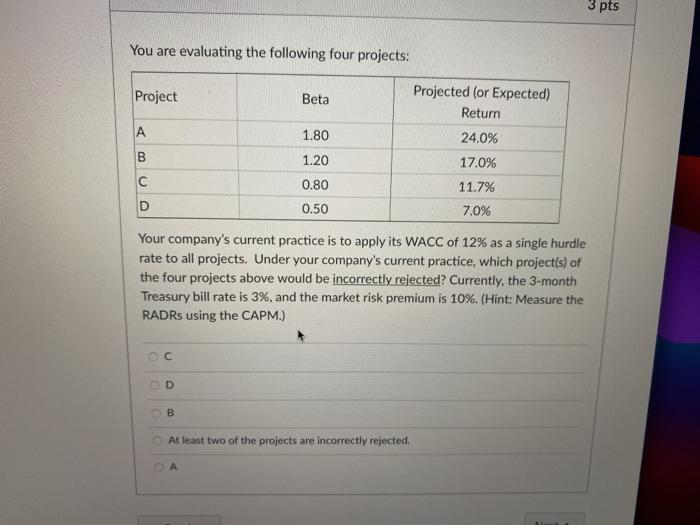

Question: 3 pts You are evaluating the following four projects: Project Beta Projected (or Expected) Return A 1.80 24.0% B 17.0% 1.20 0.80 11.7% 7.0% D

3 pts You are evaluating the following four projects: Project Beta Projected (or Expected) Return A 1.80 24.0% B 17.0% 1.20 0.80 11.7% 7.0% D 0.50 Your company's current practice is to apply its WACC of 12% as a single hurdle rate to all projects. Under your company's current practice, which project(s) of the four projects above would be incorrectly rejected? Currently, the 3-month Treasury bill rate is 3%, and the market risk premium is 10%. (Hint: Measure the RADRs using the CAPM.) D B At least two of the projects are incorrectly rejected. A

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock