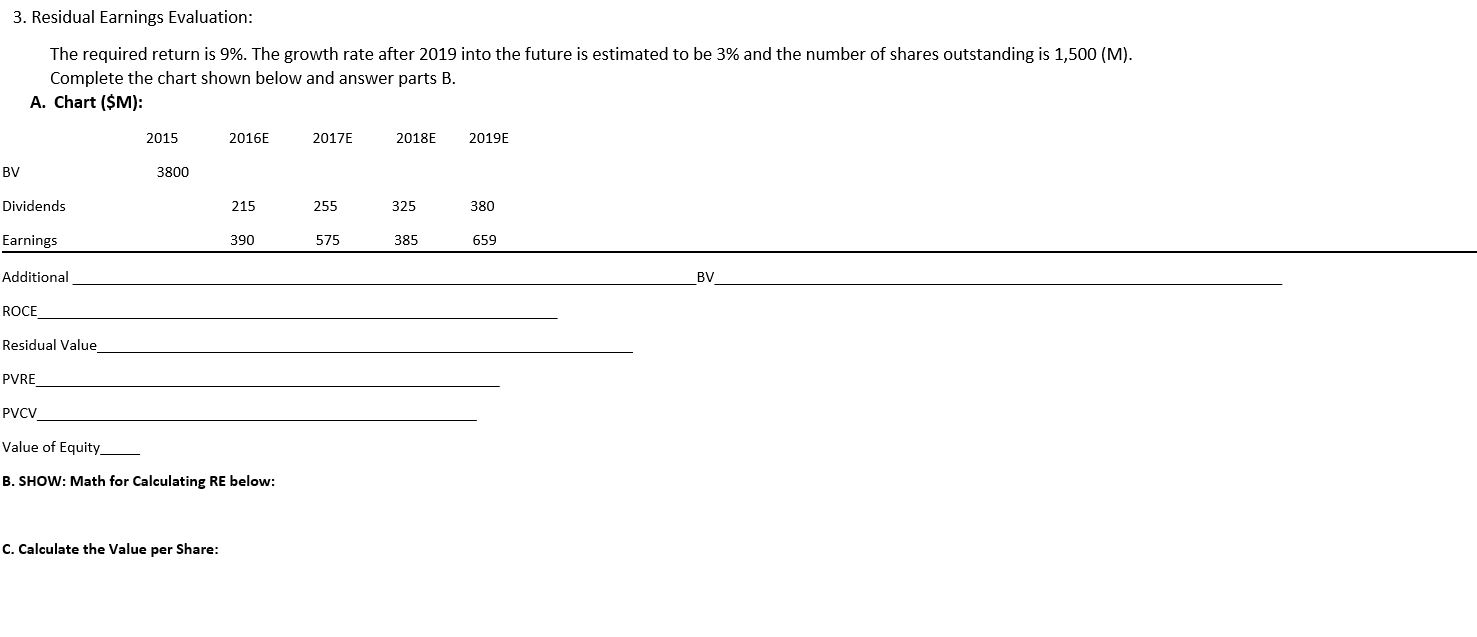

Question: 3. Residual Earnings Evaluation: The required return is 9%. The growth rate after 2019 into the future is estimated to be 3% and the number

3. Residual Earnings Evaluation: The required return is 9%. The growth rate after 2019 into the future is estimated to be 3% and the number of shares outstanding is 1,500 (M). Complete the chart shown below and answer parts B. A. Chart ($M): 2015 2016E 2017E 2018E 2019E BV 3800 Dividends 215 255 325 380 Earnings 390 575 385 659 Additional BV ROCE Residual Value PVRE PVCV Value of Equity B. SHOW: Math for Calculating RE below: C. Calculate the Value per Share: 3. Residual Earnings Evaluation: The required return is 9%. The growth rate after 2019 into the future is estimated to be 3% and the number of shares outstanding is 1,500 (M). Complete the chart shown below and answer parts B. A. Chart ($M): 2015 2016E 2017E 2018E 2019E BV 3800 Dividends 215 255 325 380 Earnings 390 575 385 659 Additional BV ROCE Residual Value PVRE PVCV Value of Equity B. SHOW: Math for Calculating RE below: C. Calculate the Value per Share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts