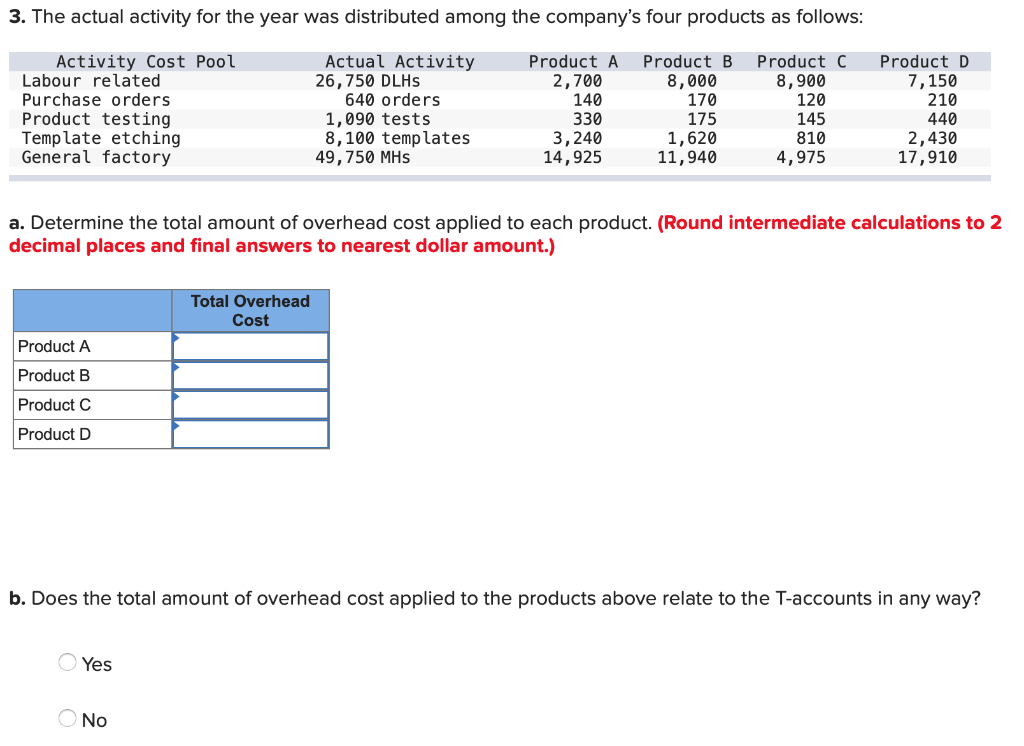

Question: 3. The actual activity for the year was distributed among the company's four products as follows: Activity Cost Pool Labour related Purchase orders Product testing

3. The actual activity for the year was distributed among the company's four products as follows: Activity Cost Pool Labour related Purchase orders Product testing Template etching General factory Actual Activity 26,750 DLHS 640 orders 1,090 tests 8,100 templates 49,750 MHS Product A 2,700 140 330 3,240 14,925 Product B 8,000 170 175 1,620 11,940 Product C 8,900 120 145 810 4,975 Product D 7,150 210 440 2,430 17,910 a. Determine the total amount of overhead cost applied to each product. (Round intermediate calculations to 2 decimal places and final answers to nearest dollar amount.) Total Overhead Cost Product A Product B Product C Product D b. Does the total amount of overhead cost applied to the products above relate to the T-accounts in any way? Yes No 3. The actual activity for the year was distributed among the company's four products as follows: Activity Cost Pool Labour related Purchase orders Product testing Template etching General factory Actual Activity 26,750 DLHS 640 orders 1,090 tests 8,100 templates 49,750 MHS Product A 2,700 140 330 3,240 14,925 Product B 8,000 170 175 1,620 11,940 Product C 8,900 120 145 810 4,975 Product D 7,150 210 440 2,430 17,910 a. Determine the total amount of overhead cost applied to each product. (Round intermediate calculations to 2 decimal places and final answers to nearest dollar amount.) Total Overhead Cost Product A Product B Product C Product D b. Does the total amount of overhead cost applied to the products above relate to the T-accounts in any way? Yes No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts