Question: 3 seperate questions Need to calculate the trailing p/e, second question needs the price-to-book multiple, and third needs the multiple of enterprise value You are

Need to calculate the trailing p/e, second question needs the price-to-book multiple, and third needs the multiple of enterprise value

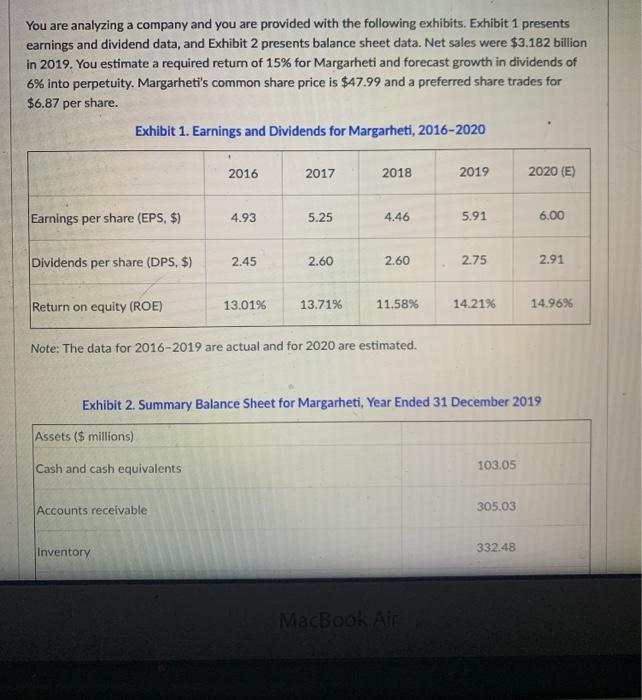

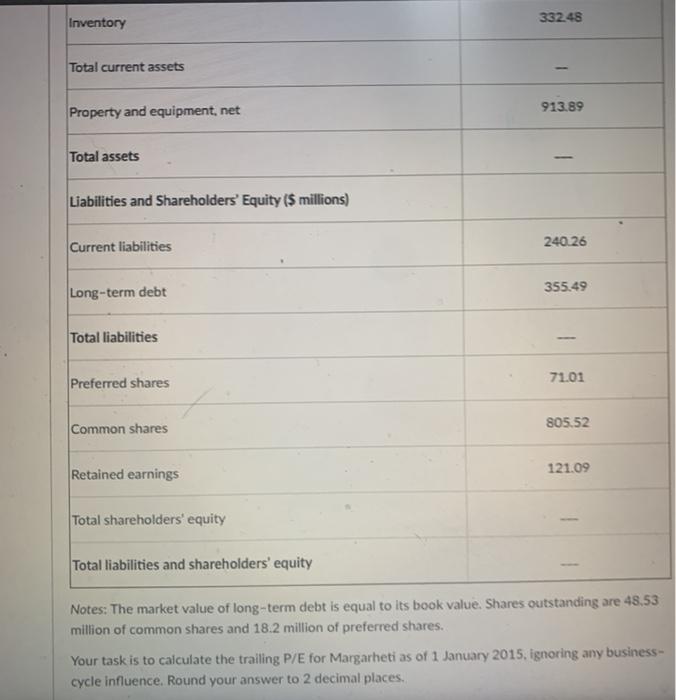

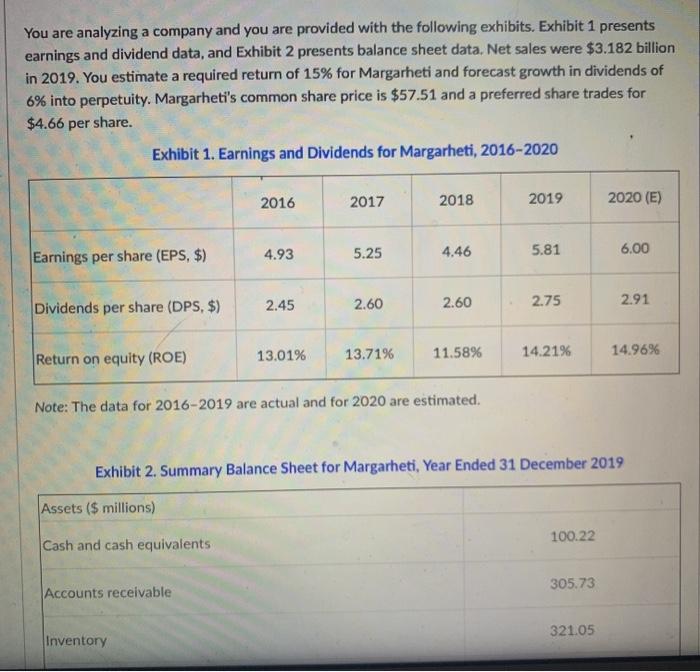

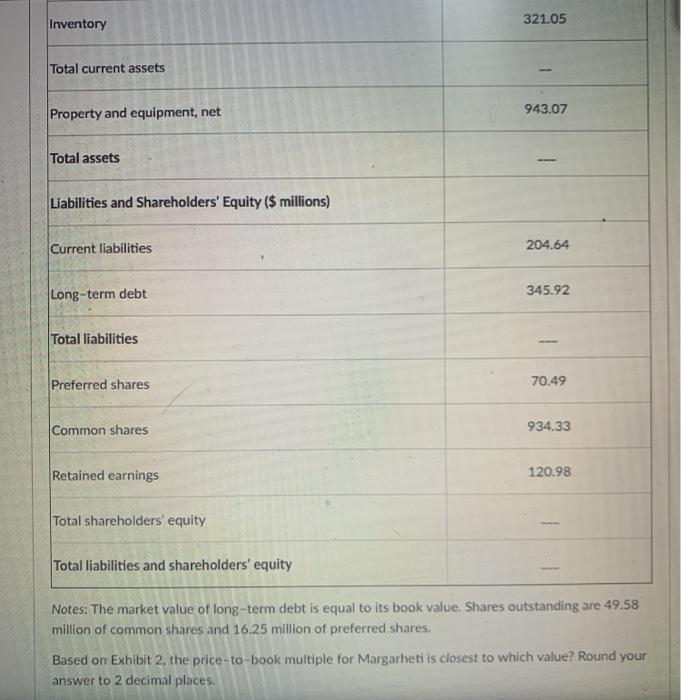

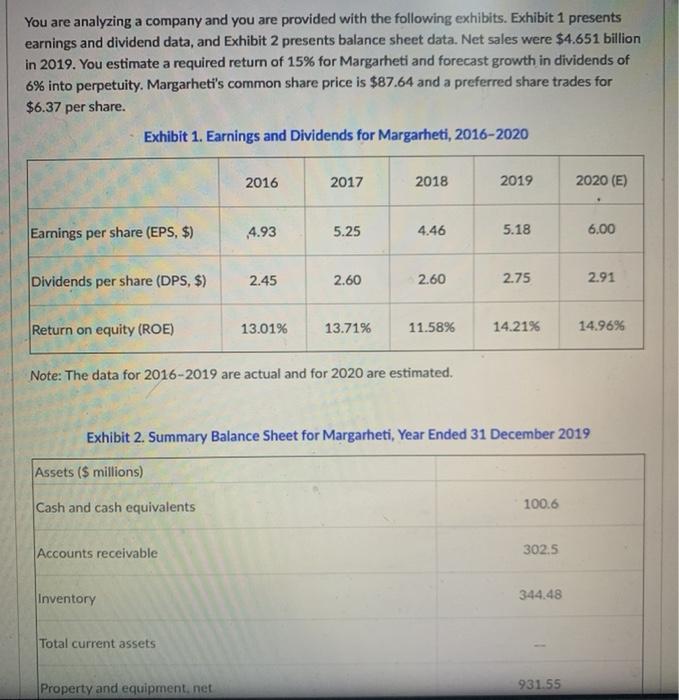

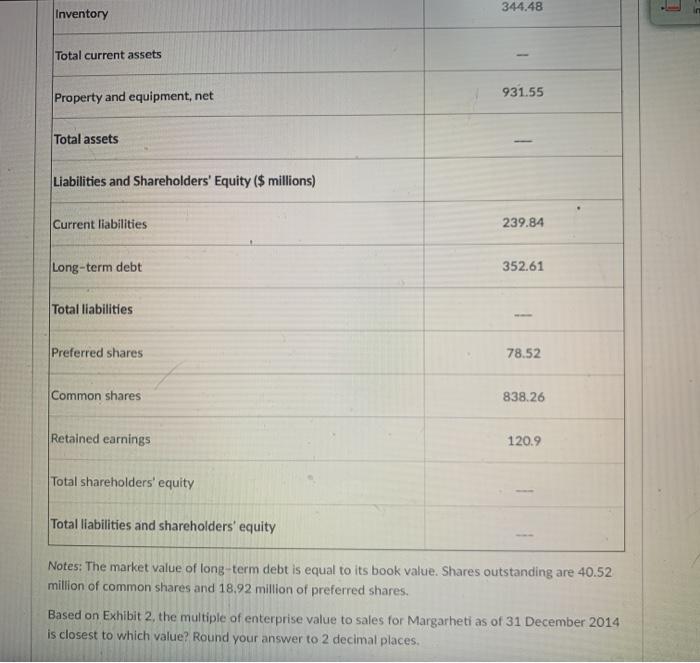

You are analyzing a company and you are provided with the following exhibits. Exhibit 1 presents earnings and dividend data, and Exhibit 2 presents balance sheet data. Net sales were $3.182 billion in 2019. You estimate a required return of 15% for Margarheti and forecast growth in dividends of 6% into perpetuity. Margarheti's common share price is $47.99 and a preferred share trades for $6.87 per share. Exhibit 1. Earnings and Dividends for Margarheti, 2016-2020 2016 2017 2018 2019 2020 (E) Earnings per share (EPS, $) 4.93 5.25 4.46 5.91 6.00 Dividends per share (DPS, $) 2.45 2.60 2.60 2.75 2.91 Return on equity (ROE) 13.0196 13.71% 11.58% 14.21% 14.96% Note: The data for 2016-2019 are actual and for 2020 are estimated. Exhibit 2. Summary Balance Sheet for Margarheti, Year Ended 31 December 2019 Assets ($ millions) Cash and cash equivalents 103.05 Accounts receivable 305.03 332.48 Inventory MacBook Air Inventory 33248 Total current assets 913.89 Property and equipment, net Total assets Liabilities and Shareholders' Equity (5 millions) Current liabilities 240.26 355.49 Long-term debt Total liabilities Preferred shares 7101 805.52 Common shares 121.09 Retained earnings Total shareholders' equity Total liabilities and shareholders' equity Notes: The market value of long-term debt is equal to its book value. Shares outstanding are 48,53 million of common shares and 18.2 million of preferred shares. Your task is to calculate the trailing P/E for Margarheti as of 1 January 2015, ignoring any business- cycle influence. Round your answer to 2 decimal places You are analyzing a company and you are provided with the following exhibits. Exhibit 1 presents earnings and dividend data, and Exhibit 2 presents balance sheet data. Net sales were $3.182 billion in 2019. You estimate a required return of 15% for Margarheti and forecast growth in dividends of 6% into perpetuity. Margarheti's common share price is $57.51 and a preferred share trades for $4.66 per share. Exhibit 1. Earnings and Dividends for Margarheti, 2016-2020 2016 2017 2018 2019 2020 (E) 4.93 5.25 4.46 5.81 Earnings per share (EPS, $) 6.00 2.45 2.60 Dividends per share (DPS, $) 2.60 2.75 2.91 13.01% 13.71% Return on equity (ROE) 11.58% 14.21% 14.96% Note: The data for 2016-2019 are actual and for 2020 are estimated. Exhibit 2. Summary Balance Sheet for Margarheti, Year Ended 31 December 2019 Assets ($ millions) 100.22 Cash and cash equivalents 305.73 Accounts receivable 321.05 Inventory Inventory 321.05 Total current assets Property and equipment, net 943.07 Total assets Liabilities and Shareholders' Equity ($ millions) Current liabilities 204.64 Long-term debt 345.92 Total liabilities Preferred shares 70.49 Common shares 934.33 Retained earnings 120.98 Total shareholders' equity Total liabilities and shareholders' equity Notes: The market value of long-term debt is equal to its book value. Shares outstanding are 49.58 million of common shares and 16.25 million of preferred shares. Based on Exhibit 2, the price-to-book multiple for Margarheti is closest to which value? Round your answer to 2 decimal places. 344.48 Inventory Total current assets Property and equipment, net 931.55 Total assets Liabilities and Shareholders' Equity ($ millions) Current liabilities 239.84 Long-term debt 352.61 Total liabilities Preferred shares 78.52 Common shares 838.26 Retained earnings 120.9 Total shareholders' equity Total liabilities and shareholders' equity Notes: The market value of long-term debt is equal to its book value. Shares outstanding are 40.52 million of common shares and 18.92 million of preferred shares. Based on Exhibit 2, the multiple of enterprise value to sales for Margarheti as of 31 December 2014 is closest to which value? Round your answer to 2 decimal places. You are analyzing a company and you are provided with the following exhibits. Exhibit 1 presents earnings and dividend data, and Exhibit 2 presents balance sheet data. Net sales were $3.182 billion in 2019. You estimate a required return of 15% for Margarheti and forecast growth in dividends of 6% into perpetuity. Margarheti's common share price is $47.99 and a preferred share trades for $6.87 per share. Exhibit 1. Earnings and Dividends for Margarheti, 2016-2020 2016 2017 2018 2019 2020 (E) Earnings per share (EPS, $) 4.93 5.25 4.46 5.91 6.00 Dividends per share (DPS, $) 2.45 2.60 2.60 2.75 2.91 Return on equity (ROE) 13.0196 13.71% 11.58% 14.21% 14.96% Note: The data for 2016-2019 are actual and for 2020 are estimated. Exhibit 2. Summary Balance Sheet for Margarheti, Year Ended 31 December 2019 Assets ($ millions) Cash and cash equivalents 103.05 Accounts receivable 305.03 332.48 Inventory MacBook Air Inventory 33248 Total current assets 913.89 Property and equipment, net Total assets Liabilities and Shareholders' Equity (5 millions) Current liabilities 240.26 355.49 Long-term debt Total liabilities Preferred shares 7101 805.52 Common shares 121.09 Retained earnings Total shareholders' equity Total liabilities and shareholders' equity Notes: The market value of long-term debt is equal to its book value. Shares outstanding are 48,53 million of common shares and 18.2 million of preferred shares. Your task is to calculate the trailing P/E for Margarheti as of 1 January 2015, ignoring any business- cycle influence. Round your answer to 2 decimal places You are analyzing a company and you are provided with the following exhibits. Exhibit 1 presents earnings and dividend data, and Exhibit 2 presents balance sheet data. Net sales were $3.182 billion in 2019. You estimate a required return of 15% for Margarheti and forecast growth in dividends of 6% into perpetuity. Margarheti's common share price is $57.51 and a preferred share trades for $4.66 per share. Exhibit 1. Earnings and Dividends for Margarheti, 2016-2020 2016 2017 2018 2019 2020 (E) 4.93 5.25 4.46 5.81 Earnings per share (EPS, $) 6.00 2.45 2.60 Dividends per share (DPS, $) 2.60 2.75 2.91 13.01% 13.71% Return on equity (ROE) 11.58% 14.21% 14.96% Note: The data for 2016-2019 are actual and for 2020 are estimated. Exhibit 2. Summary Balance Sheet for Margarheti, Year Ended 31 December 2019 Assets ($ millions) 100.22 Cash and cash equivalents 305.73 Accounts receivable 321.05 Inventory Inventory 321.05 Total current assets Property and equipment, net 943.07 Total assets Liabilities and Shareholders' Equity ($ millions) Current liabilities 204.64 Long-term debt 345.92 Total liabilities Preferred shares 70.49 Common shares 934.33 Retained earnings 120.98 Total shareholders' equity Total liabilities and shareholders' equity Notes: The market value of long-term debt is equal to its book value. Shares outstanding are 49.58 million of common shares and 16.25 million of preferred shares. Based on Exhibit 2, the price-to-book multiple for Margarheti is closest to which value? Round your answer to 2 decimal places. 344.48 Inventory Total current assets Property and equipment, net 931.55 Total assets Liabilities and Shareholders' Equity ($ millions) Current liabilities 239.84 Long-term debt 352.61 Total liabilities Preferred shares 78.52 Common shares 838.26 Retained earnings 120.9 Total shareholders' equity Total liabilities and shareholders' equity Notes: The market value of long-term debt is equal to its book value. Shares outstanding are 40.52 million of common shares and 18.92 million of preferred shares. Based on Exhibit 2, the multiple of enterprise value to sales for Margarheti as of 31 December 2014 is closest to which value? Round your answer to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts