Question: 3. There is a 3-month (assume 90 days) LIBOR based forward rate agreement with a notional of $25mm and fix a rate of 3.25% between

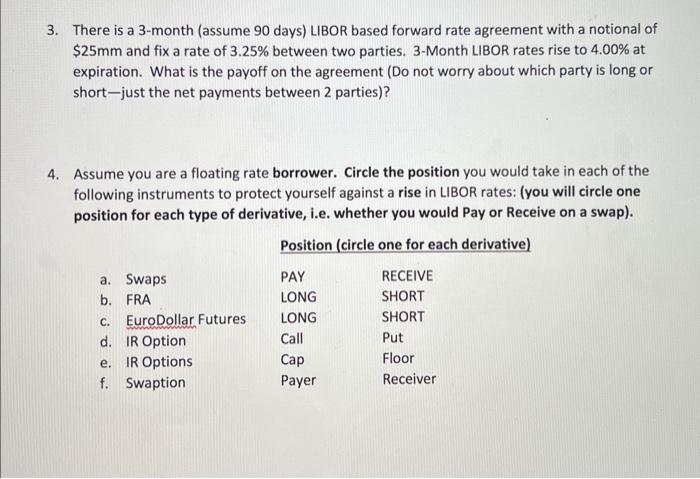

3. There is a 3-month (assume 90 days) LIBOR based forward rate agreement with a notional of $25mm and fix a rate of 3.25% between two parties. 3-Month LIBOR rates rise to 4.00% at expiration. What is the payoff on the agreement (Do not worry about which party is long or short-just the net payments between 2 parties)? 4. Assume you are a floating rate borrower. Circle the position you would take in each of the following instruments to protect yourself against a rise in LIBOR rates: (you will circle one position for each type of derivative, i.e. whether you would Pay or Receive on a swap)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock