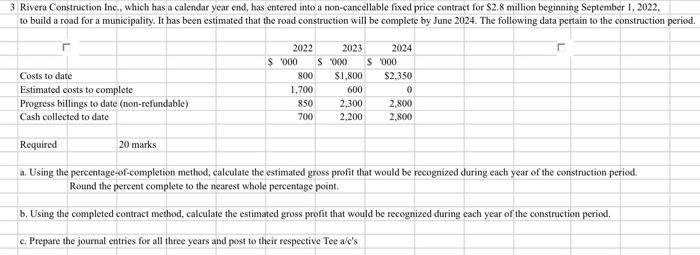

Question: 3 Rivera Construction inc., which has a calendar year end, has entered into a non-cancellable fixed price contract for $2.8 million beginning September 1 ,

3 Rivera Construction inc., which has a calendar year end, has entered into a non-cancellable fixed price contract for $2.8 million beginning September 1 , 2022 . to build a road for a municipality. It has been estimated that the road construction will be complete by June 2024 . The following data pertain to the construction period. a. Using the percentage-of-completion method, calculate the estimated gross profit that would be recognized during each year of the construction period. Round the pereent complete to the nearest whole percentage point. b. Using the completed contract method, calculate the estimated gross profit that would be recognized during each year of the construction period. c. Prepare the journal entries for all three years and post to their respective Tee a/c's

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts