Question: 3. [Put-Call Parity Condition] At date 1, there is a European call option on the dollar with a strike price of K = 0.75 and

![3. [Put-Call Parity Condition] At date 1, there is a European](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fe9974ed6cd_46066fe997487868.jpg)

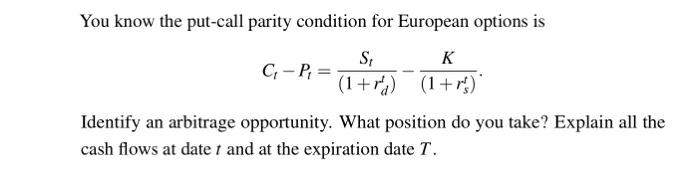

3. [Put-Call Parity Condition] At date 1, there is a European call option on the dollar with a strike price of K = 0.75 and an expiration date of T > t and a European put option on the dollar with the same strike price and expiration date. Both are notional one dollar (N = 1). The risk-free interest rate in the UK is r' = 1/5 (20%) and the risk-free interest rate in the US is r'a = 1/4 (25%). The current spot exchange rate is S, = 0.8 (that is, each dollar costs 80 pence). (a) You buy the put option at the price of P, = 2.5 pence. Explain the position you have at the expiration date T. (b) Five minutes later you find out that the equivalent call is trading at C = 5 pence. You know the put-call parity condition for European options is C-P,= S, (1+r) K (1+r) Identify an arbitrage opportunity. What position do you take? Explain all the cash flows at date t and at the expiration date T

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts