Question: 3. The correct statement includes a. If a firm makes a stock split, its stock return in the long run tends to be higher, according

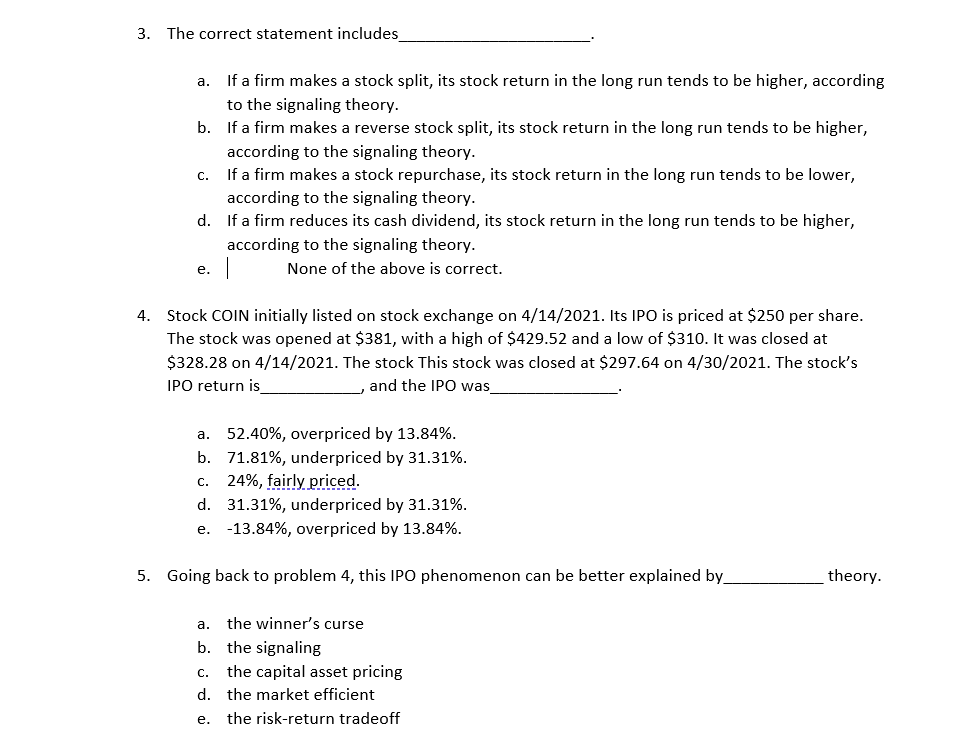

3. The correct statement includes a. If a firm makes a stock split, its stock return in the long run tends to be higher, according to the signaling theory. b. If a firm makes a reverse stock split, its stock return in the long run tends to be higher, according to the signaling theory. C. If a firm makes a stock repurchase, its stock return in the long run tends to be lower, according to the signaling theory. d. If a firm reduces its cash dividend, its stock return in the long run tends to be higher, according to the signaling theory. None of the above is correct. e. 4. Stock COIN initially listed on stock exchange on 4/14/2021. Its IPO is priced at $250 per share. The stock was opened at $381, with a high of $429.52 and a low of $310. It was closed at $328.28 on 4/14/2021. The stock This stock was closed at $297.64 on 4/30/2021. The stock's IPO return is and the IPO was a. 52.40%, overpriced by 13.84%. b. 71.81%, underpriced by 31.31%. C. 24%, fairly priced. d. 31.31%, underpriced by 31.31%. -13.84%, overpriced by 13.84%. e. 5. Going back to problem 4, this IPO phenomenon can be better explained by theory. a. the winner's curse b. the signaling c. the capital asset pricing d. the market efficient e. the risk-return tradeoff

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts