Question: 3. RJ Enterprises has an operating account which is maintained at Ameris Bank. You learned the following: The cash receipts journal showed cash of $16,450

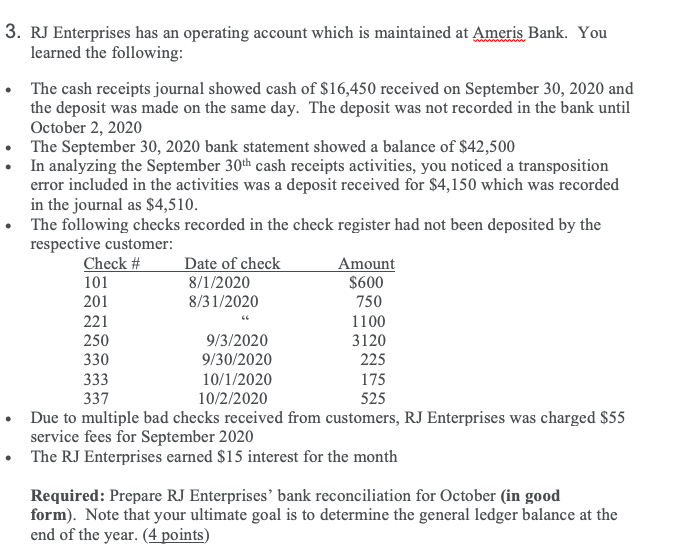

3. RJ Enterprises has an operating account which is maintained at Ameris Bank. You learned the following: The cash receipts journal showed cash of $16,450 received on September 30, 2020 and the deposit was made on the same day. The deposit was not recorded in the bank until October 2, 2020 The September 30, 2020 bank statement showed a balance of $42,500 In analyzing the September 30th cash receipts activities, you noticed a transposition error included in the activities was a deposit received for $4,150 which was recorded in the journal as $4,510. The following checks recorded in the check register had not been deposited by the respective customer: Check # Date of check Amount 101 8/1/2020 $600 201 8/31/2020 221 1100 250 9/3/2020 3120 330 9/30/2020 225 333 10/1/2020 175 337 10/2/2020 525 Due to multiple bad checks received from customers, RJ Enterprises was charged $55 service fees for September 2020 The RJ Enterprises earned $15 interest for the month 750 Required: Prepare RJ Enterprises' bank reconciliation for October (in good form). Note that your ultimate goal is to determine the general ledger balance at the end of the year. (4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts