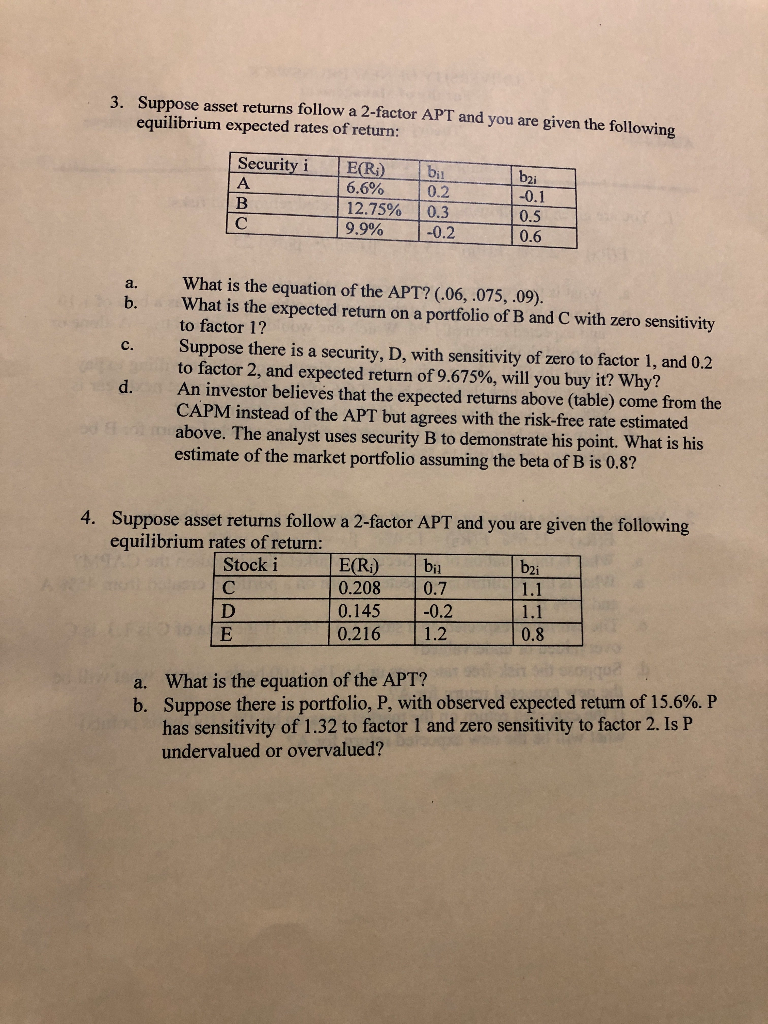

Question: 3. Suppose asset returns follow a 2-factor APT and you are given the following equilibrium expected rates of return: Security i bil E(R) 6.6% 12.75%

3. Suppose asset returns follow a 2-factor APT and you are given the following equilibrium expected rates of return: Security i bil E(R) 6.6% 12.75% 9.9% 1 -0.2 0.5 0.6 do o What is the equation of the APT? (.06, .075, .09). What is the expected return on a portfolio of B and C with zero sensitivity to factor 1? Suppose there is a security, D, with sensitivity of zero to factor 1, and 0.2 to factor 2, and expected return of 9.675%, will you buy it? Why? An investor believes that the expected returns above (table) come from the CAPM instead of the APT but agrees with the risk-free rate estimated above. The analyst uses security B to demonstrate his point. What is his estimate of the market portfolio assuming the beta of B is 0.8? d. 4. Suppose asset returns follow a 2-factor APT and you are given the following equilibrium rates of return: Stock i E (Ri) bil bzi C 0.208 0.7 1.1 D 0.145 -0.2 1.1 E 0 .216 1.2 0.8 a. What is the equation of the APT? b. Suppose there is portfolio, P, with observed expected return of 15.6%. P has sensitivity of 1.32 to factor 1 and zero sensitivity to factor 2. Is P undervalued or overvalued? 3. Suppose asset returns follow a 2-factor APT and you are given the following equilibrium expected rates of return: Security i bil E(R) 6.6% 12.75% 9.9% 1 -0.2 0.5 0.6 do o What is the equation of the APT? (.06, .075, .09). What is the expected return on a portfolio of B and C with zero sensitivity to factor 1? Suppose there is a security, D, with sensitivity of zero to factor 1, and 0.2 to factor 2, and expected return of 9.675%, will you buy it? Why? An investor believes that the expected returns above (table) come from the CAPM instead of the APT but agrees with the risk-free rate estimated above. The analyst uses security B to demonstrate his point. What is his estimate of the market portfolio assuming the beta of B is 0.8? d. 4. Suppose asset returns follow a 2-factor APT and you are given the following equilibrium rates of return: Stock i E (Ri) bil bzi C 0.208 0.7 1.1 D 0.145 -0.2 1.1 E 0 .216 1.2 0.8 a. What is the equation of the APT? b. Suppose there is portfolio, P, with observed expected return of 15.6%. P has sensitivity of 1.32 to factor 1 and zero sensitivity to factor 2. Is P undervalued or overvalued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts