Question: 3 Question 3 (no code) . A butterfly spread consists of three options on the same stock. . All three options have the same expiration

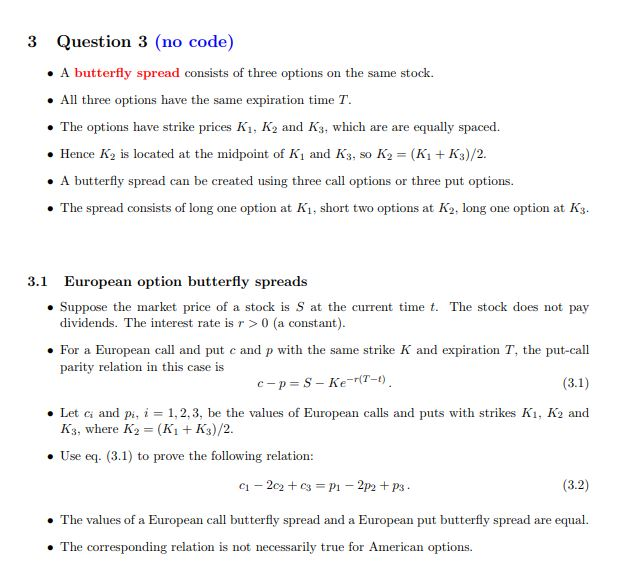

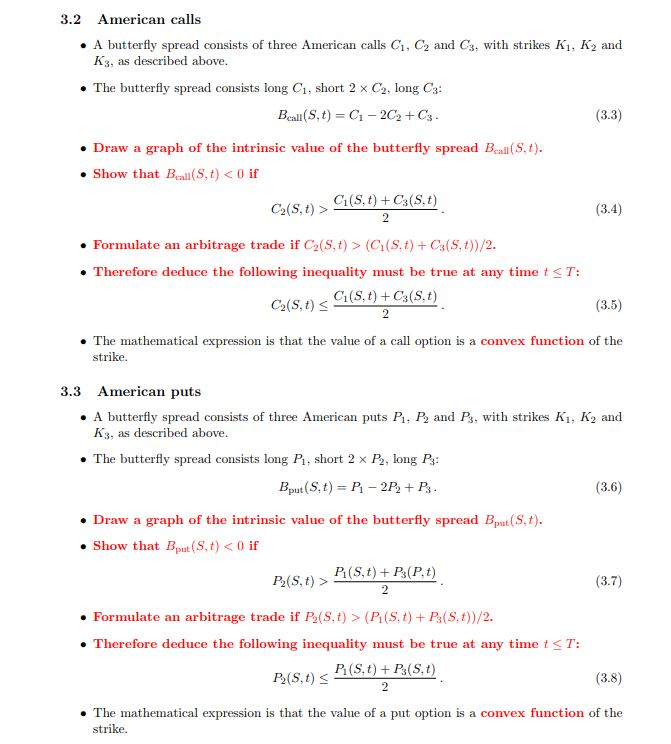

3 Question 3 (no code) . A butterfly spread consists of three options on the same stock. . All three options have the same expiration time T. . The options have strike prices K1, K2 and K3, which are are equally spaced Hence K2 is located at the midpoint of K1 and K3, so K2 = (Ki + K3)/2 . A butterfly spread can be created using three call options or three put options . The spread consists of long one option at Ki, short two options at K2, long one option at K3 3.1 European option butterfly spreads Suppose the market price of a stock is S at the current time t. The stock does not pay dividends. The interest rate is r>0 (a constant) . For a European call and put c and p with the same strike K and expiration T, the put-call parity relation in this case is . Let ci and pi,i 1,2,3, be the values of European calls and puts with strikes Ki, K2 and K3, where K2 (K K3)/2. . Use eq. (3.1) to prove the following relation: (3.2) . The values of a European call butterfly spread and a European put butterfly spread are equal . The corresponding relation is not necessarily true for American options

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts