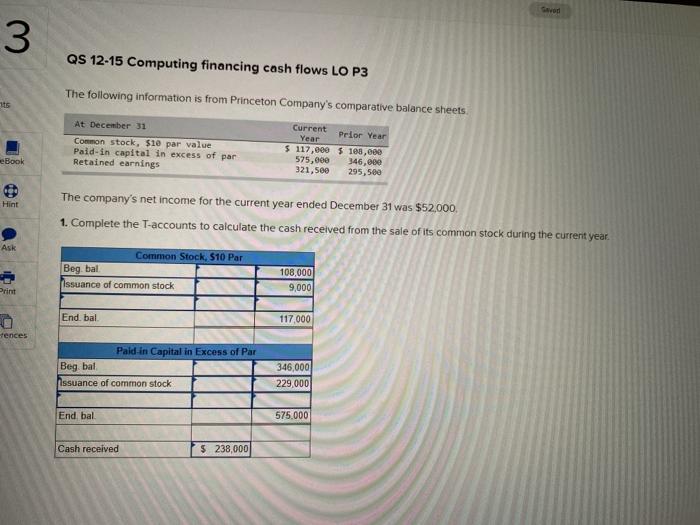

Question: 3 QS 12-15 Computing financing cash flows LO P3 The following information is from Princeton Company's comparative balance sheets At December 31 Common stock, $10

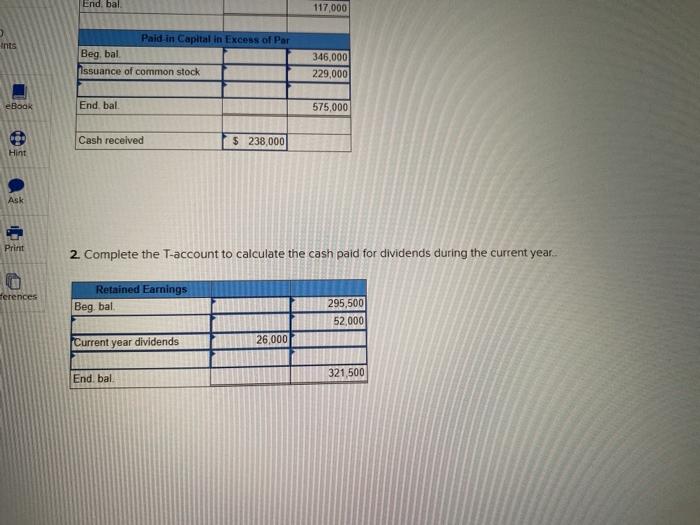

3 QS 12-15 Computing financing cash flows LO P3 The following information is from Princeton Company's comparative balance sheets At December 31 Common stock, $10 par value Paid in capital in excess of par Retained earnings Current Year Prior Year $ 117,000 5 188,000 575,000 346,00 321,500 295,500 eBook Hint The company's net income for the current year ended December 31 was $52,000 1. Complete the T-accounts to calculate the cash received from the sale of its common stock during the current year. Ask Common Stock, $10 Par Beg bal Issuance of common stock 108,000 9,000 Print End, bal 117,000 tences Pald-in Capital in Excess of Par Beg bal 346,000 229.000 Assuance of common stock End bal 575.000 Cash received $ 238,000 End, bal 117,000 Ints Paid in Capital in Excess of Par Beg, bal Issuance of common stock 346,000 229,000 eBook End bal 575,000 Cash received $ 238,000 Hint Ask Print 2. Complete the T-account to calculate the cash paid for dividends during the current year. Retained Earnings ferences Beg bal 295,500 52,000 Current year dividends 26,000 321,500 End bal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts