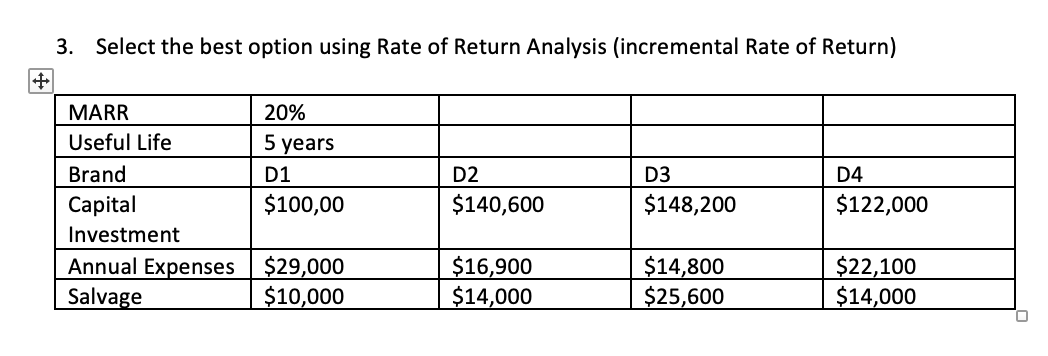

Question: 3. Select the best option using Rate of Return Analysis (incremental Rate of Return) MARR 20% Useful Life 5 years Brand D1 D2 D3

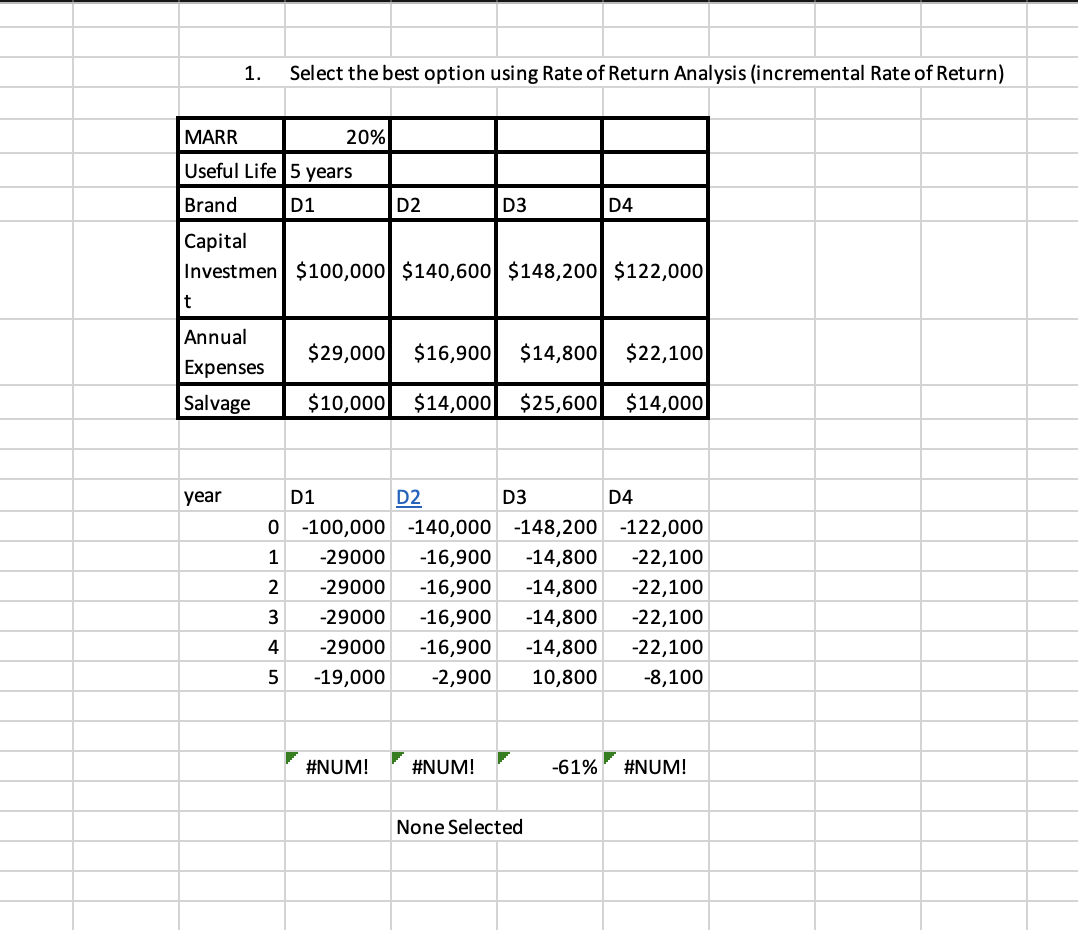

3. Select the best option using Rate of Return Analysis (incremental Rate of Return) MARR 20% Useful Life 5 years Brand D1 D2 D3 D4 Capital $100,00 $140,600 $148,200 $122,000 Investment Annual Expenses $29,000 $16,900 $14,800 $22,100 Salvage $10,000 $14,000 $25,600 $14,000 1. Select the best option using Rate of Return Analysis (incremental Rate of Return) MARR Useful Life 5 years Brand D1 Capital 20% D2 D3 D4 Investmen $100,000 $140,600 $148,200 $122,000 t Annual $29,000 $16,900 $14,800 $22,100 Expenses Salvage $10,000 $14,000 $25,600 $14,000 year D1 D2 D3 0 -100,000 -140,000 -148,200 -122,000 1 -29000 -16,900 2 3 -29000 -16,900 -29000 -14,800 -22,100 -14,800 -22,100 -16,900 -14,800 -22,100 4 -29000 5 -16,900 -14,800 -22,100 -19,000 -2,900 10,800 -8,100 #NUM! #NUM! None Selected -61% #NUM!

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts