Question: 3. Short answer questions. Circle the correct answer and briefly explain (one sentence is enough) T/F: The tangency portfolio is the portfolio of risky assets

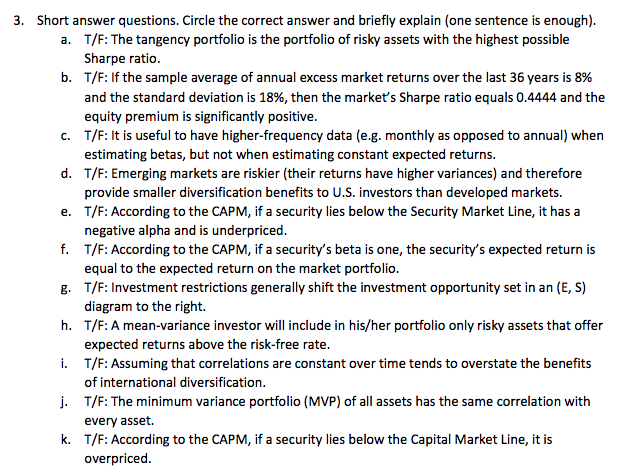

3. Short answer questions. Circle the correct answer and briefly explain (one sentence is enough) T/F: The tangency portfolio is the portfolio of risky assets with the highest possible Sharpe ratio T/F: If the sample average of annual excess market returns over the last 36 years is 8% and the standard deviation is 18%, then the market's Sharpe ratio equals 0.4444 and the equity premium is significantly positive a. b, c. T/F: It is useful to have higher-frequency data (e.g. monthly as opposed to annual) when d. T/F: Emerging markets are riskier (their returns have higher variances) and therefore e. T/F: According to the CAPM, if a security lies below the Security Market Line, it has a f. T/F: According to the CAPM, if a security's beta is one, the security's expected return is g. T/F: Investment restrictions generally shift the investment opportunity set in an (E, S) h. T/F: A mean-variance investor will include in his/her portfolio only risky assets that offer i. T/F: Assuming that correlations are constant over time tends to overstate the benefits j. T/F: The minimum variance portfolio (MVP) of all assets has the same correlation with k. T/F: According to the CAPM, if a security lies below the Capital Market Line, it is estimating betas, but not when estimating constant expected returns. provide smaller diversification benefits to U.S. investors than developed markets. negative alpha and is underpriced equal to the expected return on the market portfolio. diagram to the right. expected returns above the risk-free rate of international diversification every asset. overpriced

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts