Question: 3. Total risk can be divided into: A) standard deviation and variance. B) standard deviation and covariance. C) systematic risk and beta. D) market risk

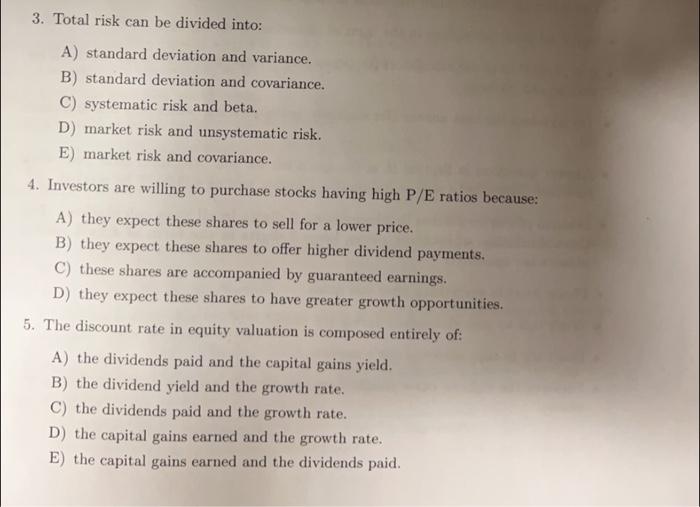

3. Total risk can be divided into: A) standard deviation and variance. B) standard deviation and covariance. C) systematic risk and beta. D) market risk and unsystematic risk. E) market risk and covariance. 4. Investors are willing to purchase stocks having high P/E ratios because: A) they expect these shares to sell for a lower price. B) they expect these shares to offer higher dividend payments. C) these shares are accompanied by guaranteed earnings. D) they expect these shares to have greater growth opportunities. 5. The discount rate in equity valuation is composed entirely of: A) the dividends paid and the capital gains yield. B) the dividend yield and the growth rate. C) the dividends paid and the growth rate. D) the capital gains earned and the growth rate. E) the capital gains earned and the dividends paid

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts