Question: 3. The interest-rate parity condition is the proposition that differences in interest rates on similar bonds in different countries reflect expectations of future changes in

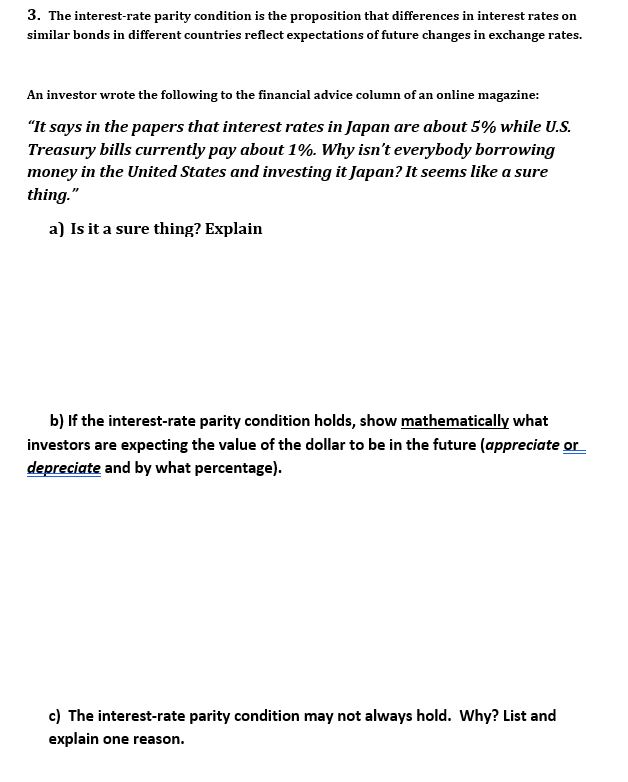

3. The interest-rate parity condition is the proposition that differences in interest rates on similar bonds in different countries reflect expectations of future changes in exchange rates. An investor wrote the following to the financial advice column of an online magazine: "It says in the papers that interest rates in Japan are about 5% while U.S. Treasury bills currently pay about 1%. Why isn't everybody borrowing money in the United States and investing it Japan? It seems like a sure thing." a) Is it a sure thing? Explain b) If the interest-rate parity condition holds, show mathematically what investors are expecting the value of the dollar to be in the future (appreciate or depreciate and by what percentage). c) The interest-rate parity condition may not always hold. Why? List and explain one reason

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts