Exercise Price (6) 53.60 $ - Value * Intrinsic Value) 63 $ 63 $ January 28, 2017 Granted Expired/forfeited Exercised/issued February 3, 2018 In thousands Weighted average per share. Represents stock price appreciation subsequent to the grant date, in millions. Number of Options 6,210 2,106 (276) (2,102) 5,938 Total Outstanding Exercise Price 6 53.68 $ 55.60 59.50 52.45 54.53 $ $ 109 3.913 $ 53.97 $ 74 Repies Stock Option Exercises (millions) 2017 2016 2015 Cash received for exercise price 109 $ 219 $ 303 Intrinsic value 34 103 159 Income tax benefit 13 40 77 Fit to page At February 3, 2018, there was $8 million of total unrecognized compensation expense related to nonvested price-vested options, which is expected to be recognized over a weighted average period of 2.3 years. The weighted average remaining life of exercisable options is 3.4 years, and the weighted average remaining life of all outstanding options is 4.4 years. The total fair value of options vested was $0 million, $9 million, and $23 million in 2017, 2016, and 2015, respectively. 3. Projections of future performance should be based primarily on continuing operations. What was diluted EPS for continuing operations in each of the most recent three years? 4. How many shares were included in diluted earnings per share but not basic earnings per share due to share-based compensation awards? 26. Share-Based Compensation We maintain a long-term incentive plan (the Plan) for key team members and non-employee members of our Board of Directors. The Plan allows us to grant equity-based compensation awards, including stock options, stock appreciation rights, performance share units, restricted stock units, restricted stock awards, or a combination of awards (collectively, share-based awards). The number of unissued common shares reserved for future grants under the Plan was 24.5 million and 31.0 million at February 3, 2018 and January 28, 2017, respectively. Compensation expense associated with share-based awards is recognized on a straight-line basis over the shorter of the vesting period or the minimum required service period and reflects estimated forfeitures. Share-based compensation expense recognized in the Consolidated Statements of Operations was $115 million, $116 million, and $118 million in 2017, 2016, and 2015, respectively. The related income tax benefit was $26 million, $43 million, and $46 million in 2017, 2016, and 2015, respectively. Restricted Stock Units We issue restricted stock units and performance-based restricted stock units generally with three-year cliff or four-year graduated vesting from the grant date (collectively restricted stock units) to certain team members. The final number of shares issued under performance-based restricted stock units will be based on our total shareholder return relative to a retail peer group over a three-year performance period. We also regularly issue restricted stock units to our Board of Directors, which vest quarterly over a one-year period and are settled in shares of Target common stock upon departure from the Board. The fair value for restricted stock units is calculated based on the stock price on the date of grant, incorporating an analysis of the total shareholder return performance measure where applicable. The weighted average grant date fair value for restricted stock units was $56.19, $74.05, and $73.76 in 2017, 2016, and 2015, respectively Restricted Stock Unit Activity Total Nonvested Units Restricted Grant Date Stock ) Fair Value b) January 28, 2017 3,339 $ 71.62 Granted 2,115 56.19 Forfeited (459) 67.06 Vested (1,232) 70.61 February 3, 2018 3,763 $ 64.35 Represents the number of shares of restricted stock units, in thousands. For performance-based restricted stock units, assumes attainment of maximum payout rates as set forth in the performance criteria. Applying actual or expected payout rates, the number of outstanding restricted stock units and performance-based restricted stock units at February 3, 2018 was 3,145 thousand. Weighted average per unit. The expense recognized each period is partially dependent upon our estimate of the number of shares that will ultimately be issued. At February 3, 2018, there was $96 million of total unrecognized compensation expense related to restricted stock units, which is expected to be recognized over a weighted average period of 2.5 years. The fair value of restricted stock units vested and converted to shares of Target common stock was $87 million, $75 million, and $90 million in 2017, 2016, and 2015, respectively. Performance Share Units We issue performance share units to certain team members that represent shares potentially issuable in the future. Issuance is based upon our performance relative to a retail peer group over a three-year performance period on certain measures including domestic market share change, return on invested capital, and EPS growth. In 2015 we also issued strategic alignment performance share units to certain team members. Issuance is based on performance against four strategic metrics identified as vital to Target's success, including total sales growth, digital channel sales growth, EBIT growth, and return on invested capital, over a two-year performance period. The fair value of performance share units is calculated based on the stock price on the date of grant. The weighted average grant date fair value for performance share units was $55.93, $71.37, and $74.19 in 2017, 2016, and 2015, respectively. Performance Share Unit Activity Total Nonvested Units Performance Grant Date Share Units (2) Fair Value (5) January 28, 2017 3,973 $ 70.55 Granted 1,259 55.93 Forfeited (949) 67.28 Vested (459) 65.88 February 3, 2018 3,824 S 68.23 Represents the number of performance share units, in thousands. Assumes attainment of maximum payout rates as set forth in the performance criteria. Applying actual or expected payout rates, the number of outstanding units at February 3, 2018 was 1,618 thousand. Weighted average per unit. 54 The expense recognized each period is partially dependent upon our estimate of the number of shares that will ultimately be issued. Future compensation expense for unvested awards could reach a maximum of $164 million assuming payout of all unvested awards. The unrecognized expense is expected to be recognized over a weighted average period of 1.6 years. The fair value of performance share units vested and converted to shares of Target common stock was $30 million in 2017, $1 million in 2016, and $2 million in 2015. Stock Options In May 2017 we granted price-vested stock options (price-vested options) to certain team members. The price-vested options are not exercisable during the first three years and will become exercisable after that time period only if Target's stock price exceeds a hurdle of $75 for 20 consecutive trading days within the seven-year term of the options. Shares received upon exercise, net of exercise costs and taxes, are subject to a one-year post-exercise holding period. The fair value of the price-vested options was estimated using a lattice model. Through 2013, we granted nonqualified stock options to certain team members. All are vested and currently exercisable. Stock Options In May 2017 we granted price-vested stock options (price-vested options) to certain team members. The price-vested options are not exercisable during the first three years and will become exercisable after that time period only if Target's stock price exceeds a hurdle of $75 for 20 consecutive trading days within the seven-year term of the options. Shares received upon exercise, net of exercise costs and taxes, are subject to a one-year post-exercise holding period. The fair value of the price-vested options was estimated using a lattice model. Through 2013, we granted nonqualified stock options to certain team members. All are vested and currently exercisable. Stock Option Activity Stock Options Intrinsic Value Number of Options() 6,180 Exercisable Exercise Price (6) 53.60 $ - Value * Intrinsic Value) 63 $ 63 $ January 28, 2017 Granted Expired/forfeited Exercised/issued February 3, 2018 In thousands Weighted average per share. Represents stock price appreciation subsequent to the grant date, in millions. Number of Options 6,210 2,106 (276) (2,102) 5,938 Total Outstanding Exercise Price 6 53.68 $ 55.60 59.50 52.45 54.53 $ $ 109 3.913 $ 53.97 $ 74 Repies Stock Option Exercises (millions) 2017 2016 2015 Cash received for exercise price 109 $ 219 $ 303 Intrinsic value 34 103 159 Income tax benefit 13 40 77 Fit to page At February 3, 2018, there was $8 million of total unrecognized compensation expense related to nonvested price-vested options, which is expected to be recognized over a weighted average period of 2.3 years. The weighted average remaining life of exercisable options is 3.4 years, and the weighted average remaining life of all outstanding options is 4.4 years. The total fair value of options vested was $0 million, $9 million, and $23 million in 2017, 2016, and 2015, respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts