Question: 3. Question 3 (5 points): Alpha and Beta Companies can borrow for a ten-year term at the following rates: Alpha Beta Fixed-rate borrowing cost 5.0%

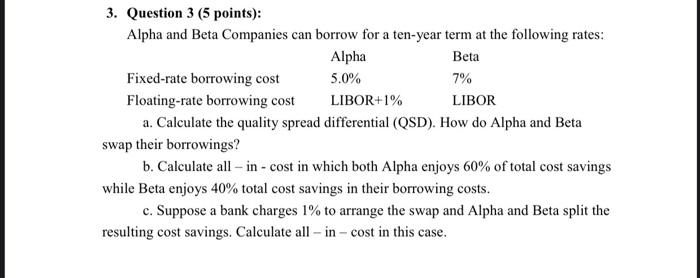

3. Question 3 (5 points): Alpha and Beta Companies can borrow for a ten-year term at the following rates: Alpha Beta Fixed-rate borrowing cost 5.0% 7% Floating-rate borrowing cost LIBOR+1% LIBOR a. Calculate the quality spread differential (QSD). How do Alpha and Beta swap their borrowings? b. Calculate all-in-cost in which both Alpha enjoys 60% of total cost savings while Beta enjoys 40% total cost savings in their borrowing costs. c. Suppose a bank charges 1% to arrange the swap and Alpha and Beta split the resulting cost savings. Calculate all-in-cost in this case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts