Question: 3. Sunlight Batteries has a 40% debt. Its required return on assets (WACC) is 12% and cost of debt is 8%. What is the

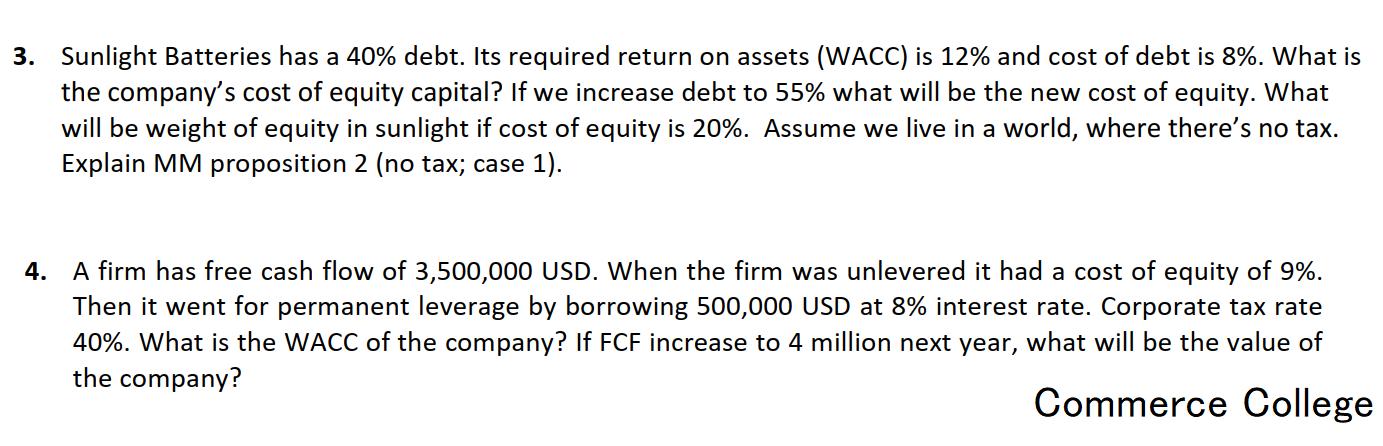

3. Sunlight Batteries has a 40% debt. Its required return on assets (WACC) is 12% and cost of debt is 8%. What is the company's cost of equity capital? If we increase debt to 55% what will be the new cost of equity. What will be weight of equity in sunlight if cost of equity is 20%. Assume we live in a world, where there's no tax. Explain MM proposition 2 (no tax; case 1). 4. A firm has free cash flow of 3,500,000 USD. When the firm was unlevered it had a cost of equity of 9%. Then it went for permanent leverage by borrowing 500,000 USD at 8% interest rate. Corporate tax rate 40%. What is the WACC of the company? If FCF increase to 4 million next year, what will be the value of the company? Commerce College

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

SOLUTION 4 aCalculation of WACC Valur of equityFree cash flowCost of equity 350000000... View full answer

Get step-by-step solutions from verified subject matter experts