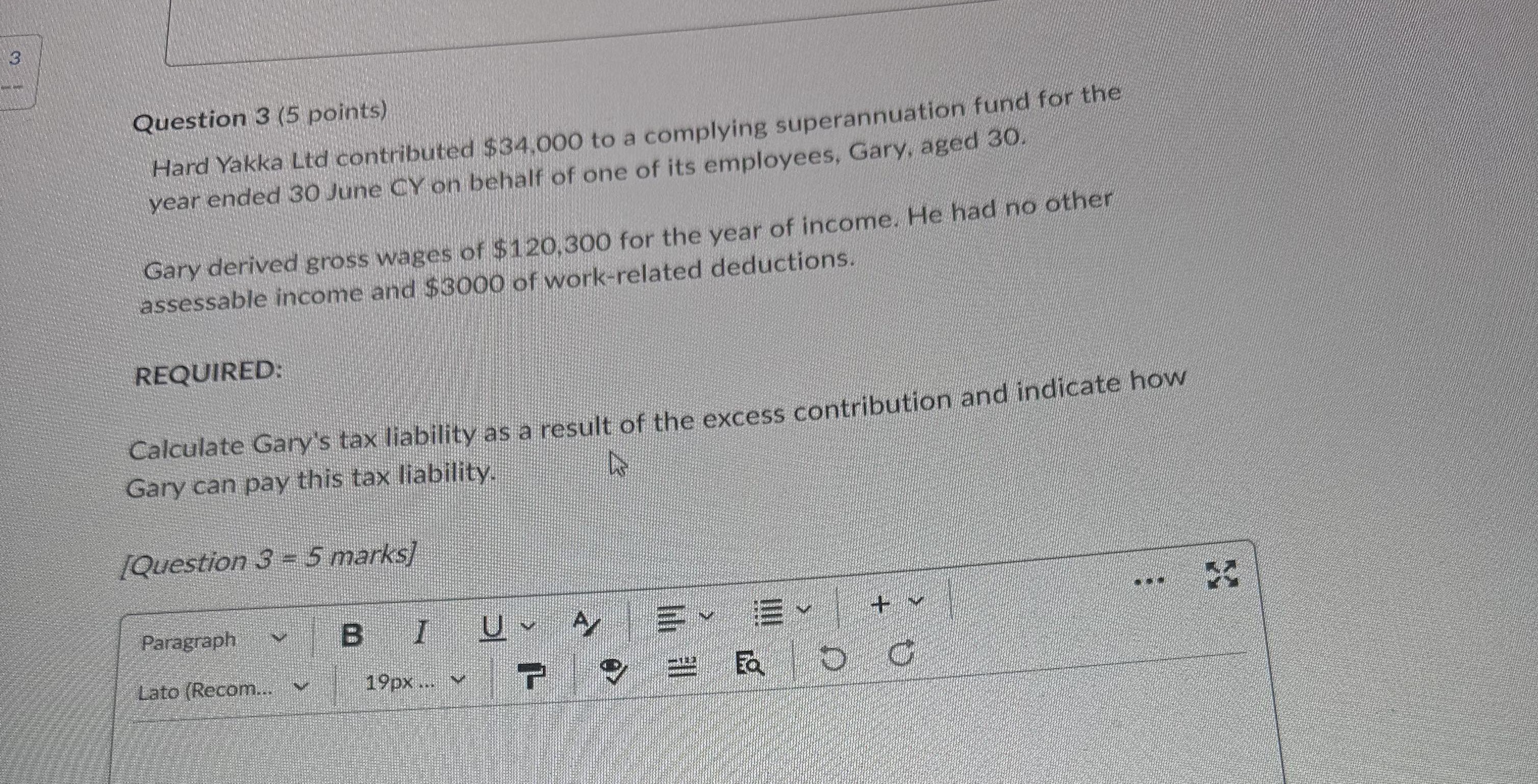

Question: 3 Question 3 (5 points) Hard Yakka Lid contributed $34,000 to a complying superannuateon fund for the year ended 30 June CY on behalf of

3 Question 3 (5 points) Hard Yakka Lid contributed $34,000 to a complying superannuateon fund for the year ended 30 June CY on behalf of one of its employees, Gary, aged 30 Gary derived gross wages of $120,300 for the year of income. He had no other assessable income and $3000 of work-related deductions. REQUIRED: Calculate Gary's tax liability as a result of the excess contribution and indicate how Gary can pay this tax liability (Question 3 - 5 marks] Paragraph B U A Lato (Recom... 19px ... V

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock