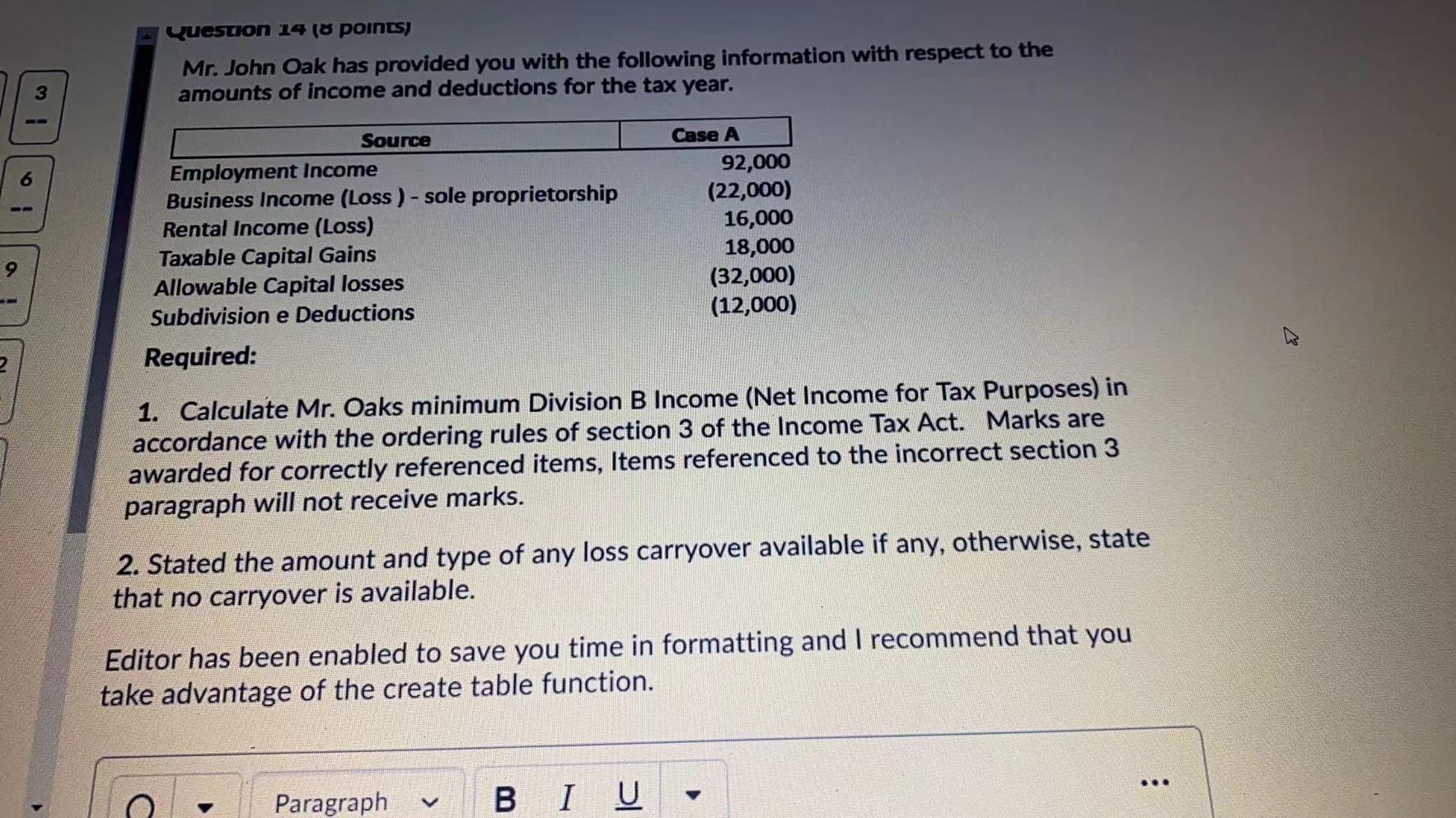

Question: 3 Question 14 (8 points) Mr. John Oak has provided you with the following information with respect to the amounts of income and deductions

3 Question 14 (8 points) Mr. John Oak has provided you with the following information with respect to the amounts of income and deductions for the tax year. Source Employment Income Business Income (Loss) - sole proprietorship Rental Income (Loss) Taxable Capital Gains 9 Allowable Capital losses Case A 92,000 (22,000) 16,000 18,000 (32,000) (12,000) 2 Subdivision e Deductions Required: 1. Calculate Mr. Oaks minimum Division B Income (Net Income for Tax Purposes) in accordance with the ordering rules of section 3 of the Income Tax Act. Marks are awarded for correctly referenced items, Items referenced to the incorrect section 3 paragraph will not receive marks. 2. Stated the amount and type of any loss carryover available if any, otherwise, state that no carryover is available. Editor has been enabled to save you time in formatting and I recommend that you take advantage of the create table function. Paragraph BIU ***

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts