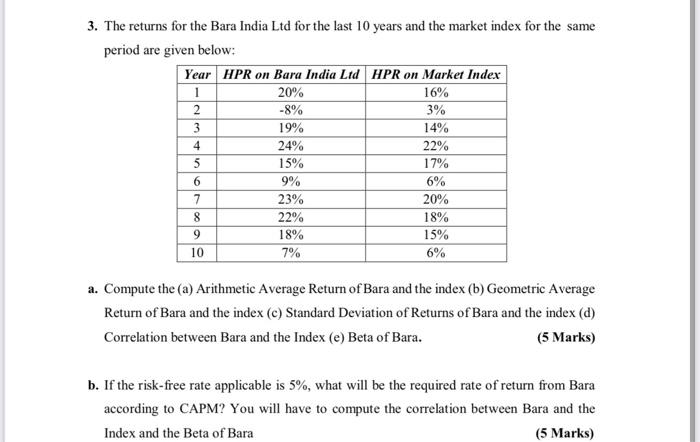

Question: 3. The returns for the Bara India Ltd for the last 10 years and the market index for the same period are given below: Year

3. The returns for the Bara India Ltd for the last 10 years and the market index for the same period are given below: Year HPR on Bara India Ltd HPR on Market Index 1 20% 16% 2 -8% 3% 3 19% 14% 4 24% 22% 5 15% 17% 9% 7 23% 20% 8 22% 18% 9 15% 10 7% 6% 6 6% 18% a. Compute the (a) Arithmetic Average Return of Bara and the index (b) Geometric Average Return of Bara and the index (c) Standard Deviation of Returns of Bara and the index (d) Correlation between Bara and the Index (e) Beta of Bara. (5 Marks) b. If the risk-free rate applicable is 5%, what will be the required rate of return from Bara according to CAPM? You will have to compute the correlation between Bara and the Index and the Beta of Bara

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts