Question: 3. Read the following problem and apply the best method to find the cash flows by making efficient capital investment decisions Tommy Inc., has identified

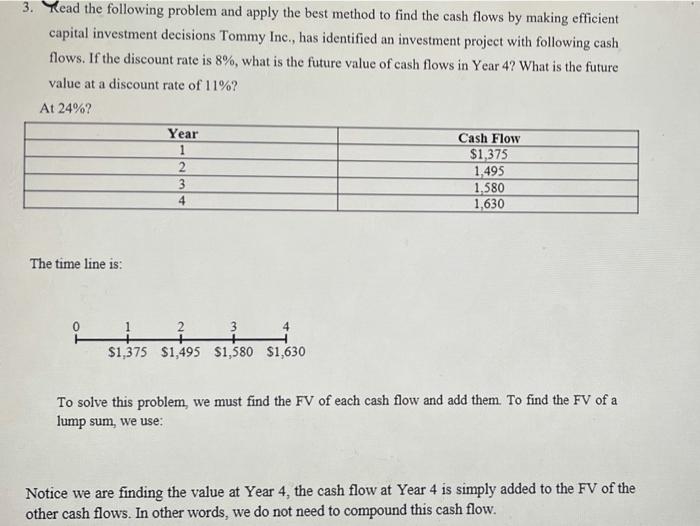

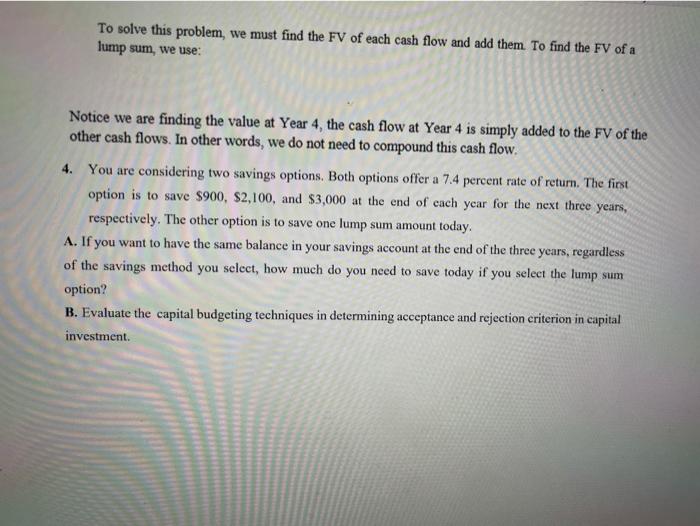

3. Read the following problem and apply the best method to find the cash flows by making efficient capital investment decisions Tommy Inc., has identified an investment project with following cash flows. If the discount rate is 8%, what is the future value of cash flows in Year 4? What is the future value at a discount rate of 11%? At 24%? Year Cash Flow 1 $1,375 2 1,495 3 1.580 4 1,630 The time line is: 2 3 $1,375 $1,495 $1,580 $1,630 To solve this problem, we must find the FV of each cash flow and add them. To find the FV of a lump sum, we use: Notice we are finding the value at Year 4, the cash flow at Year 4 is simply added to the FV of the other cash flows. In other words, we do not need to compound this cash flow. To solve this problem, we must find the FV of each cash flow and add them. To find the FV of a lump sum, we use: Notice we are finding the value at Year 4, the cash flow at Year 4 is simply added to the FV of the other cash flows. In other words, we do not need to compound this cash flow, 4. You are considering two savings options. Both options offer a 7.4 percent rate of return. The first option is to save $900, $2,100, and $3,000 at the end of each year for the next three years, respectively. The other option is to save one lump sum amount today. A. If you want to have the same balance in your savings account at the end of the three years, regardless of the savings method you select, how much do you need to save today if you select the lump sum option? B. Evaluate the capital budgeting techniques in determining acceptance and rejection criterion in capital investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts