Question: 3 question ( 40 marks). The sta- Notes: (1) During the year land was revalued. Also, non-current assets which had cost $100,000, and which had

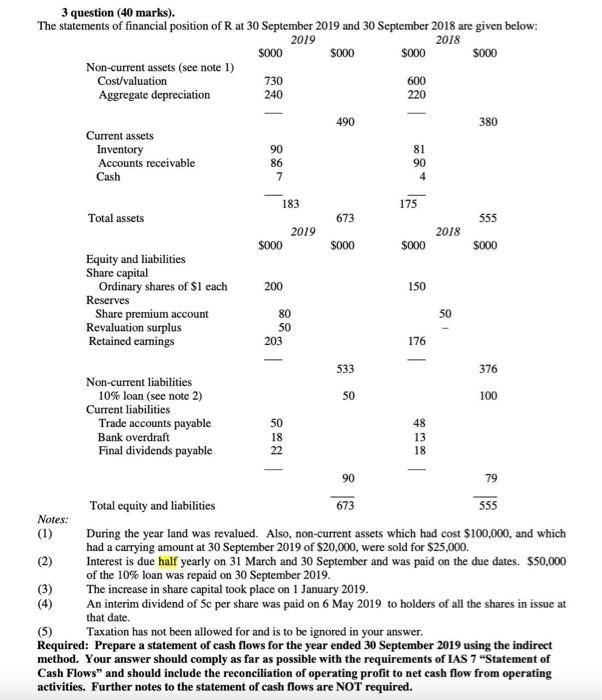

3 question ( 40 marks). The sta- Notes: (1) During the year land was revalued. Also, non-current assets which had cost $100,000, and which had a carrying amount at 30 September 2019 of $20,000, were sold for $25,000. (2) Interest is due half yearly on 31 March and 30 September and was paid on the due dates. $50,000 of the 10% loan was repaid on 30 September 2019. (3) The increase in share capital took place on 1 January 2019. (4) An interim dividend of 5c per share was paid on 6 May 2019 to holders of all the shares in issue at that date. (5) Taxation has not been allowed for and is to be ignored in your answer. Required: Prepare a statement of cash flows for the year ended 30 September 2019 using the indirect method. Your answer should comply as far as possible with the requirements of IAS 7 "Statement of Cash Flows" and should include the reconciliation of operating profit to net cash flow from operating activities. Further notes to the statement of cash flows are NOT required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts