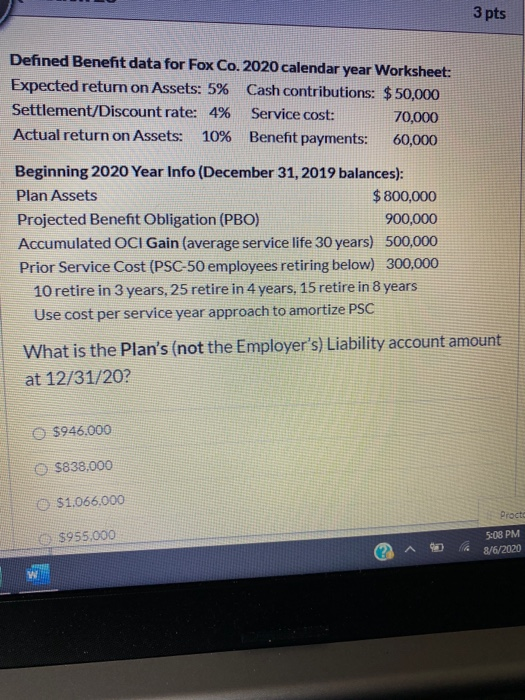

Question: 3 pts Defined Benefit data for Fox Co. 2020 calendar year Worksheet: Expected return on Assets: 5% Cash contributions: $ 50,000 Settlement/Discount rate: 4% Service

3 pts Defined Benefit data for Fox Co. 2020 calendar year Worksheet: Expected return on Assets: 5% Cash contributions: $ 50,000 Settlement/Discount rate: 4% Service cost: 70,000 Actual return on Assets: 10% Benefit payments: 60,000 Beginning 2020 Year Info (December 31, 2019 balances): Plan Assets $ 800,000 Projected Benefit Obligation (PBO) 900,000 Accumulated OCI Gain (average service life 30 years) 500,000 Prior Service Cost (PSC-50 employees retiring below) 300,000 10 retire in 3 years, 25 retire in 4 years, 15 retire in 8 years Use cost per service year approach to amortize PSC What is the Plan's (not the Employer's) Liability account amount at 12/31/20? O $946.000 O $838,000 $1.066.000 Procta $955.000 5:08 PM 8/6/2020 w

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts