Question: 3. The required return for Bot Bot Inc.'s stock is assumed to be 12%, and the firm has paid the following dividends. What is the

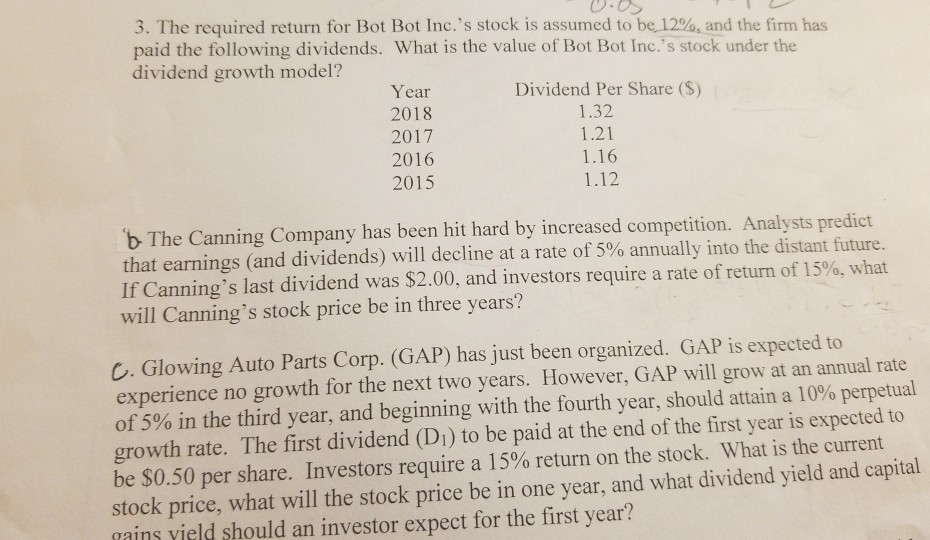

3. The required return for Bot Bot Inc.'s stock is assumed to be 12%, and the firm has paid the following dividends. What is the value of Bot Bot Inc.'s stock under the dividend growth model? Year Dividend Per Share ($) 2018 1.32 2017 2016 1.16 2015 1.12 1.21 b The Canning Company has been hit hard by increased competition. Analysts predict that earnings (and dividends) will decline at a rate of 5% annually into the distant future. If Canning's last dividend was $2.00, and investors require a rate of return of 15%, what will Canning's stock price be in three years? c. Glowing Auto Parts Corp. (GAP) has just been organized. GAP is expected to experience no growth for the next two years. However, GAP will grow at an annual rate of 5% in the third year, and beginning with the fourth year, should attain a 10% perpetual growth rate. The first dividend (D1) to be paid at the end of the first year is expected to be $0.50 per share. Investors require a 15% return on the stock. What is the current stock price, what will the stock price be in one year, and what dividend yield and capital asins vield should an investor expect for the first year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts