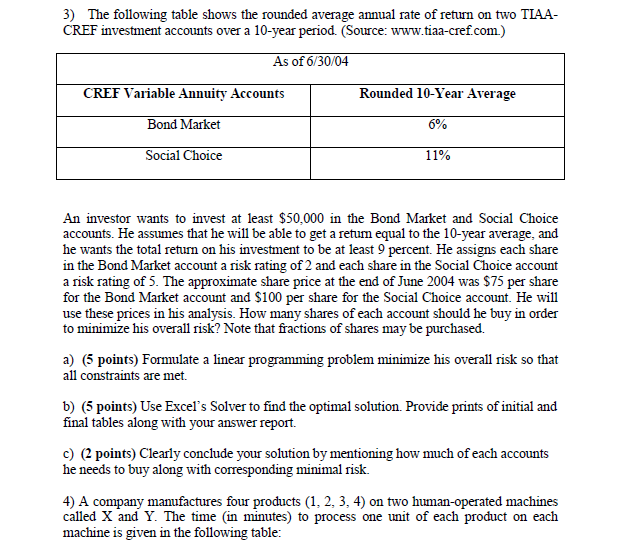

Question: 3) The following table shows the rounded average annual rate of return on two TLAACREF investment accounts over a 10-year period. (Source: www.tiaa-cref.com.) An investor

3) The following table shows the rounded average annual rate of return on two TLAACREF investment accounts over a 10-year period. (Source: www.tiaa-cref.com.) An investor wants to invest at least $50,000 in the Bond Market and Social Choice accounts. He assumes that he will be able to get a retum equal to the 10 -year average, and he wants the total return on his investment to be at least 9 percent. He assigns each share in the Bond Market account a risk rating of 2 and each share in the Social Choice account a risk rating of 5. The approximate share price at the end of June 2004 was $75 per share for the Bond Market account and $100 per share for the Social Choice account. He will use these prices in his analysis. How many shares of each account should he buy in order to minimize his overall risk? Note that fractions of shares may be purchased. a) (5 points) Formulate a linear programming problem minimize his overall risk so that all constraints are met. b) (5 points) Use Excel's Solver to find the optimal solution. Provide prints of initial and final tables along with your answer report. c) (2 points) Clearly conclude your solution by mentioning how much of each accounts he needs to buy along with corresponding minimal risk. 4) A company manufactures four products (1,2,3,4) on two human-operated machines called X and Y. The time (in minutes) to process one unit of each product on each machine is given in the following table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts