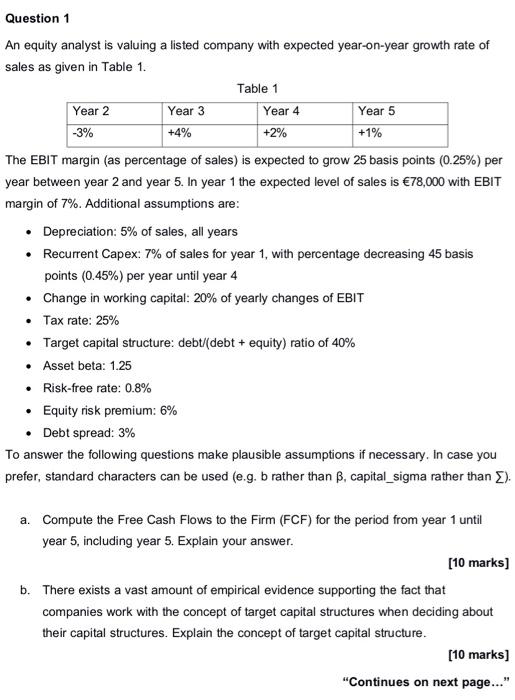

Question: -3% Question 1 An equity analyst is valuing a listed company with expected year-on-year growth rate of sales as given in Table 1. Table 1

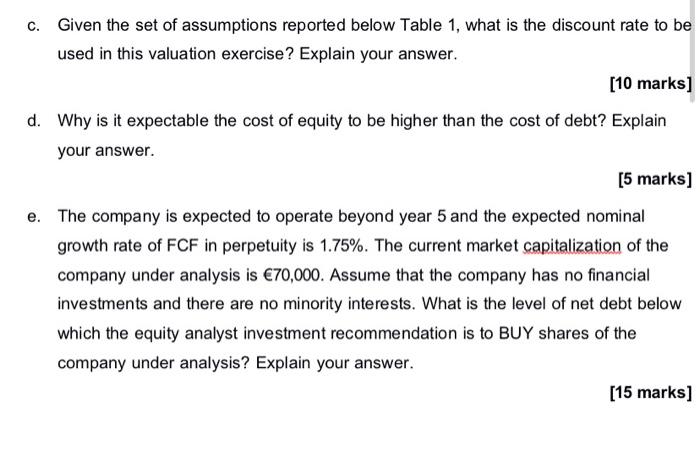

-3% Question 1 An equity analyst is valuing a listed company with expected year-on-year growth rate of sales as given in Table 1. Table 1 Year 2 Year 3 Year 4 Year 5 +4% +2% +1% The EBIT margin (as percentage of sales) is expected to grow 25 basis points (0.25%) per year between year 2 and year 5. In year 1 the expected level of sales is 78,000 with EBIT margin of 7%. Additional assumptions are: Depreciation: 5% of sales, all years Recurrent Capex: 7% of sales for year 1, with percentage decreasing 45 basis points (0.45%) per year until year 4 Change in working capital: 20% of yearly changes of EBIT Tax rate: 25% Target capital structure: debt (debt + equity) ratio of 40% Asset beta: 1.25 Risk-free rate: 0.8% Equity risk premium: 6% Debt spread: 3% To answer the following questions make plausible assumptions if necessary. In case you prefer, standard characters can be used (e.g. b rather than B, capital_sigma rather than ). a. Compute the Free Cash Flows to the Firm (FCF) for the period from year 1 until year 5, including year 5. Explain your answer. [10 marks] b. There exists a vast amount of empirical evidence supporting the fact that companies work with the concept of target capital structures when deciding about their capital structures. Explain the concept of target capital structure. [10 marks] "Continues on next page..." C. Given the set of assumptions reported below Table 1, what is the discount rate to be used in this valuation exercise? Explain your answer. [10 marks] d. Why is it expectable the cost of equity to be higher than the cost of debt? Explain your answer. [5 marks] e. The company is expected to operate beyond year 5 and the expected nominal growth rate of FCF in perpetuity is 1.75%. The current market capitalization of the company under analysis is 70,000. Assume that the company has no financial investments and there are no minority interests. What is the level of net debt below which the equity analyst investment recommendation is to BUY shares of the company under analysis? Explain your answer. [15 marks] -3% Question 1 An equity analyst is valuing a listed company with expected year-on-year growth rate of sales as given in Table 1. Table 1 Year 2 Year 3 Year 4 Year 5 +4% +2% +1% The EBIT margin (as percentage of sales) is expected to grow 25 basis points (0.25%) per year between year 2 and year 5. In year 1 the expected level of sales is 78,000 with EBIT margin of 7%. Additional assumptions are: Depreciation: 5% of sales, all years Recurrent Capex: 7% of sales for year 1, with percentage decreasing 45 basis points (0.45%) per year until year 4 Change in working capital: 20% of yearly changes of EBIT Tax rate: 25% Target capital structure: debt (debt + equity) ratio of 40% Asset beta: 1.25 Risk-free rate: 0.8% Equity risk premium: 6% Debt spread: 3% To answer the following questions make plausible assumptions if necessary. In case you prefer, standard characters can be used (e.g. b rather than B, capital_sigma rather than ). a. Compute the Free Cash Flows to the Firm (FCF) for the period from year 1 until year 5, including year 5. Explain your answer. [10 marks] b. There exists a vast amount of empirical evidence supporting the fact that companies work with the concept of target capital structures when deciding about their capital structures. Explain the concept of target capital structure. [10 marks] "Continues on next page..." C. Given the set of assumptions reported below Table 1, what is the discount rate to be used in this valuation exercise? Explain your answer. [10 marks] d. Why is it expectable the cost of equity to be higher than the cost of debt? Explain your answer. [5 marks] e. The company is expected to operate beyond year 5 and the expected nominal growth rate of FCF in perpetuity is 1.75%. The current market capitalization of the company under analysis is 70,000. Assume that the company has no financial investments and there are no minority interests. What is the level of net debt below which the equity analyst investment recommendation is to BUY shares of the company under analysis? Explain your answer. [15 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts