Question: 3. RETURN ON EQUITY 4. WHY ARE THEY DIFFERENT? 5.If total assets are the same for each firm, what can you conclude about their respective

3. RETURN ON EQUITY

4. WHY ARE THEY DIFFERENT?

5.If total assets are the same for each firm, what can you conclude about their respective uses of debt financing?

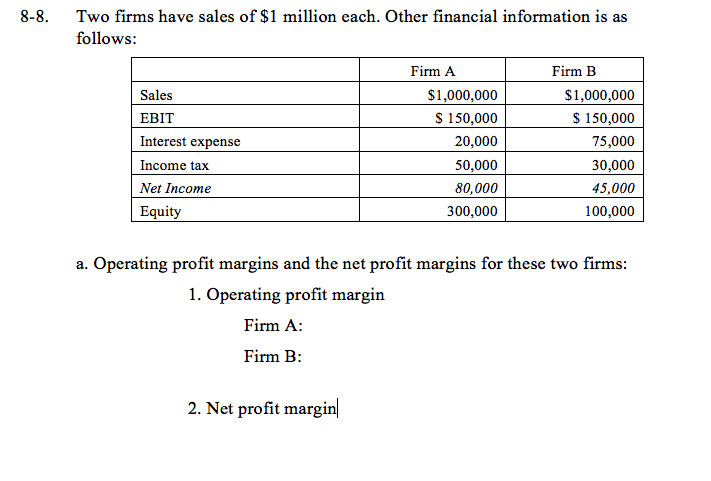

Two firms have sales of $1 million each. Other financial information is as follows: a. Operating profit margins and the net profit margins for these two firms: 1. Operating profit margin Firm A: Firm B: 2. Net profit margin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts