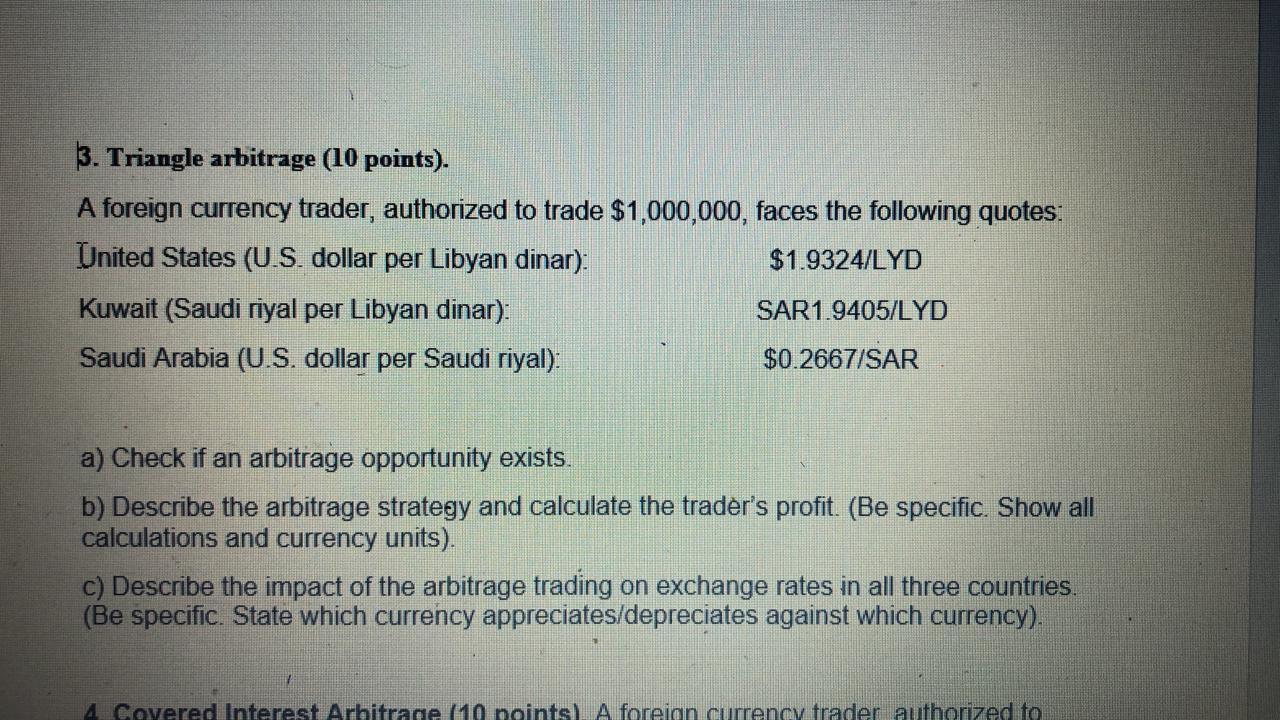

Question: 3. Triangle arbitrage (10 points). A foreign currency trader, authorized to trade $1,000,000, faces the following quotes: United States (U.S. dollar per Libyan dinar): $1.9324/LYD

3. Triangle arbitrage (10 points). A foreign currency trader, authorized to trade $1,000,000, faces the following quotes: United States (U.S. dollar per Libyan dinar): $1.9324/LYD Kuwait (Saudi riyal per Libyan dinar): SAR1.9405/LYD Saudi Arabia (U.S. dollar per Saudi riyal): $0.2667/SAR a) Check if an arbitrage opportunity exists. b) Describe the arbitrage strategy and calculate the trader's profit. (Be specific. Show all calculations and currency units). c) Describe the impact of the arbitrage trading on exchange rates in all three countries. (Be specific. State which currency appreciates/depreciates against which currency). 4 Covered Interest Arbitrage 110 points) A foreign currency trader authorized to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts