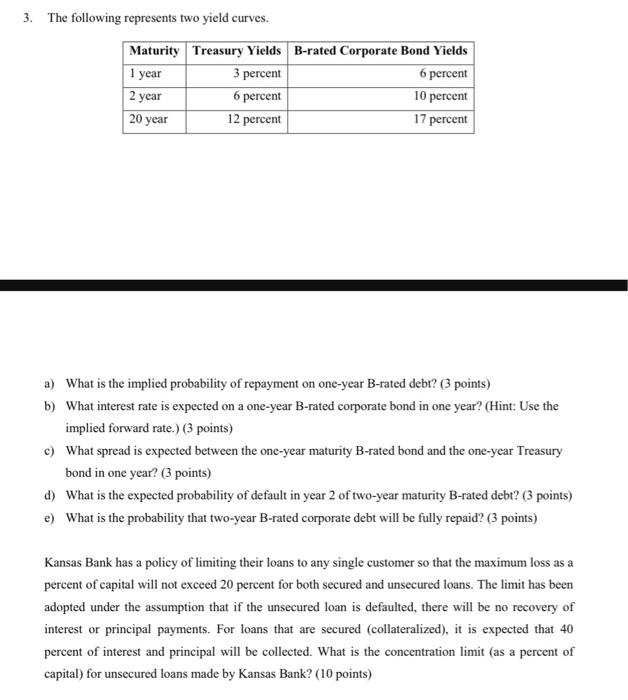

Question: 3. The following represents two yield curves. Maturity Treasury Yields B-rated Corporate Bond Yields 1 year 3 percent 6 percent 2 year 6 percent 10

3. The following represents two yield curves. Maturity Treasury Yields B-rated Corporate Bond Yields 1 year 3 percent 6 percent 2 year 6 percent 10 percent 20 year 12 percent 17 percent a) What is the implied probability of repayment on one-year B-rated debt? (3 points) b) What interest rate is expected on a one-year B-rated corporate bond in one year? (Hint: Use the implied forward rate.) 3 points) c) What spread is expected between the one-year maturity B-rated bond and the one-year Treasury bond in one year? (3 points) d) What is the expected probability of default in year 2 of two-year maturity B-rated debt? (3 points) e) What is the probability that two-year B-rated corporate debt will be fully repaid? (3 points) Kansas Bank has a policy of limiting their loans to any single customer so that the maximum loss as a percent of capital will not exceed 20 percent for both secured and unsecured loans. The limit has been adopted under the assumption that if the unsecured loan is defaulted, there will be no recovery of interest or principal payments. For loans that are secured (collateralized), it is expected that 40 percent of interest and principal will be collected. What is the concentration limit (as a percent of capital) for unsecured loans made by Kansas Bank? (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts