Question: 3. Suppose stock return at time t can be decomposed into components related to market return and bond return as follows, R_stk_t= 0.05+1.2*R_mkt_t+0.3*R_bond_t+e_t The variance

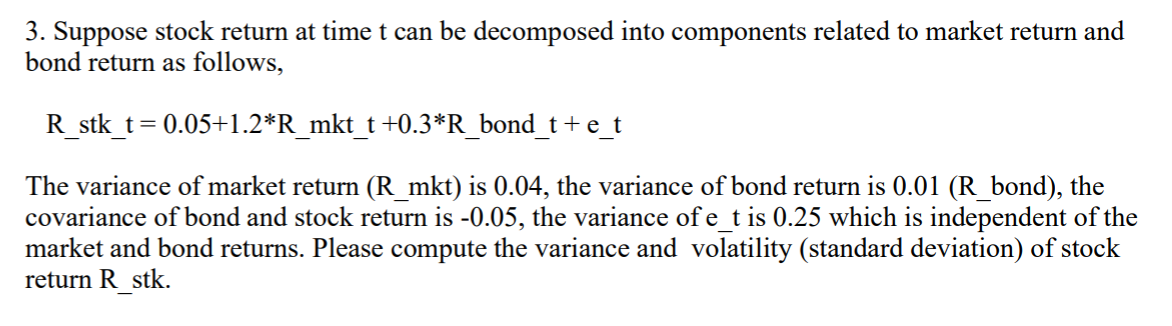

3. Suppose stock return at time t can be decomposed into components related to market return and bond return as follows, R_stk_t= 0.05+1.2*R_mkt_t+0.3*R_bond_t+e_t The variance of market return (R_mkt) is 0.04, the variance of bond return is 0.01 (R_bond), the covariance of bond and stock return is -0.05, the variance of e_t is 0.25 which is independent of the market and bond returns. Please compute the variance and volatility (standard deviation) of stock return R_stk. 3. Suppose stock return at time t can be decomposed into components related to market return and bond return as follows, R_stk_t= 0.05+1.2*R_mkt_t+0.3*R_bond_t+e_t The variance of market return (R_mkt) is 0.04, the variance of bond return is 0.01 (R_bond), the covariance of bond and stock return is -0.05, the variance of e_t is 0.25 which is independent of the market and bond returns. Please compute the variance and volatility (standard deviation) of stock return R_stk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts