Question: 3) The current interest rate for a one year bond is 4%, the expected interest rates for the same bonds are 4%, 4% and 4%

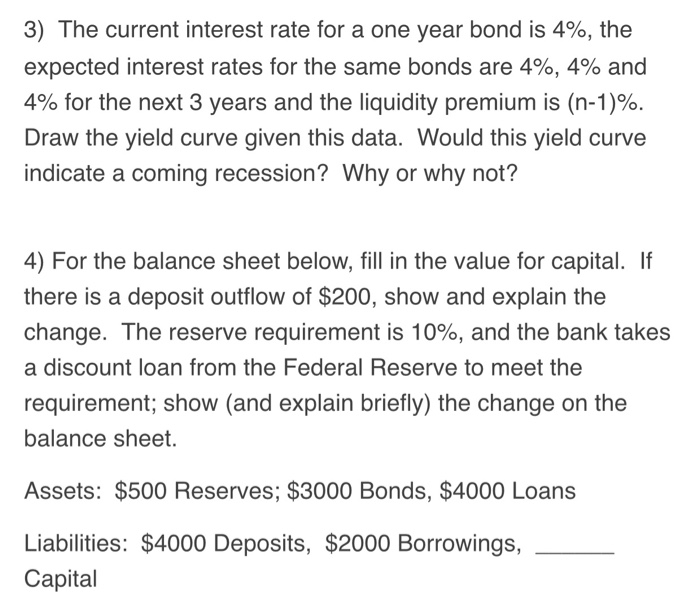

3) The current interest rate for a one year bond is 4%, the expected interest rates for the same bonds are 4%, 4% and 4% for the next 3 years and the liquidity premium is (n-1)% Draw the yield curve given this data. Would this yield curve indicate a coming recession? Why or why not? 4) For the balance sheet below, fill in the value for capital. If there is a deposit outflow of $200, show and explain the change. The reserve requirement is 10%, and the bank takes a discount loan from the Federal Reserve to meet the requirement; show (and explain briefly) the change on the balance sheet. Assets: $500 Reserves; $3000 Bonds, $4000 Loans Liabilities: $4000 Deposits, $2000 Borrowings, Capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts