Question: 3 pts Question 27 A call option has an exercise price of USD 35.00 and the current stock price is USD 36.50. If the call

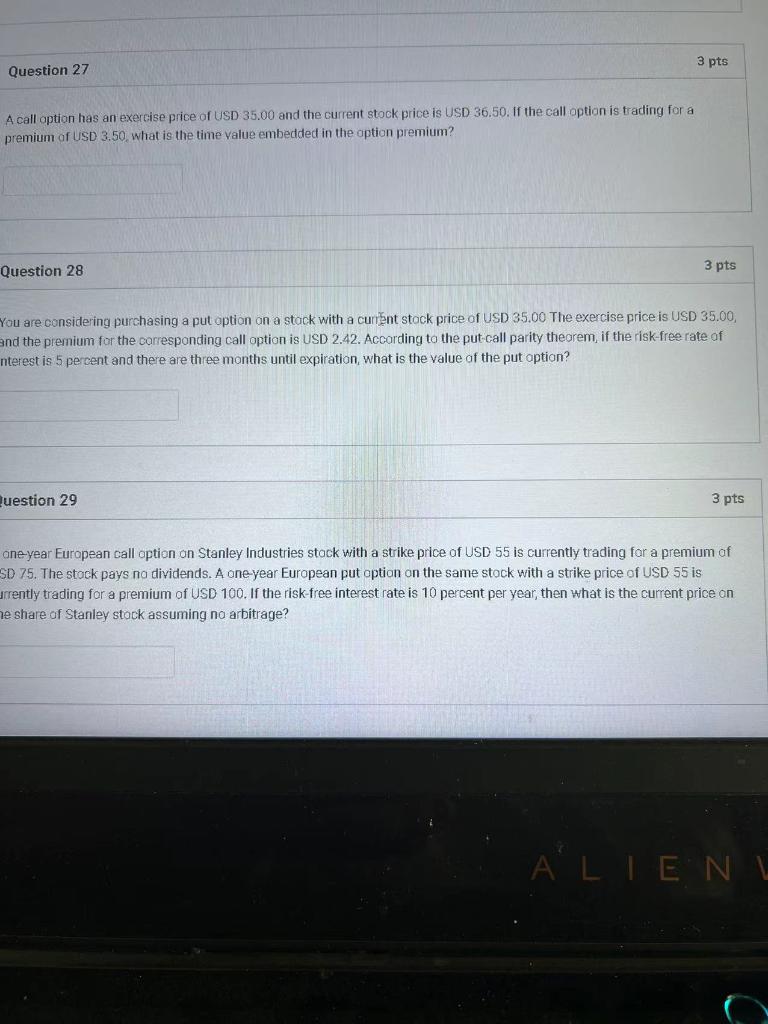

3 pts Question 27 A call option has an exercise price of USD 35.00 and the current stock price is USD 36.50. If the call option is trading for a premium of USD 3.50, what is the time value embedded in the option premium? Question 28 3 pts You are considering purchasing a put option on a stock with a current stock price of USD 35.00 The exercise price is USD 35.00, and the premium for the corresponding call option is USD 2.42. According to the put call parity theorem, if the risk-free rate of nterest is 5 percent and there are three months until expiration, what is the value of the put option? uestion 29 3 pts one year European call option on Stanley Industries stock with a strike price of USD 55 is currently trading for a premium of SD 75. The stock pays na dividends. A one-year European put option on the same stock with a strike price of USD 55 is urrently trading for a premium of USD 100. If the risk-free interest rate is 10 percent per year, then what is the current price on ne share of Stanley stock assuming no arbitrage? ALIEN

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts