Question: 3. Suppose Masahiro wants to replace an existing printer with a new high-speed copier. The existing printer was purchased ten years ago at a cost

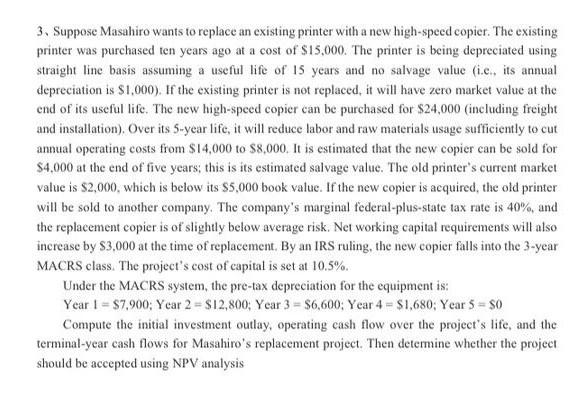

3. Suppose Masahiro wants to replace an existing printer with a new high-speed copier. The existing printer was purchased ten years ago at a cost of $15,000. The printer is being depreciated using straight line basis assuming a useful life of 15 years and no salvage value (ie, its annual depreciation is $1,000). If the existing printer is not replaced, it will have zero market value at the end of its useful life. The new high-speed copier can be purchased for $24,000 (including freight and installation). Over its 5-year life, it will reduce labor and raw materials usage sufficiently to cut annual operating costs from $14,000 to $8,000. It is estimated that the new copier can be sold for $4,000 at the end of five years, this is its estimated salvage value. The old printer's current market value is $2,000, which is below its $5,000 book value. If the new copier is acquired, the old printer will be sold to another company. The company's marginal federal-plus-state tax rate is 40%, and the replacement copier is of slightly below average risk. Net working capital requirements will also increase by $3,000 at the time of replacement. By an IRS ruling, the new copier falls into the 3-year MACRS class. The project's cost of capital is set at 10.5%. Under the MACRS system, the pre-tax depreciation for the equipment is: Year 1 = 87,900; Year 2 = $12,800; Year 3 = $6,600; Year 4 = $1,680; Year 5 = $0 Compute the initial investment outlay, operating cash flow over the project's life, and the terminal-year cash flows for Masahiro's replacement project. Then determine whether the project should be accepted using NPV analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts