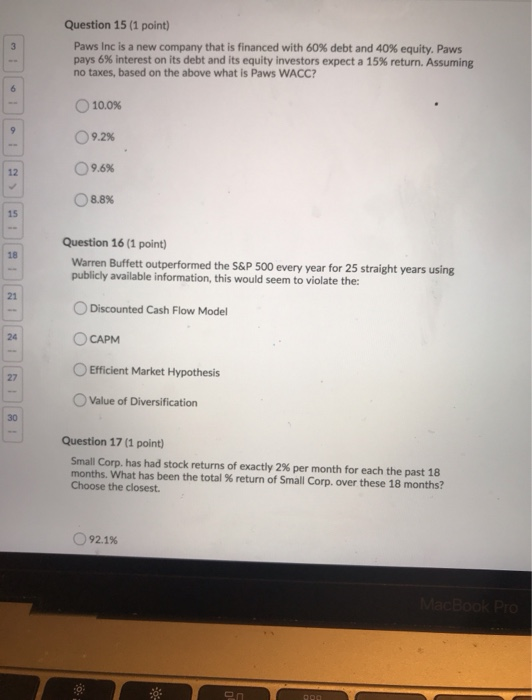

Question: 3 Question 15 (1 point) Paws Inc is a new company that is financed with 60% debt and 40% equity. Paws pays 6% interest on

3 Question 15 (1 point) Paws Inc is a new company that is financed with 60% debt and 40% equity. Paws pays 6% interest on its debt and its equity investors expect a 15% return. Assuming no taxes, based on the above what is Paws WACC? 10.0% 9 9.2% 12 9.6% 8.8% 15 18 Question 16 (1 point) Warren Buffett outperformed the S&P 500 every year for 25 straight years using publicly available information, this would seem to violate the: Discounted Cash Flow Model CAPM 21 24 27 Efficient Market Hypothesis Value of Diversification 30 Question 17 (1 point) Small Corp. has had stock returns of exactly 2% per month for each the past 18 months. What has been the total % return of Small Corp. over these 18 months? Choose the closest 92.1% MACBOOK Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts