Question: (3) Sofia purchases a ter when the $6,000 7% eight-year par-value bond with annual coupons. If held to maturity, her yield is 6.6%. The bond

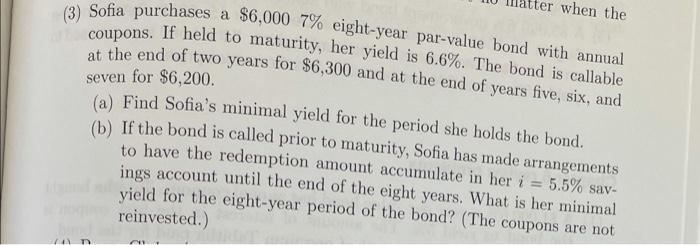

(3) Sofia purchases a ter when the $6,000 7% eight-year par-value bond with annual coupons. If held to maturity, her yield is 6.6%. The bond is callable at the end of two years for $6,300 and at the end of years five, six, and seven for $6,200. (a) Find Sofia's minimal yield for the period she holds the bond. (b) If the bond is called prior to maturity, Sofia has made arrangements to have the redemption amount accumulate in her i = 5.5% sav- ings account until the end of the eight years. What is her minimal yield for the eight-year period of the bond? (The coupons are not reinvested.) (3) Sofia purchases a ter when the $6,000 7% eight-year par-value bond with annual coupons. If held to maturity, her yield is 6.6%. The bond is callable at the end of two years for $6,300 and at the end of years five, six, and seven for $6,200. (a) Find Sofia's minimal yield for the period she holds the bond. (b) If the bond is called prior to maturity, Sofia has made arrangements to have the redemption amount accumulate in her i = 5.5% sav- ings account until the end of the eight years. What is her minimal yield for the eight-year period of the bond? (The coupons are not reinvested.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts